The

Equity Markets and U.S. Dollar Continue Their Bull Runs

by Victor Sperandeo with the Curmudgeon

Disclaimer: All opinions

expressed herein, unless otherwise noted, are those of Victor Sperandeo. Some of Victors opinions are in italics.

Background:

In Pamplona, Spain the

running of the bulls is a tradition from the 14th century. People run in front of the bulls along a set

path (and sometimes in narrow streets) to show how brave they are. 50-100

people get injured per year and several have died over the past few years.

The US stock and dollar bull

run continues without the expected pause, while no one has yet been injured by

being long US stocks.

The New Normal for

Markets?

Markets since March 2009,

have tended to move up in a straight line on some important news event or

(sometimes) with no apparent trigger. This form of "investing" seems

to be the new normal. Either way this is not a "trading market," but a

get long and cover shorts at all costs domain.

..

Curmudgeon Asks: What Ever Happened to Profit Taking?

In all of US stock market

history, a new sustainable advance following an intermediate decline was

accompanied by either backing, filling, basing OR a test of the recent lows

after an initial rise. Not this year!

·

On

February

11th, the DJI closed at a 2 year low, then commenced a strong

rally for all stock indexes without either basing or a test of the lows. That never look back rally was in almost

all asset classes.

·

On

October 24th, the Dow Jones Industrials (DJI) closed

at 18,223.03 and was then DOWN in 8 of the next 9 trading days to close at

17,888.28 on November 4th.

·

The

S&P 500 was down (on a closing basis) for 9 consecutive trading days

over the same time period- from 2,151.33 on October 24th to 2,085.18

on November 4th. That was

followed by the strong rally which started on November 7th and is

still going gangbusters.

·

The

Russell 2000, which has a 52-week trailing P/E of nil, has been by far

the strongest index since it bottomed on November 3rd at 1,156.89

(close). Its been up for an incredible

15 consecutive trading days to close Friday, November 25th at

1,347.20 (=190.31 points or 16.45% during that time).

SOURCE: Yahoo Finance

..

Other Markets Last Week:

Meanwhile, with the US equity

markets and the dollar making new highs, currencies, bonds, gold, silver,

platinum, crude oil, most soft commodities (cotton, sugar, cocoa, coffee) moved

lower last week. The grains moved higher

in a small way with industrial metals the big winner (December copper +8.38% in

4 days and 28% in a month).

Bullish and Bearish

Scenarios:

The basic reason for the bull

moves remains Trumps unexpected victory as the next US President. Some experts predict the US economy to grow

at 4% after Trumps fiscal policy initiatives are passed by Congress1.

Moreover, the 4th quarter is also expected to be another strong quarter with

the Atlanta Fed projecting 3.6% real growth. That is the bullish case.

Note 1. (Curmudgeon):

A 4% US GDP growth estimate is really a stretch of the

imagination. None of the details of

Trumps fiscal policy programs have been disclosed, there is no guarantee that

Congress will pass them as is, funding for the programs is uncertain (considering

an already increasing US budget deficit and national debt) and there is no

known time-frame when any new fiscal policies will become laws or approved as

US budget items.

..

The bearish case is that US

note and bond yields are rising quickly, and in a straight line2.

Note 2. (Curmudgeon): Higher

yielding fixed income securities are competition for stocks, increased yields

raise borrowing costs which lower corporate earnings and might drastically

reduce debt driven share buybacks along with mergers and acquisitions.

