Charts

Indicate Central Banks Must Tighten Monetary Policy: Part I

by the Curmudgeon

Introduction:

It's been 11 months since the Curmudgeon has posted

commentary and we're very glad of that decision. The financial asset mania's

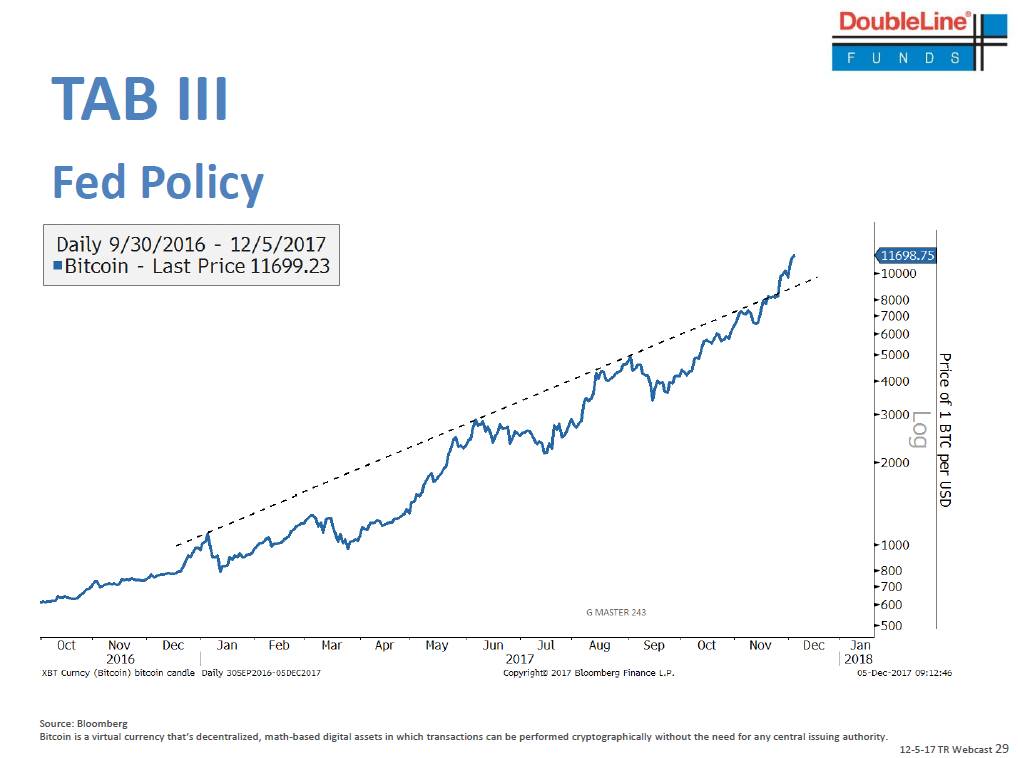

and mega bubbles have only gotten larger and have now been joined by

Bitcoin (see chart below). In our opinion, these never

before seen manias were created by global central banks that have kept

real interest rates NEGATIVE for over nine years. However, that game may

soon be over, based on DoubleLine and Bank of America

(BoA) webcasts we participated in today.

The following charts (with captions noted) speak for

themselves:

