U.S.

Equity Market Celebrates the New Year; Champagne Sparkles Till

Time is Up

by the Curmudgeon

1. Stock Market Melt-Up

Picks Up Steam in 2018:

The U.S. stock market

melt-up, which really started on November 3, 2016 when the last 3% correction ended,

accelerated in the first four trading days of 2018.

·

The S&P 500

added +2.6% from January 2 to 5, 2018 which was its

best first week of the year start since 2010 when the index finished higher for

six consecutive trading days but only rose 1.9% over that run. Incredibly, the S&P 500 now has a Shiller

P/E of 33.3 (vs 15.0 at the start of 2010 and a median of 16.15).

·

The Russell 2000

small cap index was up 1.6% on the week and sports a 52 week

trailing P/E of 133.96 vs nil (or incalculable) one year ago when the forward

P/E forecast was 18.6 off the actual P/E several orders of magnitude.

Jeremy Grantham of GMO wrote

in a blog

post:

As

a historian of the great equity bubbles, I also recognize that we are

currently showing signs of entering the blow-off or melt-up phase of this very

long bull market. The data on the high price of the market is clean and

factual. We can be as certain as we ever get in stock market analysis that the

current price is exceptionally high. In contrast, my judgment on the melt-up is

based on a mish-mash of statistical and psychological factors based on previous

eras, each one very different, so that much of the information available is not

easily comparable. It also leans very heavily on a few US examples.

Yet,

strangely, I find the less statistical data more compelling in this bubble

context than the simple fact of overpricing. Whether you will also, dear

reader, remains to be seen. In any case, my task in this note is to present the

evidence, both statistical and touchy-feely, as clearly as I can.

2. Trading data points

that may have been missed last week:

A few quick takes on the

markets first week of trading:

1. Despite the strong start for all of the popular averages, there was not one day when

Advances led Declines by 2:1 on the NYSE.

Here are the actual stats:

NYSE Composite Daily

Breadth

Daily Jan.1 Jan.2 Jan.3 Jan.4 Jan.5

Issues Traded... 3,083 3,061 3,072 3,077

Advances ... 1,852 1,757 1,755 1,794

Declines ... 1,163 1,211 1,208 1,171

Unchanged ... 68 93 109 112

NYSE American Composite

Daily Jan.1 Jan.2 Jan.3 Jan.4 Jan.5

Issues Traded... 340 336 342 337

Advances ... 209 190 179 170

Declines ... 114 122 138 146

Unchanged ... 17 24 25 21

2. Astonishingly, almost 50% NYSE volume occurs

in last 1/2 hour of trading on Thursday and Friday vs >50% of volume in last

½ hour one week ago. Check out these stats:

NYSE Stocks (9:30 a.m. to

4:00 p.m. ET)

|

|

Latest Close |

Previous Close |

Week Ago |

|

9:30 to 10:00 |

104,580,532 |

126,648,774 |

75,435,887 |

|

10:00 to 10:30 |

48,180,983 |

53,884,712 |

32,529,209 |

|

10:30 to 11:00 |

40,742,125 |

44,250,554 |

26,674,803 |

|

11:00 to 11:30 |

34,601,305 |

41,310,673 |

24,597,911 |

|

11:30 to 12:00 |

31,690,179 |

32,277,629 |

21,605,578 |

|

12:00 to 12:30 |

25,307,075 |

27,691,270 |

19,969,981 |

|

12:30 to 1:00 |

25,362,259 |

28,007,527 |

17,079,515 |

|

1:00 to 1:30 |

22,608,153 |

26,116,750 |

17,412,260 |

|

1:30 to 2:00 |

21,568,630 |

28,890,859 |

19,235,682 |

|

2:00 to 2:30 |

24,838,238 |

27,974,528 |

19,640,945 |

|

2:30 to 3:00 |

28,485,325 |

32,892,701 |

19,414,861 |

|

3:00 to 3:30 |

34,292,166 |

40,642,750 |

27,759,183 |

|

3:30 to 4:00 |

327,321,657 |

383,388,580 |

386,792,672 |

|

Total |

769,578,627 |

893,977,307 |

708,148,487 |

|

Composite |

3,198,024,887 |

3,640,617,729 |

2,409,790,952 |

Victors Comment: More evidence

to show marking up of stock prices, i.e. manipulation!

..

Also, NYSE advancing

volume never reached twice Declining volume:

Adv. volume* 467,660,100 549,935,197

221,397,608

Decl. volume* 288,094,038 335,012,713 472,119,579

*Primary market NYSE, NYSE

American or NYSE Arca only.

..

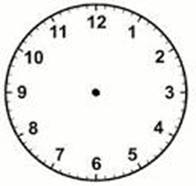

3. Analogy of stock market melt-up prior to a

crash vs a champagne ball when time is up:

Jerry Goodman, a.k.a. Adam

Smith, wrote in The Money Game:

"We are at a wonderful

ball where the champagne sparkles in every glass and soft laughter falls upon

the summer air. We know at some moment the black horsemen will come shattering

through the terrace doors wreaking vengeance and scattering the survivors. Those

who leave early are saved, but the ball is so splendid no one wants to leave

while there is still time. So, everybody keeps asking ‐‐ what time

is it? But none of the clocks have hands."

Curmudgeon: tick, tock, tic, tock....when

is the party over? What time is it now?

Good luck and till next time...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2017 by the Curmudgeon

and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).