US

Recession Coming Soon; Equities Bull Market Ending and Bear Growling

by Victor Sperandeo with the Curmudgeon

Introduction (Curmudgeon):

Economists in The Wall

Street Journals latest monthly survey of economists put the odds of a

recession occurring within the next four years at nearly 60%. Its important to note that the US economy

has never grown for more than a decade without a recession. The current

expansion began in June 2009, and has now continued for 88 months, making it

the fourth-longest period of growth in records stretching to 1854.

Economists polled by

the Journal forecast a 20% chance of a recession within the next year, and see

those odds rising as the time window gets longer. Asked to name the specific

risks, a plurality cited the possibility of a global economic slowdown, which

could be largely beyond the next US Presidents control.

In this post, Victor

provides his forecasts for the US economy and believes a recession is

imminent. Based on several factors, he

believes that the 7+ year US equity bull market is soon coming to an end and

the bear is waiting in the wings.

Easy money and the

expectation of a reasonably good 3rd quarter GDP number are

currently supporting the US stock market.

Weve written at length about reckless monetary policies driving up

financial assets while having a negative effect on the US and global

economy. Enough said on that topic. Lets first look at 3rd quarter US

economic growth, before Victor explains why he feels a recession could start in

the 1st quarter of 2017.

US Economic Growth to Weaken- No Recovery from Last

Recession (Curmudgeon with quote from John Williams):

The Conference Board is forecasting a

2.4% increase in real GDP (seasonally adjusted) for the Q3-2016. The Atlanta Fed GDPNow model

forecast is 1.9% as of October 14, down from 2.1% on October 7 and 3.7% this

August (almost a 50% decline in only two months). Thats shown in the chart below along with

the range of forecasts (2.3% to 3.2%) from the Blue Chip economic

indicators consensus1.

Chart

courtesy of the Atlanta Fed.

Note 1. Blue Chip Economic Indicators is an organization that

compiles consensus macro forecasts. The Blue Chip Economic Indicators is a

publication that surveys leading business economists and from the interviews

derives a 16 page monthly report. The report offers

forecast for real GDP and 15 other macro variables.

..

Our esteemed colleague

and very well respected economist John Williams at ShadowStats shares the

Curmudgeons views on the real economy.

He wrote in an email on October 15th:

I contend that we never fully recovered from the so-called

Great Recession, the economic collapse into 2009. Further, the economy already is has turned

down into a "new" recession, irrespective of the poor-quality

reporting in the GDP. You can see it in

negative annual growth in industrial production, S&P 500 real revenues,

help-wanted advertising and domestic freight traffic, among the better-quality

indicators.

..

Another candid

assessment of the sorry state of the US economy argues that The

US economy is in desperate need of a strong dose of fiscal penicillin. We definitely agree!

After the 3rd

quarter GDP number is reported to be weaker than expected at the end of

October, Victor expects downward economic momentum to accelerate in the 4th

quarter. We now pass the baton to him

for the rest of this post (other than one supporting comment from the

Curmudgeon).

Why the US Economy Will

Soon Be in Recession (Victor):

Like most observers, I

believe the Fed will raise short term rates at their December 14th

meeting. Such a rate hike is in part

psychological, but also the Fed catching up with all other interest rates

increases.

Three month Libor is up

44% this year (1 year -from 10/16/15 to date- Libor is + 177.6%). US Treasury

Bonds are down (

-7.72%) using T Bond futures prices. [The high was July 8th @176.29 (Sept

futures), and Friday 163.08 on the (Dec futures). The lows of the year were the

April 25th lows or another -2.8% from Fridays close. The current 30-year T

Bond yield is 2.55%.]

The Fed is following

the fixed income market, not leading it. The world has ended lowering rates at

this point. All bonds are rising in yield. Fiscal policy (i.e. infrastructure

spending) is now in play, yet its been missing in action for a very long

time.

Rates will continue to

rise and debt will increase. Therefore, auto and sub-prime loans, real estate,

building, and business of all kinds will slow dramatically as adjustable rate

mortgage (ARM) payments increase. Oil prices are also rising, which inhibits

consumer spending. All kinds of credit

growth (including margin debt to buy stock) will contract. Forget debt being 3%

of GDP (the EU rule). There are no rules in the world anymore.