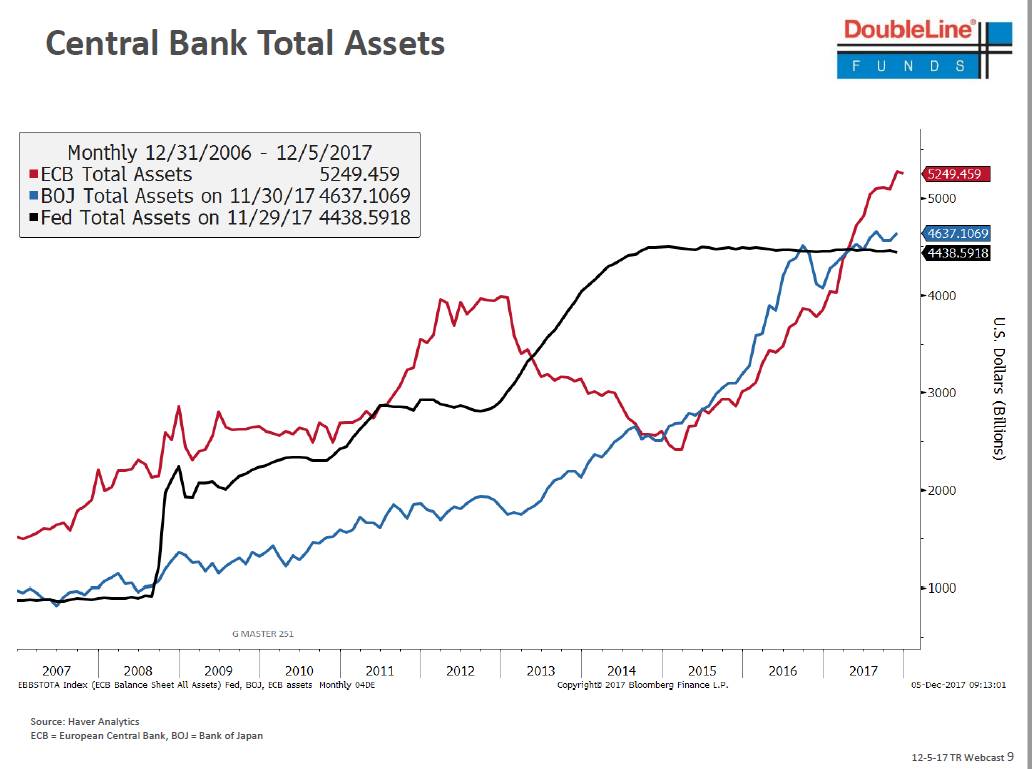

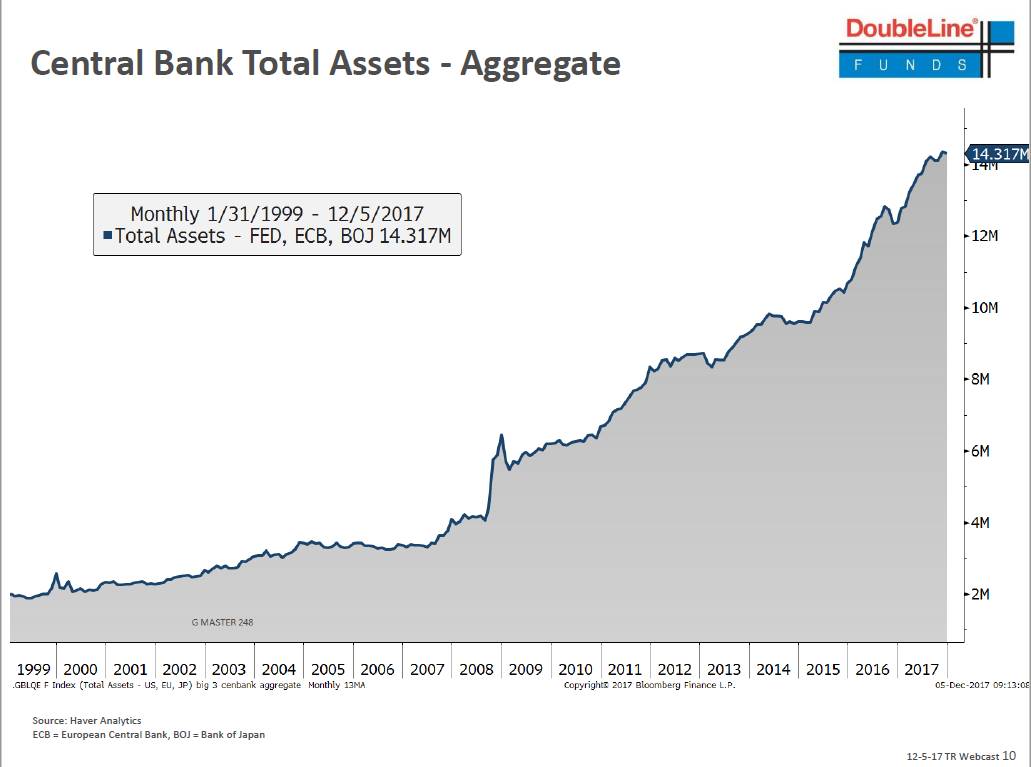

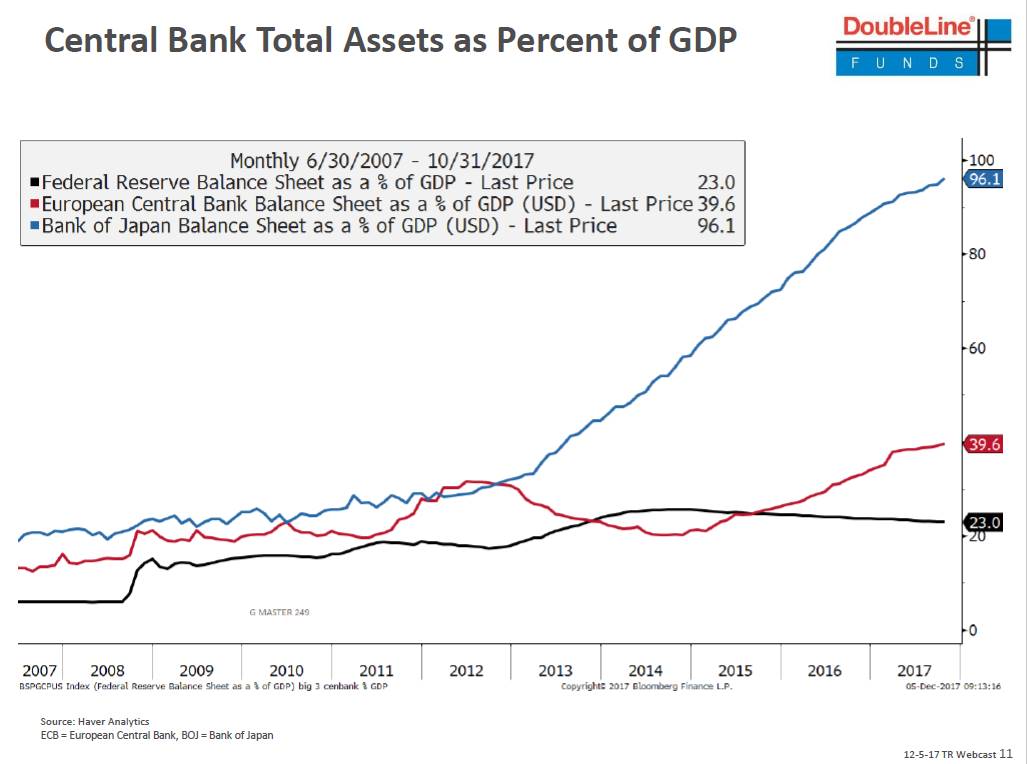

Fed

