Bull

Market Top Checklist

by the Curmudgeon

Introduction:

Fiendbear recently emailed

the Curmudgeon to inquire if the stock market bubble had burst, noting that

most of the price gains were coming from NASDAQ darlings/high flyers. Indeed, the NASDAQ and NASDAQ 100 made new

all-time highs last week. The Russell 2000 small cap index is doing especially

well too. We examine if the bull market has ended by citing the research of two

leading investment firms.

Bull Market Top Checklist:

Let’s first look at the “Bull

Market Top Checklist” provided by Strategas,

a New York-based stock market research firm.

Only one of the nine

checklist items Strategas cites is flashing red, but it’s a big one - weakening corporate earnings revisions.

The 3rd quarter earnings reports will start in a few weeks so we’ll

see if earnings are as bad as forecast.

The September 26th

Wall Street Journal (WSJ) front page article tells it all: Profit Slump for S&P 500 Heads for a Sixth Straight Quarter (on

line subscription required). Analysts have been cutting estimates for U.S.

earnings, after earlier projecting a return to growth during the third

quarter. Here’s an excerpt from the

article:

Companies

in the S&P 500 are now expected to report earnings declines for the sixth

consecutive quarter in the coming weeks, according to analysts polled by

FactSet. That slump would be the longest since FactSet began tracking the data

in 2008.

As

recently as three months ago, analysts estimated U.S. corporate earnings growth

would return to positive territory by the third quarter. As of Friday,

September 23rd FactSet was forecasting a 2.3% contraction from the year-earlier period.

In addition, FactSet reports

that corporate earnings guidance continues to deteriorate with twice as many

companies providing negative earnings growth guidance than positive guidance:

“For

Q3 2016, 79 S&P 500 companies have issued negative EPS guidance and 35

S&P 500 companies have issued positive EPS guidance.”

-->The prolonged

profits contraction has raised questions about how far stocks can rise without

corresponding strengthening in corporate earnings.

Assessment of Bull Market Top checklist items:

1.

Blow off top - NO panic buying

2.

Heavy inflows into equity mutual funds – NO

3.

Big pick up in M&A activity – NO

4.

IPO activity strong – NO

5.

Erosion in number

of stocks making new highs - NO

6.

Rising real

interest rates – NO

7.

Credit Spreads rising

(“5 year break-even expectations have deteriorated from a year ago as the

outlook on growth has come in,” Strategas said.

8.

Shift towards

defensive leadership – NO (but we say YES)

9.

Weakening upwards

earnings revisions – YES (FactSet would agree)

For sure, equity mutual fund

OUTFLOWS (net redemptions) combined with tepid IPO and M&A activity have

not hit levels that suggest “irrational exuberance.”

Market “internals” remain

supportive, especially market breadth and momentum. There is little sign of an

erosion of stocks making new highs.

The firm says there has not

been a significant shift towards defensive sectors becoming the market leaders,

but some may beg to differ. Defensive

market sectors like utilities, telecoms and consumer staples have done

especially well this year – much better than ANY broad US stock market average.

Perhaps, the most important

factor to note is that unlike the last two major stock market tops in 2000 and

2007, there is scant evidence of speculative excess.

“Retail participation in the

market rally continues to be conspicuous by its absence,” Strategas notes. “Again it appears that financial repression

is stymieing our efforts, as investors, to understand the current business cycle

and the nature of the financial markets. Only real and persistent signs of

inflation may change that.”

Leuthold Weeden Capital

Management (LWCM) Remains Bullish:

LWCM’s Chief Investment

Officer, Doug Ramsey, today presented the firms market outlook for the 4th

quarter on a conference call (financial professionals only). Doug follows the firm’s quantitative based

Major Trend Index, which provides the cold verdict of the market, rather than

what the market should be doing. Those

indicators were solidly bearish last summer and earlier in 2016, but turned

bullish in May of this year.

The firm’s Very Long Term (VLT) momentum model triggered a buy

signal on the S&P 500 in May (first low risk buy signal since May 2009) and

a VLT buy on the Russell 2000 at the end of this August. The last false VLT signal was December 31,

2001 where the S&P 500 initially rose 2.1% after the buy signal was

generated, but then rolled over and fell -32.3% from the buy level to market

low.

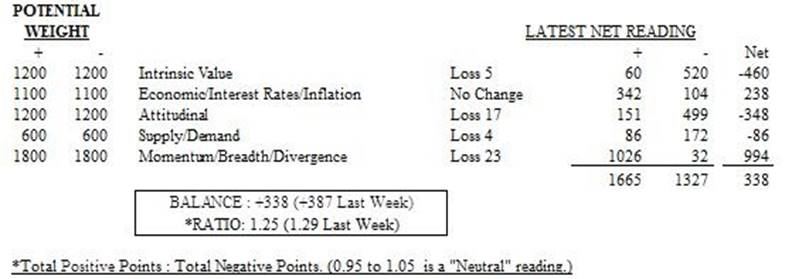

As of 3:20pm Sept 27th,

LWCMs Major Trend Index (MTI) was down 0.04 from last week to 1.25 (any reading

above 1.00 would be considered bullish).

The individual MTI components are shown in the table below:

Table Courtesy of Leuthold Weeden

Capital Management

………………………………………………………………………….

LWCM MTI report excerpt:

The

breadth and trend-following work remain the strongest elements within the

Momentum/Breadth/Divergence category (and across the entire MTI, for that

matter). All five of the daily iterations of the advance/decline work we track

reached new bull market highs last Thursday, and the cycle high in the weekly

breadth work was just three weeks ago. Historically, it’s almost invariably

required at least a few months for such broad strength to dissipate before the

final, narrower bull market high is recorded. We’re cognizant that the

proliferation of ETFs, the adoption of decimalization by the NYSE early last

decade, and the elimination of the uptick rule in 2007 have all had some likely

impact on the daily breadth figures, but strength in other measures—such as new

52-week highs, equal-weighted market indexes, etc.—make it very difficult to

argue that market participation has begun to narrow.

Overall,

the weight of the stock market evidence continues to tilt bullish and our

tactical portfolios remain fairly aggressive positioned with net equity

exposure of 63%.”

However, there’s one caveat

in LTCM quant work which we’ve been calling attention to for months if not

years!

The Intrinsic Value work is near a negative

extreme for the current bull market with a net reading of –460. Last week’s

five-point loss was triggered by a move in the MSCI World Index trailing P/E ratio into its eighth historical decile. Its

weekly closing value of 21.4x compares to a reading of 18.0x at the index peak

in July 2014.

Conclusions:

The bull market seems to be

intact, despite a slew of negatives: extraordinary high valuations, declining

earnings growth, a geriatric bull market that’s the second longest in history,

stagnant GDP, slumping productivity, uncertain fiscal policy (no matter which

candidate is elected President), massive debt build-up and a rising budget

deficit, etc.

Despite all of the above, the

beat goes on. However, we continue to

believe that bullish investors are playing a game of musical chairs. They are dancing to the music now, but when

it stops it’ll be very hard to find a chair.

In other words, liquidity on the sell side will vanish, bid- ask spreads

will widen precipitously, and the market may even shut down -with or without

“circuit breakers.”

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).