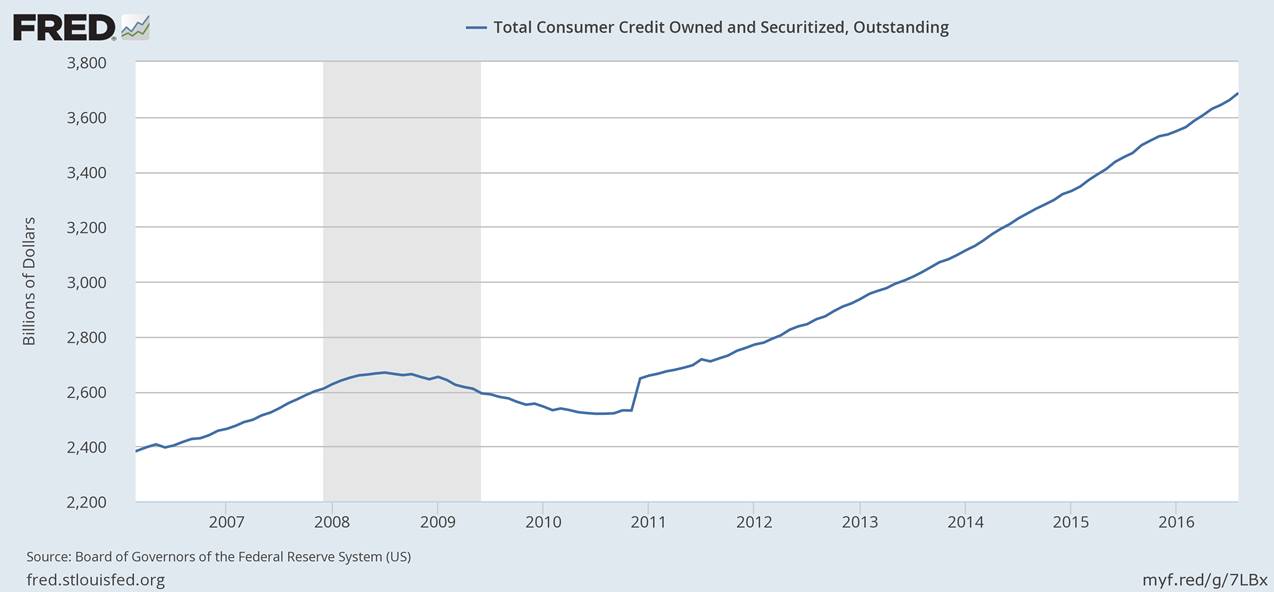

That is why you will

get a recession. I believe it will

happen very quickly (after Christmas) as the world is a House of Cards. The catalyst to a quick economic decline is

the end of expanding credit, which has risen exponentially as per this

chart:

Reasons Why US Equity

Bull Market Is Ending and the Bear is Growling (Victor):

The expected 2017 stock

market decline could get nasty. The

S&P 500 could be down as much as 40-50% from its all-time high by June

2017. Consider the following factors:

1. Interest rates will rise in December.

US interest rates are

going to be raised at the December 14th Federal Reserve meeting, or

else the Fed will lose all credibility.

This will be the major catalyst causing the end of the Equity Bull

Market that has been in place since March 2009. It will not be the primary

cause, which is a lack of responsible fiscal policy worldwide. Specifically, tax cuts have been bypassed in

lieu of reckless experimental monetary policies in a failed effort to create

economic growth. If people don't have

money and are afraid of more debt, they can't (or wont) spend.

Rates will continue to

rise as every major central bank knows that QE is a failure, and has done great

damage to banks, pension funds, and insurance companies. THIS GAME IS

OFFICIALLY OVER.

2. The probability of an EU structure collapse is under

appreciated by markets.

After Brexit, any

additional nation that leaves the EU will cause it to effectively end as an

ongoing concern. On December 4th, Italy will have a referendum on

"Constitutional Reform. A NO

vote will cause the loss of confidence in Prime Minister Matteo Renzi's power.

The trend is against the EU. More importantly there will be critical elections

of 2017, namely the French election of April 23-May 7th, where

front-runner Marine Le Pen wants to leave the EU. In The Netherlands, Greet Wilders is anti-EU

and very popular. There are also the German elections to be held August

22nd-October 22, with Angela Merkel now hugely unpopular. Many others also

occur in 2017 that will be important and each will be an effective referendum

for staying in or leaving the EU. The

2017 French election is critically important, as Manual Valls2

pointed out in a recent Financial Times editorial (on line subscription

required) titled The Push for Europe to Redefine Itself: "Let us face

facts: the European project is in trouble."