& Central Bank Assets Have Exploded since 2008

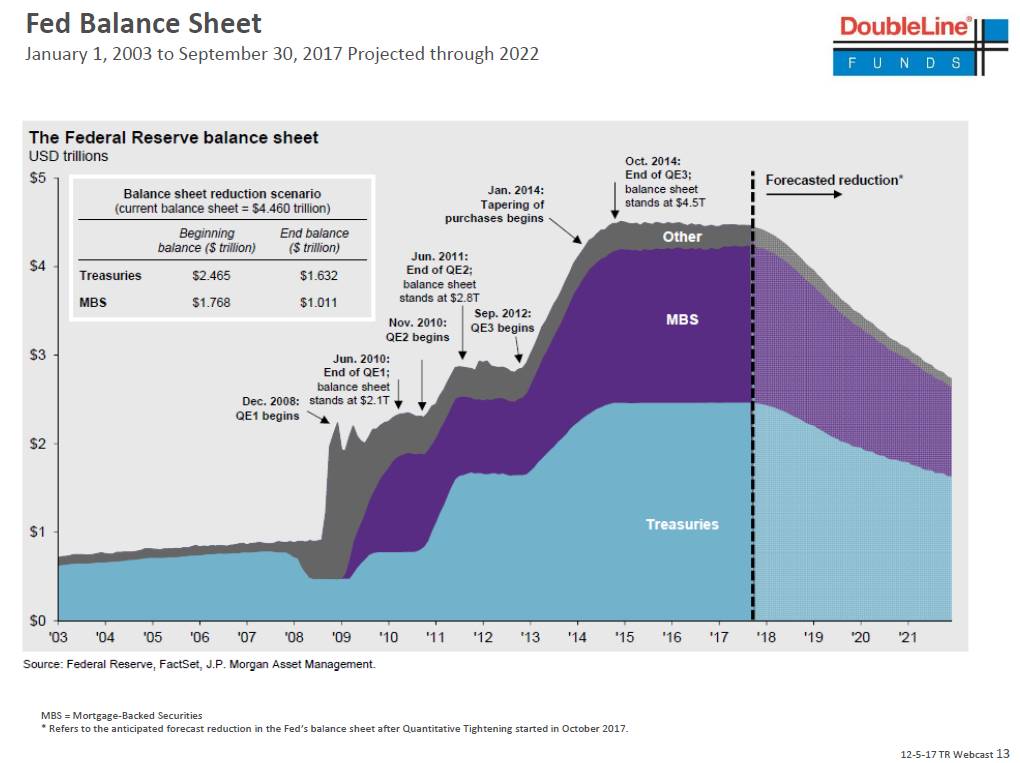

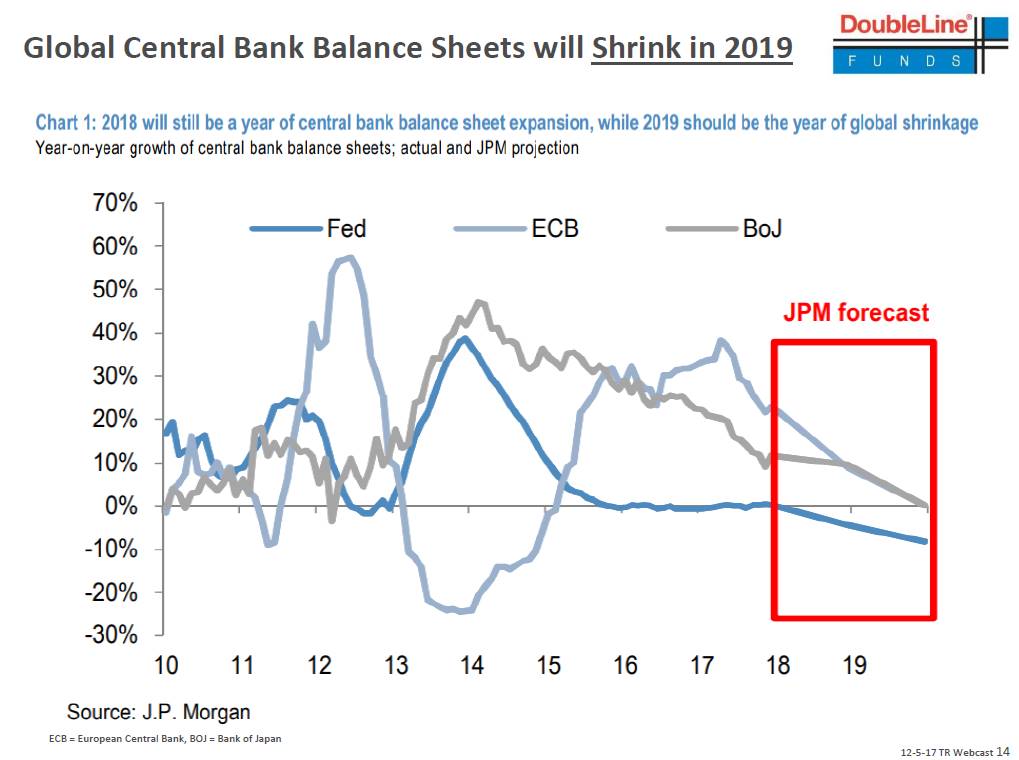

