2016

Equity Market Review, Fund Flows and Bid Adieu

by the Curmudgeon

URGENT Notice:

Victor is having open heart

surgery this coming Wednesday and will be recovering for six weeks after

that. If you’d like to send flowers or a

card to “the man for all markets (AKA Trader Vic),” please email the Curmudgeon

and I’ll provide his mailing address.

2016 US Stock Market

Review:

“It was a terrible start to

the year, and it would have been a pretty flat year except for the election of

Donald J. Trump,” said Jeffrey Elfont, President of

Pinnacle Asset Management, an investment advisory firm.

“The year was bracketed by

two opposite moves,” said Chris Giordano, founder of Giordano Wealth

Management. “The start of the year was terrible, but the end of the year

was great because of the Trump rally.”

In 2016, the Dow Jones

Industrials (DJI) gained 13.4%, Transports (DJT) rose 20.4%, the

broad-based S&P 500 was up 9.5%, the tech heavy NASDAQ

composite rose 7.5%, while the small cap Russell 2000 rocketed 19.5%

higher – even though it had a trailing 52-week P/E=nil (as we’ve several times

groused about in previous posts). The S&P

Small Cap 600 did even better. It was up a whopping 24.7%.

Source: WSJ Data

Center

The SV150, an index of

the 150 largest publicly held tech companies, was up 6.5% during 2016. That included Santa Clara, CA based Nvidia which tripled its stock price during 2016,

soaring 224%. Gilead Sciences was

the big loser among the 10 largest companies in the SV150 index. Its share

price declined by 29.2% in 2016.

PG&E, despite ongoing difficulties following a fatal

explosion in San Bruno, CA and its criminal convictions in August by a federal

trial jury, managed to post a robust gain of 14.3%.

Wells Fargo, jolted by a scandal that erupted in September over

bogus bank accounts that employees opened without permission of customers, was

up 1.4% in 2016. Yet Wells Fargo’s

fortunes after the scandal — and after the election results — exemplified how

external events can affect a company’s shares. From the time the fraudulent

accounts fiasco was disclosed until Election Day, Wells Fargo’s shares plunged

8.7%. But since the election, with the prospect of easier regulations for banks

under a Trump administration, Wells Fargo’s shares rose an eye popping

21%. Does anyone really believe Trump

is going to boost Wells Fargo’s profits or restore its reputation?

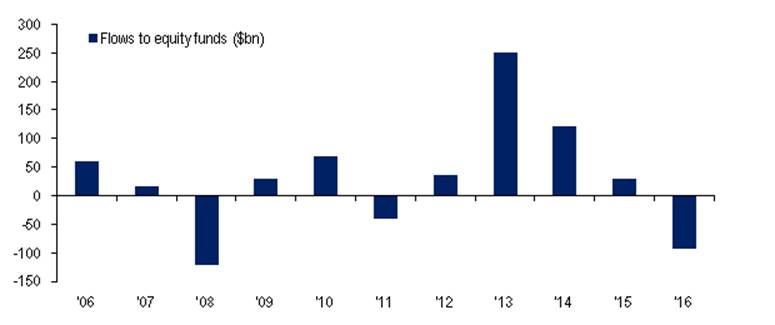

Equity Mutual Fund

Outflows Largest Since 2008!

According to a December 30th

BofA Merrill Lynch Global Research report, 2016 was the largest year of

equity mutual fund redemptions since 2008.

In contrast, bond inflows

continued for an eighth consecutive year.

From the Investment

Company Institute’s December 29th

Report, we see that Jan 1 to Nov 30, 2016 total equity fund redemptions

were almost triple redemptions during the same period in 2015.

Net New Cash Flow of Mutual

Funds*

Millions

of dollars

|

|

Nov 2016 |

Oct 2016 |

Jan–Nov 2016 |

Jan–Nov 2015 |

|

Total long-term |

-52,384 |

-33,012 |

-141,249 |

-46,521 |

|

Equity |

-28,243 |

-38,080 |

-224,650 |

-39,749 |

|

Domestic

equity |

-25,886 |

-31,460 |

-207,067 |

-144,835 |

|

World

equity |

-2,356 |

-6,619 |

-17,583 |

105,086 |

|

Hybrid |

-7,627 |

-5,087 |

-33,609 |

-8,565 |

The Buying Power Driving

US Equities Higher?

