Charts

Indicate Central Banks Must Tighten Monetary Policy: Part II

by the Curmudgeon with Victor

Sperandeo

Curmudgeon

Observations from BoA Merrill Lynch:

· Security

Analysis -a book written by professor’s Benjamin Graham and

David Dodd laid the intellectual foundation for what would later be called value investing. On the December 6th

BoA Merrill Lynch (BoAML) webcast, Savita Subramanian,

chief .U.S Equity Strategist at BoAML said she used that book while studying at

Columbia University Business School (she received a MBA in Finance in 2002),

but "we don't even use it anymore,” which implies it’s no longer relevant.

Obviously

that’s because “the old rules of valuing stock prices no longer apply.” That’s typical “new era” thinking, which we

heard non- stop during the dot com boom.

· Are

you surprised that stock valuations, based on historical data, only account for

10% of stock price movement? “They

matter in the long run, but not in the short to intermediate timeframe, Savita

said.

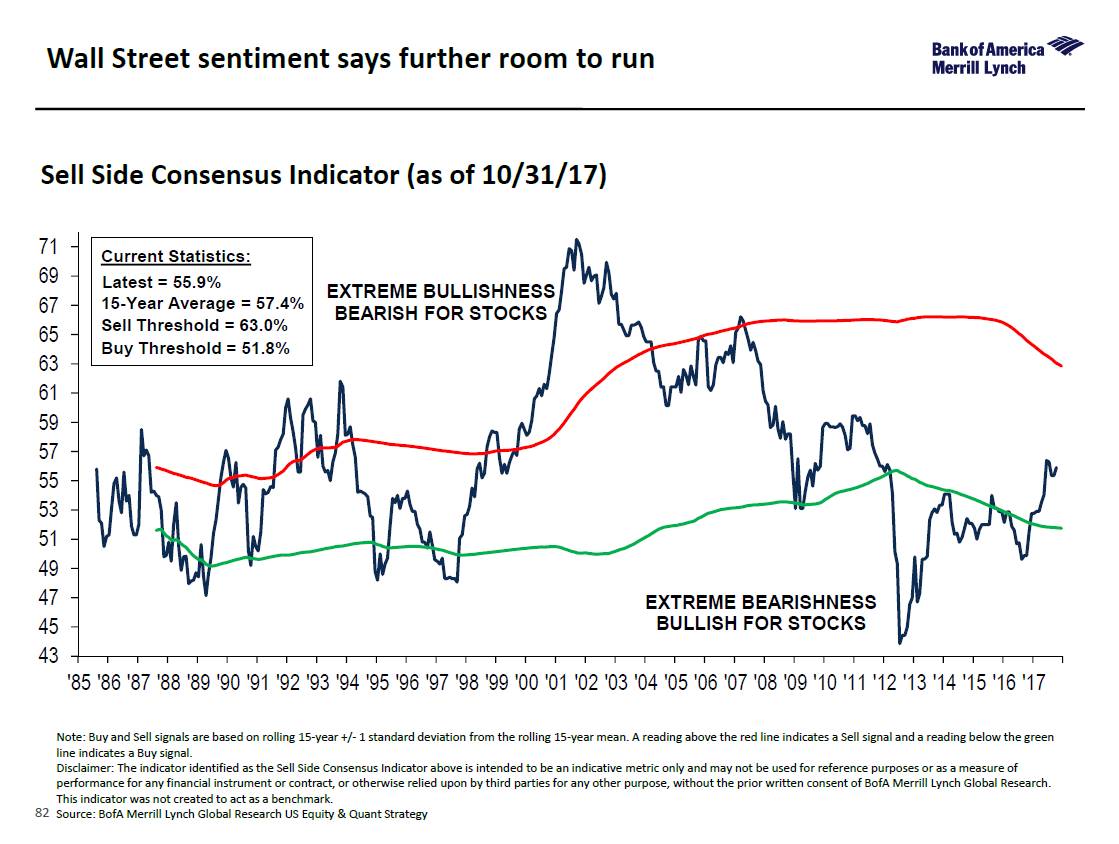

· BoAML’s Sell Side Indicator [1.]: Equity optimism is on the

rise. In November, the BoAML Sell Side

Indicator – a measure of Wall Street's

bullishness on stocks - ticked up for the 2nd month in a row to 56.1 from

55.9. That’s near a six-year high! This

model is based on comparing today's sentiment levels vs. the prior 15

years. BoAML says there is evidence that

sell signals have higher efficacy relative to shorter histories and imply a

more bearish outlook. The ongoing shift from skepticism to optimism likely

reflects the march towards euphoria

that we typically see at the end of bull markets and had been glaringly absent

for most of this cycle.

Note

1. BoAML’s Sell Side Indicator is

based on the average recommended equity allocation of Wall Street strategists

as of the last business day of each month. We have found that Wall Street's

consensus equity allocation has been a reliable contrary indicator. In other

words, it has historically been a bullish signal when Wall Street was extremely

bearish, and vice versa.

BoAML

Quick Takes/Talking Points (December 8, 2017):

· "Growth" trade reverses:

big (7th largest ever) redemption from U.S. equity growth funds, inflows to

tech funds waning; coincides with bout of weakness in tech (e.g. EMQQ -11%, SOX

-10% in 10 trading days).

· "Yield" trade fades:

smallest IG inflows in 50 weeks ($1.4bn), 6th consecutive week of HY outflows;

largest EM debt inflows in 26 weeks ($2.2bn) buck trend but note both EM debt

& equities struggling in recent weeks.

· Rotation needs wages:

"growth" in equities, "yield" in bonds = QE-leadership:

ends when "end of QE + start of fiscal stimulus + start of inflation =

higher bond yields"; missing evidence is inflation…US tax reform needs

wage growth to cause higher yields and sustained rotation to QE-losers; wage

data critical in coming months.

· Big Inflows…Poor

Returns: record inflows 2017 into bonds ($347bn), stocks ($286bn); but years of

big equity inflows (2010/13/14) were followed by poor returns (2011/14/15 - see

Table 1); this especially case when BofAML Bull &

Bear high (currently 6.4); we believe upside for risk assets in Q4/Q1 big but

both credit & stocks peak early-18)

……………………………………………………………………..

Victor's

Closing Comments:

U.S. T-Bills have yielded less than the CPI for 9 years. The German 5 and 10

year Bunds have negative real yields as do other foreign bonds (many have

negative nominal interest rates).

As long as global central banks never allow a yearly market

loss and keep rates in repression, why would corporations do anything but

buy back their own stock? The biggest shareholders always win. Investing in a

business (capex and opex) can lose if there's not a

positive return on investment (ROI).

The USA is totally corrupt and as long as it pays to do so it

will continue till it blows up!

……………………………………………………………………..

Curmudgeon’s new email address: ajwdct@gmail.com

Good luck and till next time...

The

Curmudgeon

ajwdct@gmail.com

Follow the Curmudgeon

on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2017 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).