Fed & Central Bank Balance Sheets

Will be Shrinking Next Year

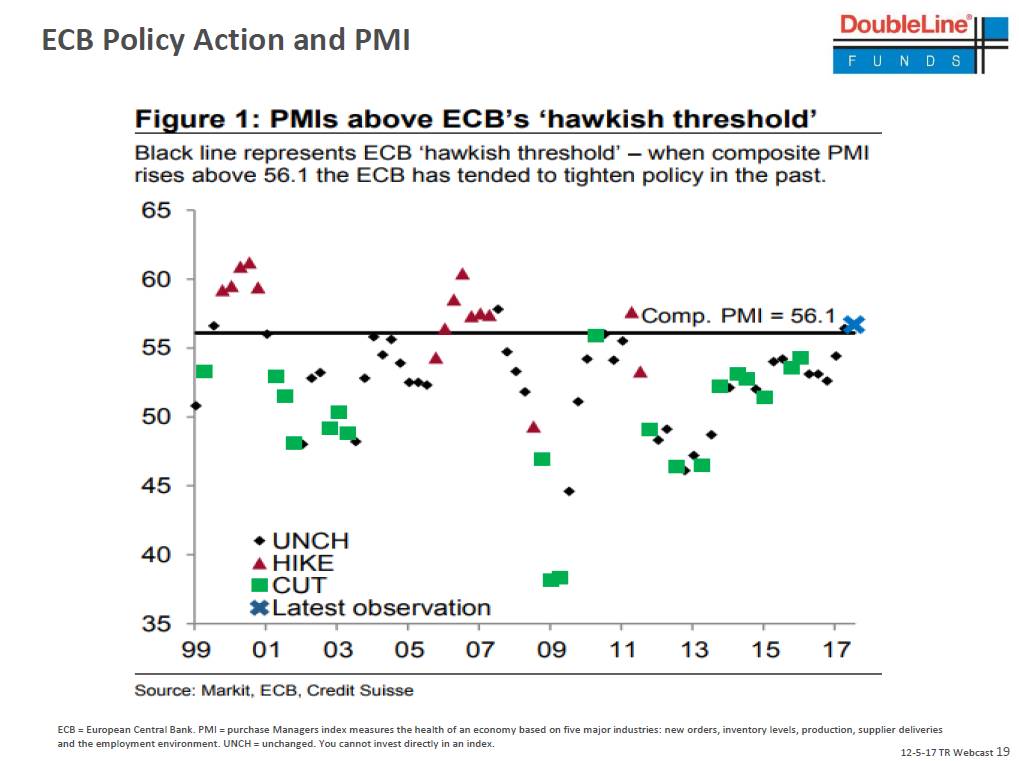

EuroZone PMI Above ECB Threshold

