Italian

Referendum Fails, PM Resigns; Possible EU Breakup?

by the Curmudgeon with Victor

Sperandeo

Background:

Italian citizens voted

against constitutional reform this Sunday in what many analysts say is the most

significant European political event of 2016. The reforms wouldve removed

power from Italys Senate such that proposed laws would only require the

approval of the lower house of parliament. The current Italian legislative

system requires approval from both houses.

Prime Minister Matteo

Renzi was campaigning for a "Yes" vote to make it easier to govern

the nation moving forwards. He resigned

Sunday after the referendum was clearly defeated. In a late-night news conference, Renzi said

he took responsibility for the outcome. The No camp must now make clear

proposals, he added.

"My experience of government finishes here" - Matteo Renzi after

losing a reform referendum.

Photo above courtesy

of Reuters

.

A "No" vote,

was championed by populist party 5 Star Movement1. The

victorious No vote blocks proposed reforms to streamline Italy's public

administration and leaves in place the extensive checks currently required in

Italys complex and very expensive political system.

Note 1. Leading the charge against Prime Minister Renzis referendum

is a comedian-turned politician Beppe Grillo, founder of the 5 Star Movement,

which started in the wake of the 2008 global financial crisis and has gained

strength as Italys economy has struggled in the years since.

.

Opinion: The Curmudgeon

believes that Renzis resignation will lead to a period of intense uncertainty

as Italy tries to form a new government.

Thats significant because some Italian banks are teetering on the edge

of insolvency (see Mauldin and Sperandeo comments below).

One of Italys leading

banks, Monte dei Paschi

di Siena, is planning to sell new shares this week to shore up its balance

sheet. The bank needs to raise 5 billion

euros by year end to avert the risk of closing (i.e. going bankrupt).

The referendum

outcome could be taken as another sign of rising anti-establishment sentiment

in the core of Europe, potentially

eroding investor confidence in the euro ahead of elections in France and

Germany next year. Indeed, the euro is

down approximately 1% vs the US dollar as this article is being submitted for

publication.

John Mauldins Comments (edited for

clarity and conciseness):

Many people think the

real question is whether the current government should stay in power and

whether Italy should remain in the Euro-zone.

Coming up with an answer isnt necessarily helpful when you cant even

agree on the question. However, Italians vote, it may take some time to figure

out exactly what the result means to Italy, the Euro-zone, the EU, and the

global economy. I am confident that the ultimate outcome wont be good, no

matter what they choose. The problems are deeper than simple structural reform

can cure.

Politically and

economically, Italy is an ungovernable mess heading straight for a Greek-style

banking and debt crisis but with an Italian flare.

Viewed from a historical

perspective, this prospect shouldnt surprise anyone. The territory we now call

Italy was a shifting collection of smaller city-states for centuries. They came

together as a Republic only after World War II, so they still have some issues

to sort out. Creating a stable banking system is high on the list. But Italy

cant have that until it has a stable political system, which has been elusive:

Italy has had 65 different governments in the postwar era. They last

just over a year, on average.

Italys economy and

markets increasingly depend on electoral politics, geopolitics, and politically

charged policy decisions. Thats just a fact of life now, one I suspect

Italians must accept for many years to come.

Now, its true that

economic forces usually prevail over politicians in the long run. How long is

that? Id say a generation twenty years or more. But political forces are

very important if were trying to forecast the next twelve months or the next

five years. Ignoring them is not an option.

Its not just Italy,

either. Political, economic, and social changes are afoot almost everywhere in

the world. As an investor, what are you to do when these inputs are

crash-landing on your portfolio?

There is a high

degree of probability (approaching 90%, Id say) that Italy will

experience a severe banking crisis in the next few quarters. Perhaps they

can stave off the problem for a year, but something must be done about the

banks. Well go into that later in the letter, since the plight of the banking

system is the root cause of all the countrys other problems. Without a banking

crisis, Italy would still be the political mess it has been for 65 years, but

the banking mess turns the political mess into an economic mess.

There is a significant

chance Italy will decide to leave the Euro-zone and/or the European Union

in the next year or so. Is it likely? No, but weve seen less likely things

happen recently. Just the discussion of the possibility could be destabilizing to

markets that already have enough worries.

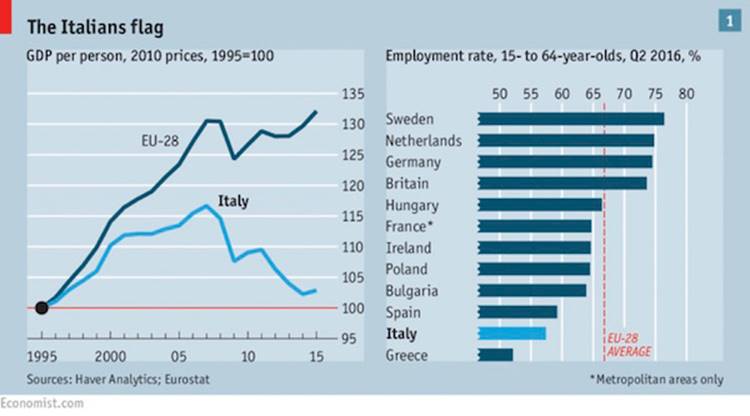

On the left side of the

chart below, you can see that Italys GDP per person has lagged the EU since

1995. Worse, its been falling after 2009 (when the global recession supposedly

ended) even as Italys neighbors recovered.

