Global

Stocks Soar Defying Skeptics; 2018 Outlook and Bull Market Tops

by the Curmudgeon with Victor

Sperandeo

2017 Market Review: An Exceptionally Terrific Year!

Global stock benchmarks surged

to multiyear highs and records in 2017, with international shares doing mostly

better than the U.S. for the first time since 2012. The MSCI ACWI ex-USA Index, which tracks

non-U.S. companies across developed and emerging markets, ended 2017 with a gain

of 24%, compared with a 19% advance for the S& P 500. However, the Dow Jones Industrials (DJI) and

Nasdaq Composite did just as well by advancing 25% and 28%, respectively in

2017. The DJI recorded 71 new all-time

highs last year, more than any in history.

It has truly been a

remarkable environment, said Eric Wiegand, portfolio manager at U.S. Bank

Private Wealth Management.

There was a long laundry

list of things that shouldve rattled markets, and nothing did, said Dec Mullarkey, a managing director on the investment research

team at Sun Life Investment Management.

There was no knocking the

market off its perch, said JJ Kinahan, chief market

strategist at TD Ameritrade. A couple of times it wobbled, but we never saw a

wild rush of sales in the market. Every dip was marked with big buyers.

Curmudgeon Note: Weve pounded the table that

dip buyers would get creamed, but it hasnt happened since the March 2009

bull market began. Has history been

repealed?

Bullish Skeptics, High Valuations and Complacency:

The magnitude of the U.S.

stock gains surprised three big name institutional investors, who are almost

always perma-bulls. BoA

Merrill Lynch, Credit Suisse, and Goldman Sachs each forecast the S&P 500

would close 2017 at 2300. The index

closed at 2673. 61 on the last trading day of 2017 and was up over 22 points on

January 2, 2017 to close at 2695.81 an all-time high.

As previously noted in these

blog posts, U.S. stock market valuations have reached dizzying heights. No one

seems to care, but in the past when valuations were excessive there was no

shock absorber to stop a serious selloff.

Some are concerned that the

low readings on the VIX index, which measures expectations about upcoming

market volatility, means that investors are incredibly complacent about

possible stock market risks.

2018 Outlook:

Some investors are now

questioning how much more room there is for stocks to move higher after a year

of large gains, particularly in the U.S.

All risk assets have been

mushrooming in price: equities, credit, commodities, said Alain Bokobza, head of global asset allocation.

One huge worry is that global

central banks will no longer be the buyer of last resort as they end QE

programs that have accounted for much of the gains in financial assets the last

few years. Thats shown in the graph below:

The coming changes in global monetary policy is nowhere near priced in and is

actually grossly underestimated, Robert Michele, chief investment officer of

JPMorgan Asset Management told the Financial Times.

Wells Fargo bank estimates

that central banks have absorbed more than all the bonds issued by G10

governments over the past two years but next year they will only buy 40 per

cent of overall debt issuance. That adds up to a large demand shortfall

that will have to be filled. Man GLG estimates that

central banks have globally swelled the size of their balance sheets by about

$15tn since 2008 with the Fed, the ECB and the BoJ accounting for most of it.

In the past there was always

another central bank that would step up and pick up the baton from someone

scaling back, says Pierre-Henri Flamand, chief

investment officer at hedge fund Man GLG. No one really knows what will happen

when theres no one there, he added.

Flamand argues that analysts always underestimate the role of

the marginal buyer in a market and what happens if they disappear.

Yes, we know that central

banks will do less next year, but no one knows what the price should then be. I

think people will be shocked by the magnitude, he said.

Torsten Slok, chief international

economist at Deutsche Bank, is especially concerned about the effect of the end

of European QE, arguing that the ECBs

exit from bond markets is the single biggest risk facing global markets in 2018,

given how the Eurozones bond purchases have sent money sloshing around

everywhere, including into U.S. stocks.

As the ECB slows and

ultimately ends QE in 2018, the amount of cash flowing to risky assets such as

credit and equities will slow down and ultimately dry up altogether, Mr. Slok says.

In his 2017 year-end Credit Strategist, Michael Lewitt

wrote:

The structure of markets favors stocks fewer shares outstanding due to stock buybacks, 50%

fewer public companies today versus 20 years ago, few attractive fixed income

alternatives, and ETFs and other passive strategies hoovering up huge amounts

of mindless capital. There are fewer places for people to invest their money

and Wall Street makes it easier than ever to invest it in stocks with very

little intellectual effort.

I

expect higher volatility in 2018 as central banks tighten and stocks start to

see more competition from the short end of the yield curve. I expect the VIX to

trade at an average closer to 15 than 10 in 2018.

There

will be more opportunities for short sellers (if there are any left) to make

money in 2018 while long-only and index investors will have a tougher go. It

would be very surprising if 2018 were anywhere as easy as 2017 was for bulls

(and if people thought their famous managers had trouble making money when the

market was rising, how do they think they are going to do when the market is

struggling?).