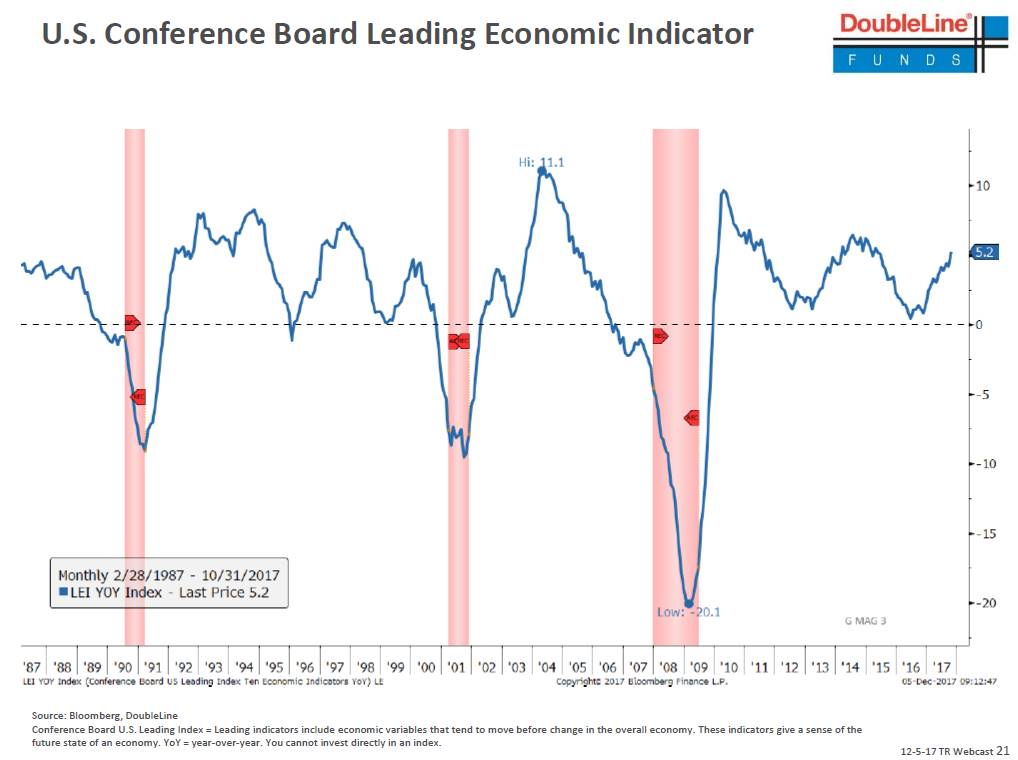

U.S. Leading Indicators in Uptrend- No

Recession in 2018

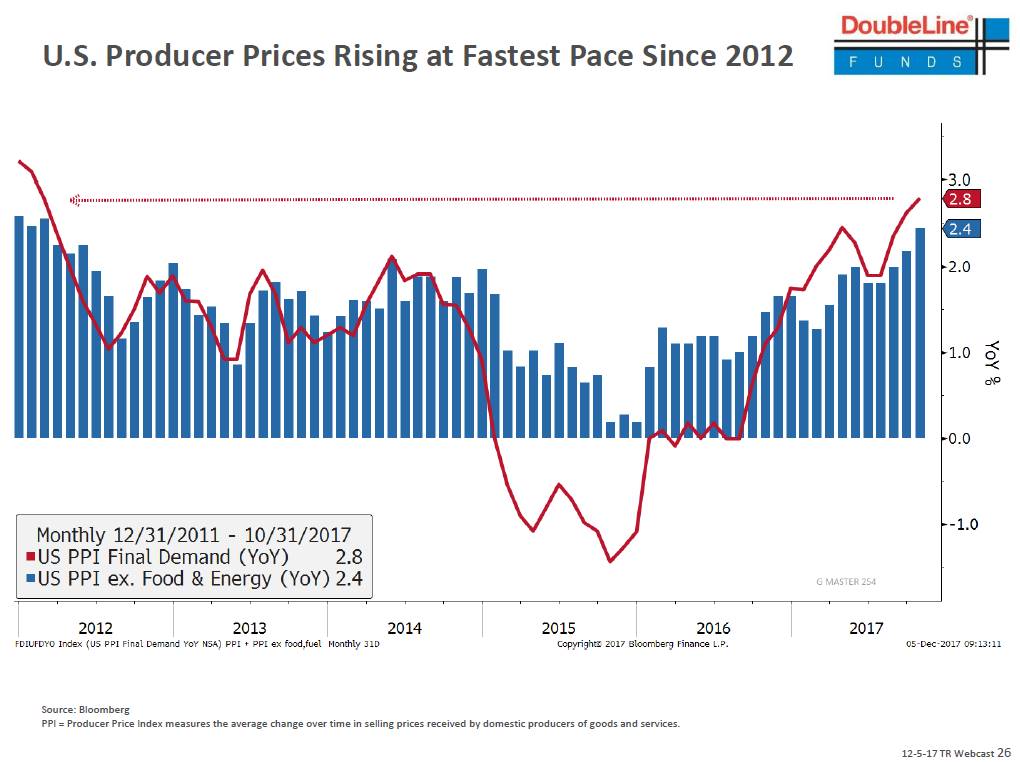

U.S.