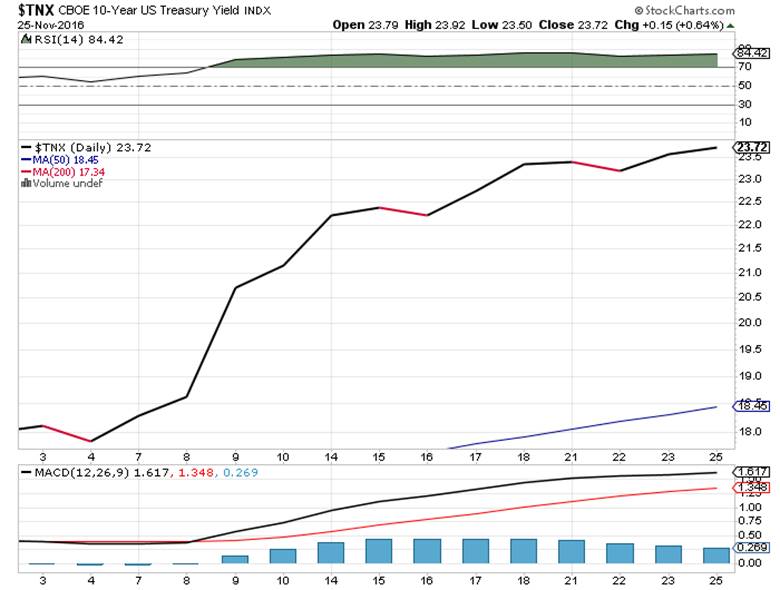

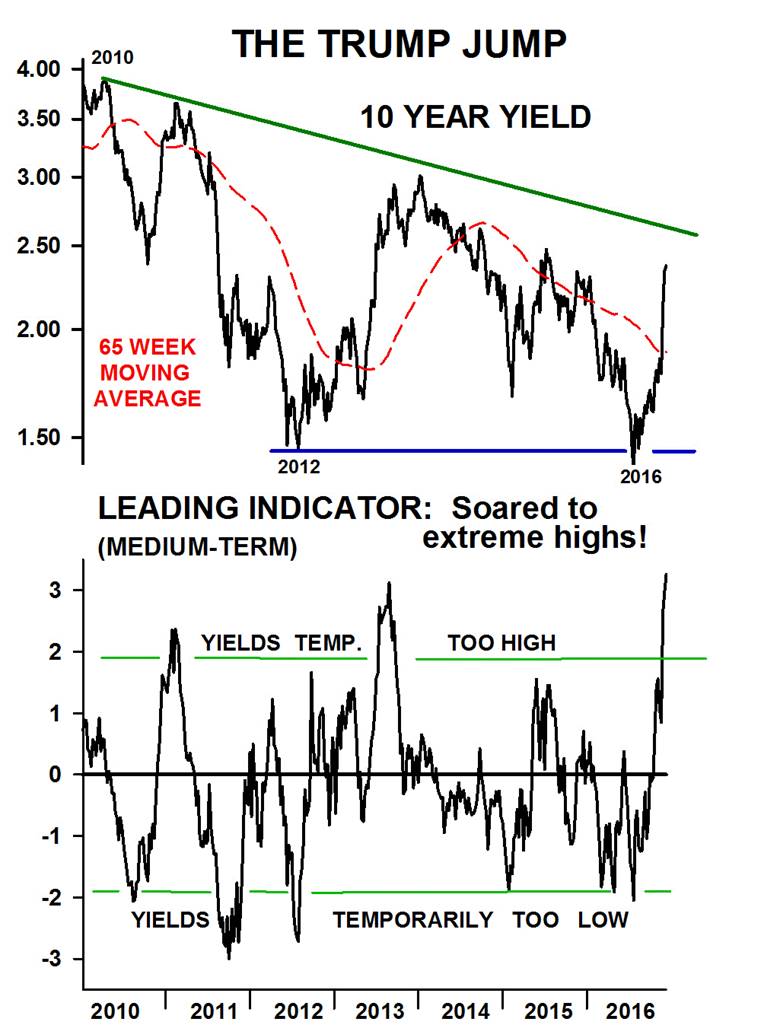

Here are a few charts which

illustrate the rise in rates, using the 10 Year Treasury Note as a benchmark:

Chart Courtesy of

StockCharts.com

Chart Courtesy of Dow

Theory Letters (Subscription Required)

..

Italian Referendum and

Effect on EU:

Rarely mentioned is the

December 4th Italian referendum vote to change their

Constitution. The Constitution change is primarily to save the Italian banks.