The real drop-off in Italian economic performance began shortly after

the introduction of the Euro in 19992 as can be seen from the chart

on the left:

Chart courtesy of Economist magazine.

Note 2. Euro

coins and currency were not put into circulation till January 1, 2002. The Euro was used for electronic payments and

selected banking transactions from 1999-2001.

During that time, each Euro-zone country continued to use their own

currency. For Italy, it was the Lira.

.

Eighteen percent of the

total loans made by Italian banks are now considered to be nonperforming.

Nonperforming loans occur everywhere, of course, but not to this level. On an

aggregated basis, the Italian banking system has less than 50% of the capital

it would require to cover the bad debts. Estimates are that Italian banks may

need 40 billion just to remain solvent.

Writing off a massive

loan as a loss will render the bank insolvent, so instead it goes into extend

and pretend mode, allowing endless payment delays on the flimsiest premises,

hoping against hope that you will win the lottery and resume paying your loan.

Thats what is happening in Italy and indeed throughout Europe.

.

Victor: EU is

Terminally Ill!

A key theme that should

continue is the "the end" of turning from the political establishment

towards the liberty of the people throughout the world.

Thereby, the Italian

referendum vote to change the Constitution this Sunday (today) should be

a" NO" vote which will indicate a potential END of the European Union

(EU) experiment. There will be several

critical elections in European countries in the new year that will

"confirm the potential EU break-up" as several countries vote to leave

the EU via a Brexit like referendum.

Evidence is everywhere

that the EU is terminal ill:

1. From a November 30,

2016 Zero Hedge blog

post:

European Commission

President, Jean-Claude Juncker issued a warning to Austrian presidential

candidate Norbert Hofer, regarding referendums.

Hofer, an anti-immigration, candidate is in a tight race for the

election coming up on December 4. If he

wins, Hofer said he would hold in-out referendums if Brussels seeks to expand

it power.

2. In a related

article in the UK Daily Mail, European president Jean-Claude

Juncker pleads with EU leaders not to hold 'in-out' referendums - because

voters will choose to LEAVE:

Jean-Claude Juncker has

urged EU leaders not to hold referendums on their membership of the bloc

because he fears their voters will also choose to leave.

The European Commission

president said giving people a vote would be 'unwise' as they could seek to

replicate Brexit.

His remarks come as one

of the contenders to become Austrian president has threatened to hold a

referendum if the EU integrates further.

European Commission President Jean-Claude Juncker has urged EU leaders not

to hold referendums

The EU, like the Chinese

Communist Politburo, can't ask the "people" what they democratically

want even if its in their best interest.

If its not in the elites best interests (or what they want), they

might lose control of the people and their POWER!

This is insolence

expanded to the point of suicide for the EU. It should be clear the European Commission is appointed (the EU people

don't vote for them). Thereby, they can't be fired!

3. France is a major nation that will

maintain, or kill the EU if far right candidate Marine Le Pen (of the National

Front party) wins the French Presidential elections in April 2017.

Former UK Prime Minister

David Cameron seems to concur. He told

the UK Independent that a Le Pen win would be a body blow for the

European project. Mr. Cameron also said

he was hoping for a victory of a mainstream party that can unite people behind

their candidacy in Aprils presidential elections in France.

An EU break-up would

be a major "deflationary" negative that will lead to depression, then

hyperinflation.

[The election in the US

may have the opposite effect as Trumps fiscal policies are

"inflationary." However, they

will not be enacted until June-September time frame at the earliest. Ive previously written that those policies

(what we know of them) will be bullish for US GDP and stocks, but were in

pause or wait and see mode right now.]

Victors Conclusions:

The ECB backing all the

pretty engraved paper (fiat) money has brought CONFIDENCE in the EU. If thats lost, the game is over.

Curmudgeon Note: Im surprised

the Euro hasnt sunk to parity with the US dollar (or lower) in view of the

ECBs continuing monthly QE, negative short term interest rates, and Draghis

talk the talk. Meanwhile, the Fed is poised to finally raise rates again at

the December FOMC meeting.

.

Europe is heading into

a perfect storm within the next seven months where confidence will be

effectively voted on by the people.

- Central banks have failed long ago to create

growth, but they fool themselves pretending that keeping the (paper) game

going will somehow solve the problem of getting out of the mess they got

us into.

- The major Italian banks are bankrupt, Italy is

the third largest sovereign bond issuing nation on earth, and they have a

132.8 debt to GDP ratio.

- This is Greece to the 10th power in nominal size.

everyone should be concerned.

Figuratively, it looks like

ECB President Mario Draghi is about to meet the Duke of Wellington and Gebhard Leberecht von Blόcher (a Prussian field marshal) at the battle of

Waterloo. Perhaps he'll win, but its not the way to bet.

.

On Sunday, Austria voted against the Freedom party's Norbert Hofner, which is a plus for the EU.

.

End Quote:

Permit me to quote the

long time Wall Street researcher and author Doug Casey as stated in the Coming Collapse of the Worlds Biggest Economy:

"Oddly, the Europeans

cant seem to imagine a libertarian alternative of private charities, limited

government, minimal taxes, an unregulated economy, and

intellectual/psychological freedom. Its another reason the Continent is a

sinking ship." --- And this ship is far bigger than the Titanic.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).