Is

Deutsche Bank a Serious Threat to the Financial and Monetary System?

by the Curmudgeon with Victor

Sperandeo

Disclaimer: Unless otherwise noted or attributed, the

opinions expressed herein are those of Victor Sperandeo.

The Problem:

Deutsche Bank (DB) has been struggling to build up capital

during the stricter financial system regulatory environment of recent

years. The largest bank in Germany has a

huge derivative exposure (estimated to be $46T at year end 2015), has been

accused of silver market manipulation, and falsifying the accounts of Italy’s

third-biggest bank (which itself is in deep trouble). One week ago, DB was threatened with a $14B

DoJ fine for its involvement in selling tainted mortgages during the financial

crisis of 2008-2009. Many investors

wondered if a fine that size would be a fatal blow to DB. Yet others are more sanguine.

Not to Worry: DB Not a Real Threat?

In fact, many financial market professionals don’t think

Deutsche Bank (DB) failure is a real threat to the monetary system.

They either believe central banks and/or government agencies

would save the biggest bank in Germany (too big to fail) OR that the

derivatives and hedge fund business counter-party risk is not as great as many

(e.g. NY Times, UK Telegraph, and many other well respected newspapers) believe

it is.

When asked to compare the possible bankruptcy of DB with the

cascading financial fall-out of the Lehman Brothers failure and non-rescue in

September 2008, Don Luskin, chief investment officer at investment firm Trend

Macro said:

"Whatever happens with Deutsche Bank, this is not — I

repeat, not — a Lehman moment. We are

not looking at globally interconnected fragility like we were in 2008. And if anything goes wrong at all, after the 2008

experience, the central banks of the world know precisely what to do to put the

fire out."

Several analysts and money managers believe global regulators

are better equipped to deal with a crisis than they were eight years ago when

Lehman filed for bankruptcy and financial market liquidity dried up.

"Banking systemic risk is much lower now than in

2007-08," says David Kotok, chief investment officer at Cumberland

Advisors. "German bank supervision is also tighter," he added.

That view is based on a somewhat shaky belief that the ECB, EU

or the German government itself, would take the necessary steps to keep DB

operating and avoid a failure. [That’s

after Germany’s Merkel denied there were any talks of her government rescuing

DB.]

"When push comes to shove, Merkel will bail out Deutsche

Bank," says Luskin of TrendMacro.

DB Presents Systematic Risk to the Financial System:

“What makes Deutsche Bank systemic is their sheer size

combined with the leverage that is required to stay in the flow and be an

intermediary,” said Anthony J. Perrotta Jr., an

expert in the structure of financial markets at TABB Group, a consulting firm.

“But as capital becomes more scarce, this becomes a fragile equation.”

A simple calculation from a NY Times article

shows DB’s fragility. Deutsche Bank has €67 billion ($75 billion) in equity

that supports assets of €1.6 trillion ($1.8 trillion), which mean it is levered

at a ratio of 25 to 1.

Making Deutsche Bank’s ratio more troubling is that many of

these assets are of the most illiquid variety, called Level 3 securities,

for which establishing a price is guesswork and finding a buyer near

impossible. According to the last annual report, DB’s Level 3 assets stood at

€32 billion, which was about half of the bank’s equity buffer.

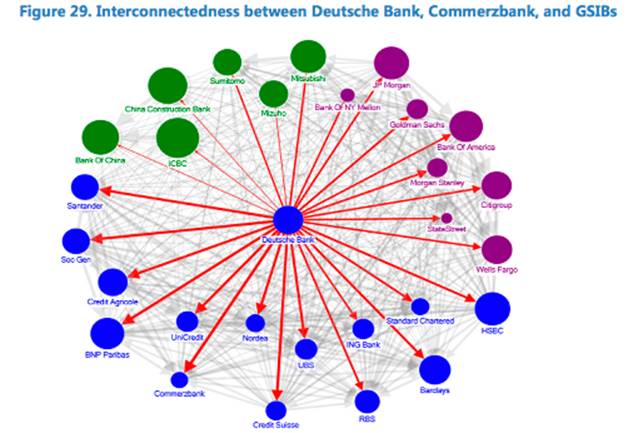

DB is also highly interconnected with other financial

institutions which increases systematic risk if it fails.

Graphic courtesy of Fortune.com

……………………………………………………………………………………………….

Stuart Graham, a banking analyst with Autonomous Research

in London, says that Deutsche Bank has more high-paid risk takers than any

other bank — including JPMorgan, Goldman Sachs, Barclays and Credit Suisse.