PPI Rising Rapidly – Will CPI Follow?

Is

the Fed Watching Bitcoin’s Parabolic Rise?

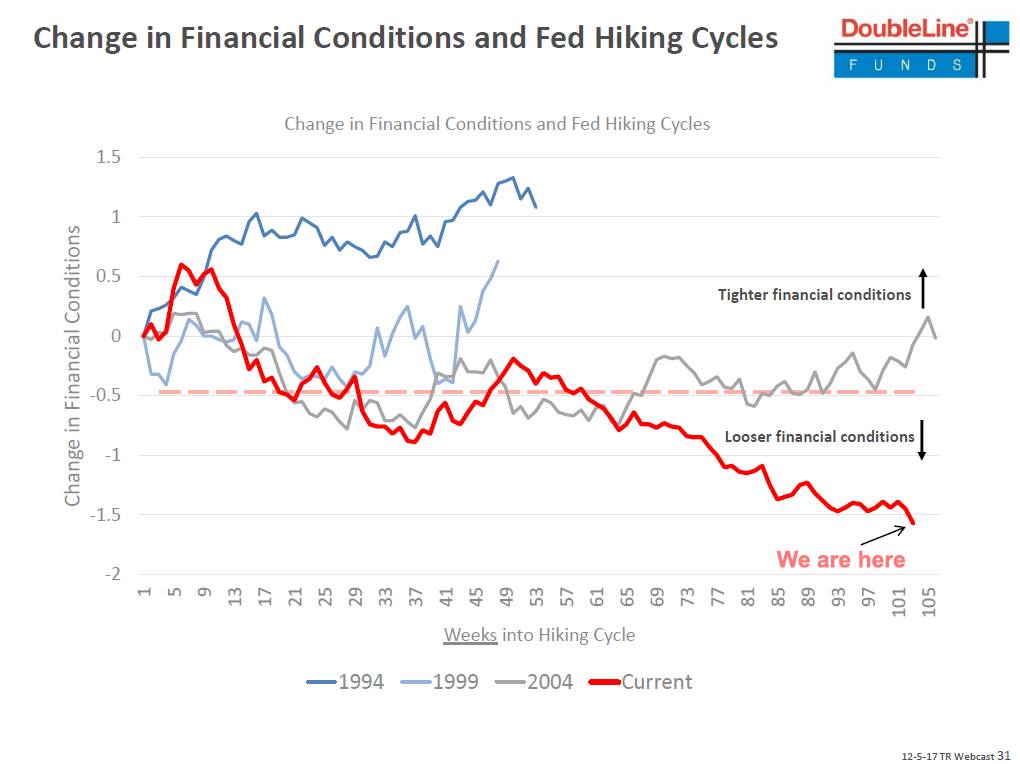

Looser

Financial Conditions Two Years Into Fed Tightening

Cycle

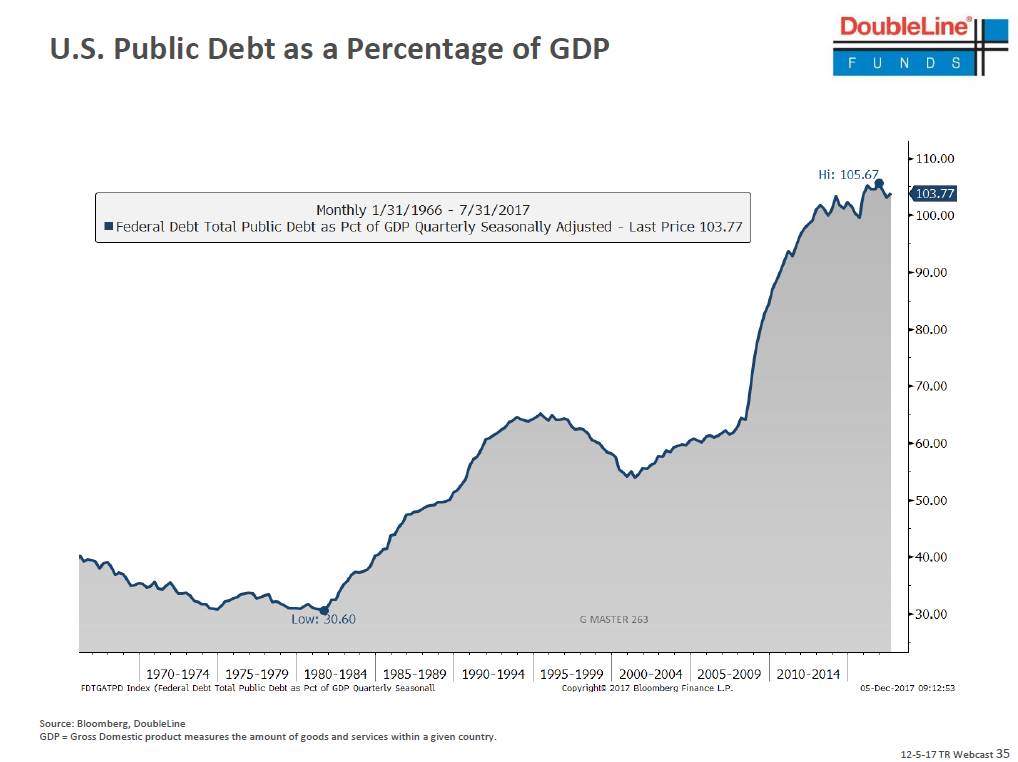