Note 2. Manuel Carlos Valls Galfetti

(born August 13, 1962) is a French politician who has been the Prime Minister

of France since March 31, 2014. He was

the Minister of the Interior from 2012 to 2014 and is a member of the Socialist

Party.

..

To buttress my contention that

Euro-socialism isnt working, consider a quote

from Vladimir Bukovsky, a Russian/USSR political

activist and dissident:

"Socialism is the gradual and

less violent form of Communism, and socialist is the project of the European

Union, which was born in Maastricht in 1992. The intent was to save socialism

in Europe after the fall of the Berlin Wall and the predictable bankruptcy of

the welfare state in the West as well."

Actually, its progressivism3

(not the socialism or the welfare state) thats the real problem.

Note 3. Progressivism is a philosophy based on the

idea of progress, which asserts that advancement in science, technology,

economic development, and social organization are vital to improve the human

condition. The meanings of progressivism

have varied over time and from different perspectives. The term is often used

now to denote a left wing way of looking at the world, as per this tutorial on the topic.

3. With an interest rate increase, a high likelihood exists

for a US (and global) recession in the first quarter of 2017.

Consumer spending is

likely to decline as a result of an interest rate increase. The U.S. consumer has added a minimum of $10

Billion to the consumer credit bubble for 50 months in a row. August was up $50 billion, the 4th largest

rise since 1950. Consumer credit is also

up $1.2 trillion since 2010, a rise of 46%.

Average credit card interest rates are 13% and rising because world

governments are talking of switching to additional fiscal spending (instead of

tax cuts) and even lower (and negative) interest rates, which have completely

failed to achieve their planned goals.

Curmudgeon Add-On

Comment:

The Federal Reserve

Bank of Cleveland recently published a very interesting research

paper which notes that fixed income spreads, which have previously been a

good indicator of a recession within 12 months, may no longer have predictive

power due to rates being so low for so long.

Instead, the metric proposed to predict future economic activity

proposed is the inflation-adjusted quarterly change in pre-tax corporate

profits.

As Ive been writing

for months now, the 3rd Quarter of 2016 marked the sixth

consecutive quarterly decline in corporate profits (source: FactSet). Hence, the US is way overdue for a recession

based on that economic indicator.

Ticking Time Bomb

Public Pensions in Crisis:

The most eerie future

monster problem was best described in a September 23rd IBD editorial. Heres an excerpt:

Insolvency: America's states, counties, cities and

municipalities are in deep trouble, owing literally trillions in public

employee pensions that they can't pay off. Nowhere is that more apparent than

in California, the nation's poster boy for fiscal irresponsibility.

All across America, bold pension promises were made,

premised on outsize returns in the stock market. When those returns didn't

occur and as spending on pensions soared, many pension funds became

insolvent. Today, state and local

pensions are nearly $2 trillion in the red, an amount that's expected to grow

in coming years.

To cover their benefits, pension funds need returns of 7.5%

or more. Unfortunately, as Elizabeth Campbell of Bloomberg News recently noted,

"public plans had a median increase of 1% for the year ended June 30, the

smallest advance since 2009." Without significant gains in coming years,

future taxpayers will be left holding the bag for bankrupt pensions denied

decent retirements themselves, but told that they still must pay for the overly

generous benefits of earlier generations.

This is a recipe for political crisis, and the risk of an

inter-generational political war is very real.

Victors Conclusions:

The equity markets are now in a calm

before the storm period. Markets are no

longer a one-way street reacting to the glib talk of central bankers (like the

ECBs Mario Draghi) saying theyll do whatever it takes. The Fed is in danger of losing all

credibility after much talk about rate hikes this year which havent

happened. They must raise rates in

December to save face. Other central

banks have reached their capacity limits (e.g. Japan and Europe) and will begin

to extricate themselves from their extraordinary reckless monetary

policies. The markets will be closely

watching.

As noted in this post, Libor rates

are way up, while long term bond prices have started a serious decline. It appears that the tide is turning and major

trends are reversing. The Curmudgeon and

I continue to believe that the next big move in the markets will be very

bearish for global equities and not at all friendly to bonds.

My theme for the economy and equity

markets is that theres a bad moon rising, as per Credence

Clearwater Revivals hit song from 1969. You can read the lyrics and hear

the music here.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).