The conundrum here is where

is the huge buying power coming from that has propelled stock prices higher,

while equity mutual fund NET redemptions are so large? The Curmudgeon believes it’s been companies

buying back their own shares- even at sky high prices.

BoAML recently said that ~70% of S&P 500 companies have

bought back their own shares in the last several years. But if Trump’s fiscal policies really do

stimulate US economic growth, companies will likely increase capital

expenditures rather than invest in their own shares. Also, rising interest rates will stop the

financial engineering trick of borrowing on the cheap to buy back shares and

pay dividends.

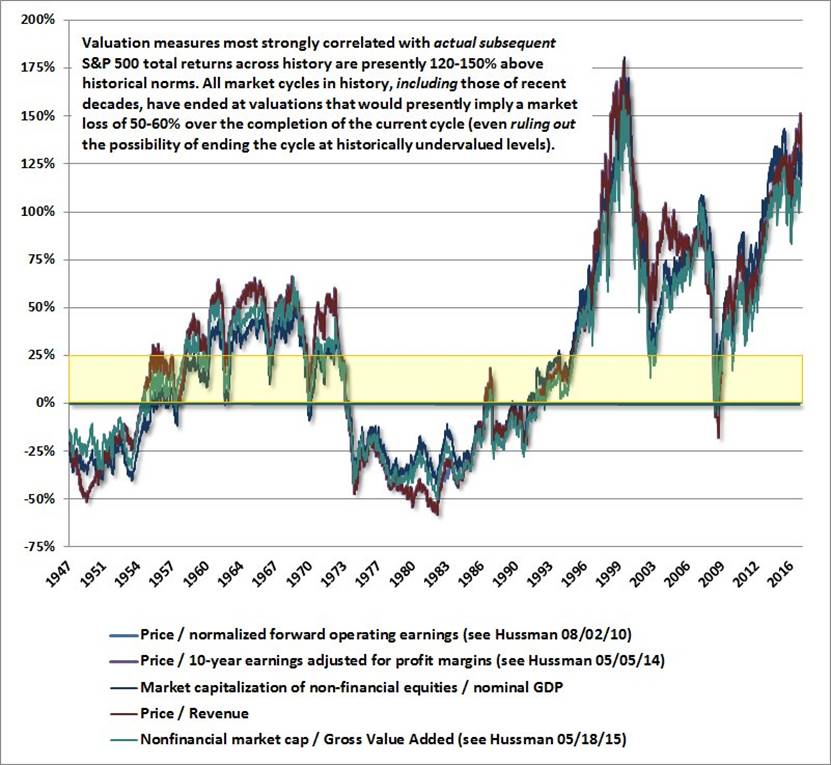

Overvaluation vs

Subsequent S&P 500 Total Returns:

December 27,

2016 Tweet from John Hussman, PhD and founder/manager of the Hussman mutual

funds:

“The great risk is not in

missing out or being short into an exhausted run at 2000 valuations, but in

failing to contemplate a 50-60% retreat.”

End Note:

For over a decade now, the

Curmudgeon (joined by Victor Sperandeo for the last four years) have endeavored

to provide important news and insights that the mainstream media has either

ignored or covered very lightly. We’ve

identified many international global risks, the true state of the US economy

(with the help of our colleague John Williams of ShadowStats), exposed

the Fed as a “no risk hedge fund” and the ECB as a “talk the talk” flimflam

central bank. Victor has also detailed

the worldwide trend towards socialism and how the public, especially in Europe,

is rejecting that and will likely continue to do so in Spring 2017

elections. He also provided his market

forecasts and revealed his investment moves for early in 2017.

With the huge disconnect

between the financial markets and real economy continuing, we don’t really have

anything more to write about. Further,

we are discouraged by the lack of reader feedback/comments or acknowledgment of

our articles (only a handful of readers have emailed the Curmudgeon that were

related to our blog posts; many more have asked for financial advice or timing

on when to go short).

Finally, we do these blog

posts as a labor of love. We are not

paid and don’t accept advertisements or “pay for play.” Therefore, we are taking an extended

publishing break for these free blog posts.

If we had the marketing prowess, we might consider a paid subscription,

as David Stockman has done.

In closing, Victor and I wish

you the best of success, good health and happiness in 2017.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).