U.S.

Public Debt Now 104% of GDP vs. 56% in 2002

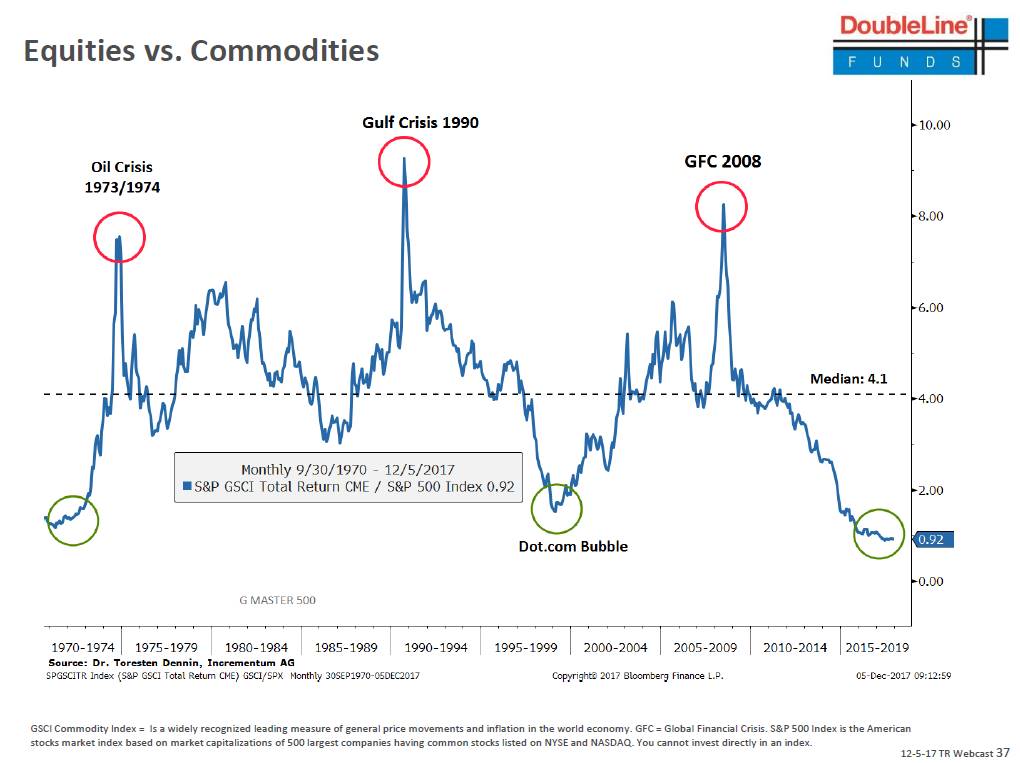

Commodity/Stock

Returns Lowest in 50 Years

Is That Bullish For Commodities and/or Bearish For

Stocks?

