Implications

of Surging Momentum and Highlights of BoAML Fund Manager Survey

by the Curmudgeon

Despite valuations and sentiment

indicators off the charts, the U.S. stock market has shown astounding relative

strength this year with the DJI average easily surpassing 26,000 in morning

trading today. The reversal to a slight daily decline in all the major

averages is insignificant, when compared to the momentum surge during the first

nine trading days of 2018.

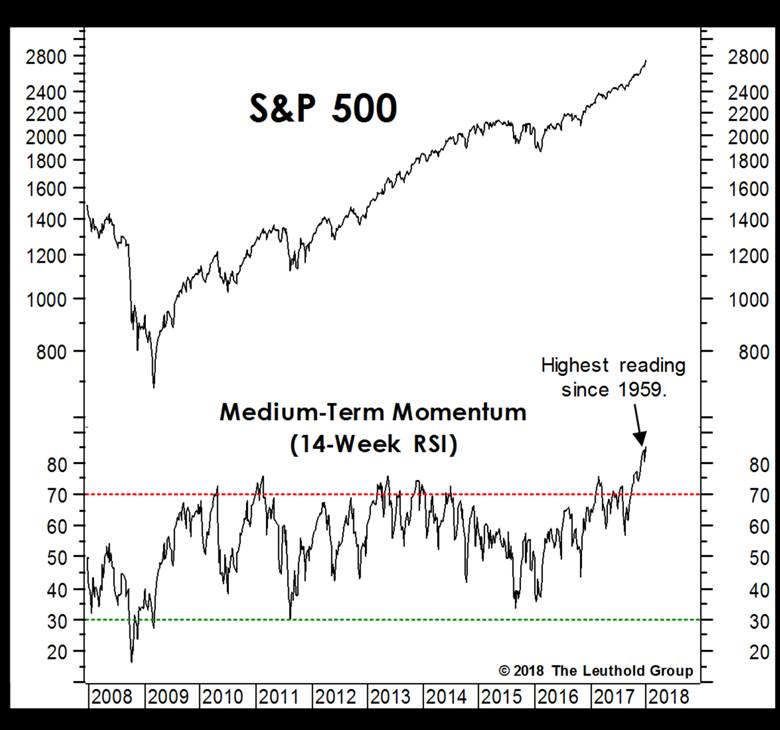

Leuthold Weedens preferred

measure of medium-term momentum (14-Week Relative Strength Index, or RSI)

blasted to a new high for the current bull market (which started in March

2009). According to one Twitter pundit, the S&P 500 RSI was the

strongest since at least 1929, which was before RSI was even calculated!

Thats extraordinary, and yet

another piece of evidence that the bull is not quite ready to meet the mortician,

said Doug Ramsey of Leuthold Weeden.

Its historically been very rare

that the cyclical peak in stock prices coincides with the peak in momentum.

The table below summarizes market behavior leading into the last 21

cyclical bull market peaks dating back to 1900. (Leuthold used weekly closing

prices to define those cycles since their momentum measure is also weekly).

Among these cases, the peak in market prices coincided with the bull markets

momentum peak only two times (in 1938 and 1980). In more than 90% of past

cycles, a fresh cycle peak in momentum was a pre-cursor to many more months of

market gains.

..

..

Chart of S&P 500 vs Medium Term

Momentum (14-week RSI):

Source: The

Leuthold Group

.

Curmudgeon Comment:

Indeed, the Curmudgeon vividly

remembers the super strong stock market in the first two weeks of 1987, with

the peak for most stock averages occurring in late August of that year prior

to the October 19th crash.

..

Once a bull market peak in momentum

has been established (which obviously can be known only with hindsight), the

average additional gain in the market has been +18.4%, occurring over an

average span of 60 weeks.

The implication is obvious (and

painful to value investors and seasoned veterans whove experienced many long

grinding bear markets): RSI and momentum this strong usually requires a

multi-month cooling-off phase before the bull market becomes vulnerable to a

severe correction, bear market, or crash.

..

The following is from a BofA

Merrill Lynch Global Research report (bold font added where deemed

appropriate):

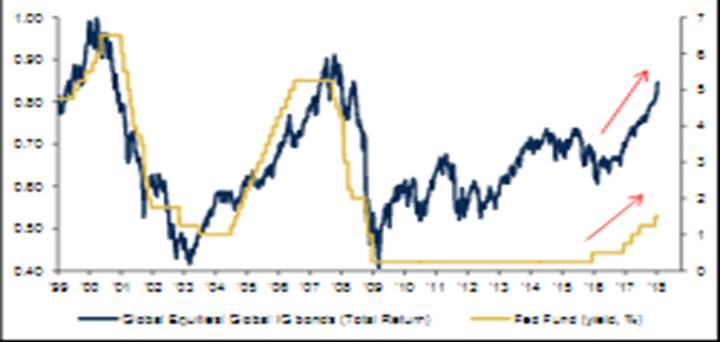

January 2018 BoA

ML Fund Manager Survey finds equities the asset of choice for investors (no

surprise!)

- Average cash balance falls from 4.7% in December

to 4.4% this month, a five-year low.

- Allocation to equities jumps to two-year highs of net

55% overweight, while allocation to bonds falls to four-year lows of net

67% underweight; investors are the most overweight equities relative to

government bonds since August 2014.

- The balance of investors indicating they are taking out

protection against a near-term correction in the markets falls to

net -50%, the lowest level since 2013.

- Investors are split on expected timing of equity markets

peaking; 2019 or beyond was the most commonly cited response (30%).

- Net hedge fund equity market exposure climbs nine

percentage points to net 49%, the highest level since 2006.

- The net share of investors saying global corporate

earnings will rise 10% or more over the next year comes in at net 15%, the

highest level since 2011; furthermore, 57% of investors would like

to see companies increase capital spending.

- Short Volatility (28%) for the first time

overtook Long FAANG+BAT (26%) and Long Bitcoin (24%) as the trade

considered most crowded.

- Inflation and/or crash in global bond markets (36%)

tops the list of tail risks cited by investors; the top three are rounded

out by a policy mistake by the Fed/ECB (19%) and market structure (11%).

- Net 11% of investors surveyed expect the U.S. yield

curve to flatten in 2018, the highest level in over two years.

- When asked about preferred regions, global investors

say they would most like to overweight Eurozone, EM and Japan; the UK

continues to be deeply out of consensus, falling once more to a new record

low since 2001.

- Investors rotate into cyclical

plays: tech (the largest monthly rise since July 2014),

industrials, EM and equities; they moved out of defensive plays like

telecom (second lowest level since 2005), bonds, utilities, and the UK.

Total Return of Global

Equities/Global Govt Bonds vs Fed Funds:

Source: BofA

Merrill Lynch Global Investment Strategy, Bloomberg

Investors continue to favor

equities, said Michael Hartnett, chief investment strategist. By the end

of Q1, we expect peak positioning to combine with peak profits and policy to

create a spike in volatility.

In summary, BoAML finds that

Investors are long stocks, unprotected from a correction or bear market, and

believe the global equity bull market will continue to 2019 and beyond.

If those pros are correct, bears are in for a lot more suffering!

Good luck and till next time...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2017 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).