In

summary, investors can take nothing for granted in the credit markets at the

end of the business cycle, because the only direction things can go from here

is down. And when the credit markets

start to crater, stock markets will follow.

Victor on IBD Big Picture article: Market Top Can

Take Months to Form: Will bull stay intact?

The above noted January 2,

2018 IBD print article (page B9) saying that market tops take months to form

is a broad generalization of history.

After WWII the premise is no longer factual as mistakes made by U.S.

government leaders have caused stock market selloffs without long lasting top

formations. For example, 1962 (JFK

Slide), 1987 (October crash), 2000 (dot com bust), and 2008 (the Fed and U.S. Treasury saved Bear

Stearns but then let Lehman Brothers die?).

One should be aware that from

1789 till 1913, and then again to 1933 the complexion of the movements of the

equity markets changed, because the monetary systems were changed

unconstitutionally. That still applies

and affects all markets.

Using the NBER business cycle

classifications from 1854-2009 (which highly correlate to the equity markets),

U.S. economic expansions averaged 38.7 months, while contractions were 17.5

months over 33 cycles.

However, economic expansions

have been extended since the Greenspan Fed, having an average of 97 months

since 1982 which is 2.5 times longer than the long-term average noted above.

From Greenspan, to Bernanke, to Yellen, the Fed has continued to bail out the

U.S. economy and financial markets.

Hence, the well accepted Fed put has become a savior for buy and hold

investors, while the familiar 4-year stock market cycle hasnt worked for a

long time.

Speaking during a Q&A

event recently with British Academy President Lord Nicholas Stern in London,

Yellen highlighted positive results from the Fed's recent "stress

test" reviews of America's big banks, and said she doesn't believe another

financial crisis will occur "in our lifetimes." ΰThis will go

down as the most outrageously stupid, idiotic and ignorant predictions in

history.

What has not changed is the

fact the gold standard (vs. the paper money standard), has not altered the

correlation of the economy and stocks. Stocks have recently followed the

intent of the Feds goals, rather than actual reported corporate earnings,

knowing or believing the Fed would do whatever was needed to keep the

(otherwise impotent) economic recovery going.

The fact is the markets will

still die due to old age, but not PURELY due to its age alone, but due to excesses, i.e. inflation, which makes the Fed tighten

credit at THE SAME TIME. Historically excesses and long in the tooth market

movements usually occurred together.

The usual average life of a

human is generally based on health.

However, accidents, genetics, food intake, and exercise all come into

play. The older a person gets, the

higher the probability and risk of death.

Normal (non-manipulated) financial markets are similar, in that they get

more vulnerable with age just like people.

The recent increases in

interest rates have been so small that theyve had almost no effect on the

markets or economy. Fed Funds going from

0 to bid 1.25-1.50% in two years still has not resulted in positive real

short-term interest rates.

As a result, the much talked

about, puny Fed rate rises have had no impact on stocks. The rate of inflation (e.g.

the CPI) has been greater than short term interest rates for 9 years! This is highly likely to change under the

Trump administration.

Curmudgeon Note: With negative real interest rates, savers who bought CDs, Treasury

bills or 2-year T-Notes or owned money market funds/savings accounts have lost

purchasing power each year for 9 consecutive years.

A stock market top can happen

for an unknown event, e.g. war. Whatever the cause, I believe the equity

markets will just END and a classic market top will not be seen this time

around.

Addendum:

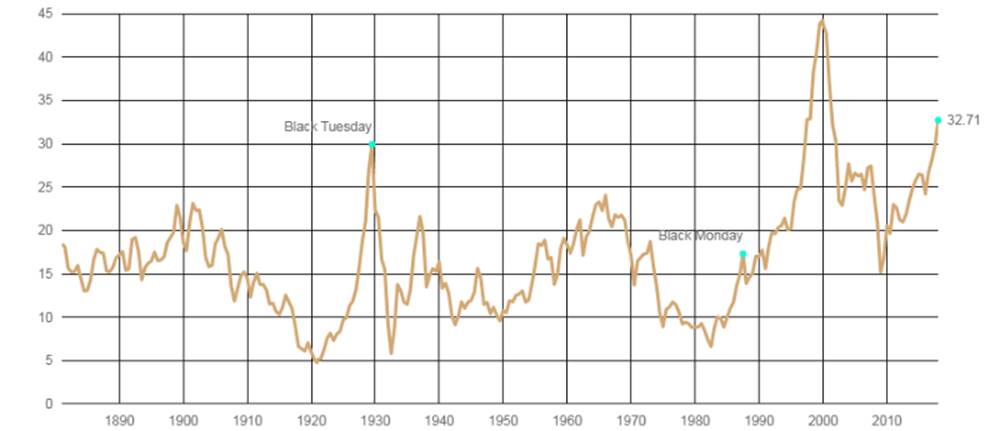

Shiller P/E for S&P

continues its straight up move with another new high:

Shiller P/E=32.71 (January 2,

2018) vs. 30 on Black Tuesday October 29, 1929.

Good luck and till next time...

The Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2017 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).