Robert Engle, an economist at New York University who

was awarded the Nobel Prize for his work on volatility and capital markets, has

designed a model that ranks financial institutions in terms of their systemic

risk. It takes into consideration

leverage, the bank’s stock price and its equity base, and as such it represents

a real-time measure of the dangers a bank poses to the financial system at a

given moment in time.

Currently, DB is ranked at the top among European banks in

terms of risk, requiring close to €100 billion in fresh cash to ensure that

it could survive a sustained sell-off in the markets.

"If you fear a bank has solvency problems, financial

managers withdraw from the bank because there is no reward and all risk,"

says Bruce Bittles, chief investment strategist at Baird.

"It doesn't mean that Deutsche Bank is in immediate danger, but you

certainly do not want to be the last one out."

Victor: DB’s Problems

Stem from ECBs Flawed Monetary Policies

The most interesting and stimulating headline I read on this

topic was titled: ECB

Says Deutsche Bank “Systemic Threat” Is “Not ECB Fault.”

The European Central Bankers, who are unelected

politicians, are blaming elected politicians for the problems of the

largest bank in Germany. Of course, the problem stems from the central banks

themselves with zero or negative interest rates and control of the bond

markets.

Yet the typical elected and appointed political leaders are

very much to blame, as they expect CENTRAL BANKS to save their decaying

collectivist agenda with monetary policy alone since their fiscal policies have

failed badly. Here’s an excerpt from an article

posted at ZeroHedge:

ECB president

Draghi brazenly "refused to answer questions" regarding Deutsche Bank

during a closed-door meeting in the German parliament. Afterwards in

conversation with journalists, he denied that the negative interest rates being

imposed by the ECB are partly responsible for Deutsche Bank and the German

financial system’s troubles.

“If a bank

represents a systemic threat it cannot be because of low interest rates. It has

to be for other reasons,” Mr Draghi asserted to

reporters somewhat dogmatically and simplistically.

However, he

was contradicted by the head of Germany’s Banking Association, Michael Kemmer, who told Deutschland funk radio that the ECB’s low

interest rate policy was partly responsible for the current problems that Deutsche

Bank and Commerzbank are facing."

Yet Mario Draghi’s QE policies have caused bond prices to

rise such that bond price appreciation became the objective and yields didn't

matter anymore. Bonds have become

trading objects, not income investments. Else why would ANYONE buy a bond

with negative interest rates if not for the expectation that ECB buying will

make them more negative?

Low

(or negative) rates on the short end of the yield curve have virtually become

one with the long end via QE. Without a spread between short and long yields

banks can’t make profits as middle men to borrowers. So big banks like DB

greatly suffer when short rates are zero or negative!

DB’s stock price has declined over 53% this year. However,

one has to hold back a gasp of awe to look back to 2007 when DB was $140.13 in

dollars. It closed Tuesday, October 4th

at $13.33, which is a loss of over 90%!

Again this is the LARGEST BANK in Germany, which is the

strongest nation in Europe! Being

compared with Lehman Bros is a joke. DB

is 1000 x's Lehman! If DB fails, the world is over as you know it. Adding to the DB’s stress (and investors’

fears) was German Chancellor Angela Merkel's promise NOT to bail the banks out,

but rather bail the banks in.

Commerzbank Also In Trouble:

Few noticed that Commerzbank1, the second

largest bank in Germany, has

suspended its dividend and cut a net 7,300 full time jobs as it tries to

shore up its business in the face of ultra-low interest rates and sagging

client activity. The bank said its decision to cut almost one in five of its

employees worldwide and merge two of its largest businesses will result in a

€700m write-off and a loss for this quarter.

Note 1. Commerzbank, has assets that are about a

third of those of Deutsche Bank.

Victor’s Conclusions and End Quote:

DB will be saved- forget Merkel's absurd claim, which is

political. The question for investors is what about the OTHER big banks that

are in big trouble? For example, Italy's

oldest (large) bank "Banca Monte dei Paschi di Seiena” is on life

support as is Uni-credit. And there are many more Italian banks like

it. How will they ALL be saved?

This in turn means it is time to be very concerned! Having

government(s) save big banks that were brought down by counterproductive (if

not egregious) central bank monetary policies could be the beginning of the end

of our modern financial system.

It is best described by Screwface (which means to make an angry face), a

Jamaican drug lord character in the 1990 movie Marked for Death:

"Everybody want go heaven. Nobody want dead. Afraid.”

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).