Understand that Italy -like Japan -has not grown its economy in any noticeable

way in 20 years. Many bank loans are

non-performing. The polls are indicating a "NO" vote, which would be

forecasting the continued trend towards an end of the European Union (EU). The demise of the EU would be a true game

changer.

Of course, polls have proven

a poor guide to the future in Brexit and Trump elections. However, the Italian referendum seems to be

going with the peoples wishes, not the establishment elites. Reuters believes

a defeat for the constitutional reform referendum is likely.

This vote is so complex for

most Italians that it is really a vote for or against Prime Minister Matteo

Renzi. A "NO" vote would be

one more step to the end of this camouflaged experiment of "New World

Order" socialism run by non-elected officials in Brussels.

European Migrant Crisis:

The mess the EU is in was

gravely aggravated due to the allowing of millions of migrants into Europe by

the dictate of Germanys Angela Merkel and the EU bureaucrats in Brussels. The

people did not get a vote or even an opportunity to express their opinions on

the migrant crisis in Europe.

It is my strong view the vote

will be NO, because the people feel the Socialist laws have now turned into a

fascist force upon them!

This Shock

Video went viral all over the world, along with many other reports, and

interviews, available on YouTube and Google. The 80-year-old man seen in the

video is Luigi Fogli who runs Hotel Lory in Ficarolo, Italy. Fogli briefly considered

providing asylum accommodation services for migrants arriving from North

Africa, but dropped the issue when he discovered he would ONLY be paid "7

euros" per night for each refugee ...

At that point, the local

prefecture simply confiscated his hotel and forced the invaders upon him,

according to Diversity

Macht Frei.

There are many other reports

on this poor man, who is forced to house 15 migrants for 7 euros a day... Note

that an espresso coffee is approximately 2.2 euros, and a Starbucks Latte is

4.76 euros in Zurich. A common hotel room In Italy is 79-150 euros a day. Can you now understand why Angela Merkel

is also behind in the polls?

Market Positioning vs

Trump Administration Policies (?):

My market thinking before the

election was to wait till after the Fed officially raised rates on 12/14/16 and

then to go short looking for a repeat of January/February 2016 and continue up

to the European elections in April 2017.

I'm flat now on all

"trading positions" - and have been since the election. (Of course Im

long Gold and Silver as investments dating back to the early 1990's and have

added along the way -never selling any yet).

On November 8th (election

day in the US), I believed Hillary would win the Presidential victor, or at

least the Senate would be controlled by the Democrats. With the GOP controlling

the House, the Senate, the Executive branch, and soon the Judiciary branch too,

there is certainly a reason to be a bull in the long run.

However, higher interest

rates are here and moving up rapidly, while new US laws, budget proposals and

the minds of men in the future Trump administration can change from a

politician's campaign promises. Recognizing that Donald Trump has not one fixed

principle in his head, and is a 100% pragmatist, he can change his mind at the

mere suggestion of someone he respects.

For example, Trump was for

"water-boarding" and worse to get information from captured enemies.

Then in interviewing General James (Mad Dog) Mattis for Secretary of Defense

the General disagreed. So now Trump is against torture of captured terrorists?

I can give dozens of examples of Trump changing his positions. These are

interesting times indeed.

Curmudgeons Closing

Comment:

Even if stocks on a

fundamental basis look expensive, Vinny Catalano, President of Blue Marble

Research, told the Financial Times that money managers would feel

obliged to keep buying. On a technical basis, the music is playing, there are

no negative signals and people are dancing, he said. Its career suicide if

youre not in the market.

The Curmudgeon still has

small short positions in inverse index mutual funds and Leuthold Grizzly Short

(GRZZX). Evidently, lessons learned in almost five

decades of stock market investing must be unlearned to profit in todays stock

market.

End Quotes:

Lets end with two sentiments

of Mad Dog Mattis, which may portend the future of US security, which is

certainly important to all.

1. Be polite, be

professional, but have a plan to kill everybody you meet.

2. "Demonstrate to the

world there is No Better Friend, No Worse Enemy than a US. Marine.

Quotes by General James Mattis.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).