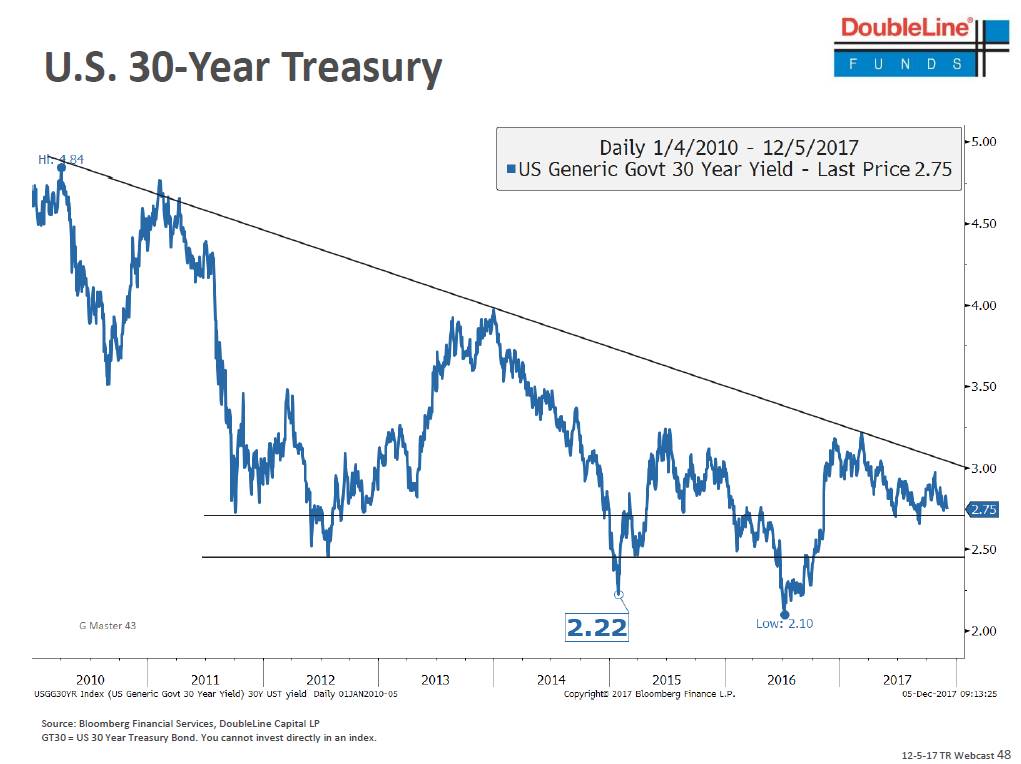

U.S.

30-Year Treasury Yield Still in a Downward Trend

While

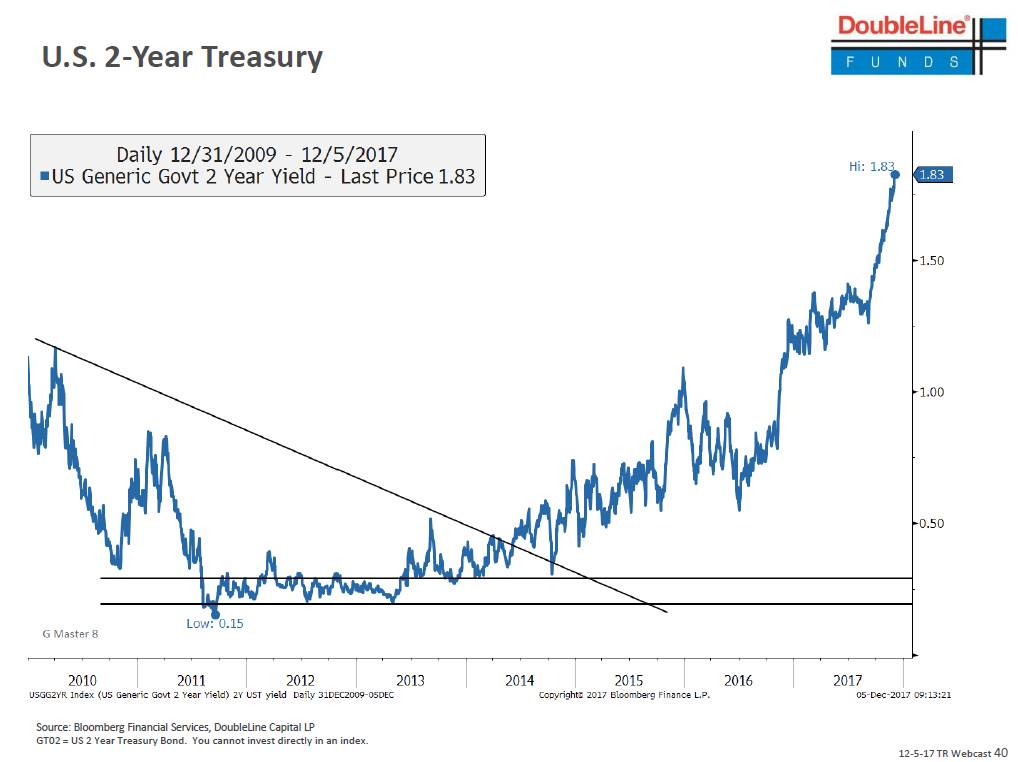

U.S. 2-Year Treasury Yield in Sharp Uptrend

Good luck and till next time...

The

Curmudgeon

ajwdct@gmail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2017 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).