BoAML

Survey: Financial Markets Overvalued and Bond Shock Possible; Wage Gains?

by the Curmudgeon

Introduction:

For a very long time, Victor and I have claimed that bonds and stocks are

stupendously overvalued. This week, the

Bank of America Merrill Lynch (BoAML) Fund Manager Survey (FMS) agreed with our

assessment. All quotes and excerpts from

that survey referenced in this article are from the BofA Merrill Lynch

Global Research report, except two charts courtesy of the Financial

Times.

A different BoAML study (subscription only) found that the small US wage growth has been due in

large part to more states adopting a higher minimum wages. Hence, US worker pay increases have occurred

most frequently in the lowest-paying jobs, including fast-food outlets such as

McDonalds and large retailers such as Walmart.

Both of those

surveys are described in this article along with related comments and analysis.

Overvalued

Stocks & Bonds Cause Move to Cash:

Global bond

and stock market valuations have reached their highest level since the early

2000s, leading investors to adopt a bearish outlook amid potential frothiness

in the worlds risk assets, according to the BoAML FMS released this past week

(subscription required).

Chart courtesy of the Financial Times

.

Propelled by

record amounts of monetary stimulus, ZIRP and even negative interest rates from

several global central banks, 54% of fund managers surveyed by Bank of America

Merrill Lynch said a combined measure of bonds and equities is now at an

all-time record overvaluation for the survey, which started in 2000. Mark Hulbert recently wrote something similar

in an August

16th MarketWatch column:

The U.S. stock market currently is more overvalued than

it was at almost every bull market peak over the past 100 years. Thats crucial, since it undercuts one of the

arguments some exuberant investors currently are using to try to wriggle out

from underneath the otherwise bearish message of various valuation indicators.

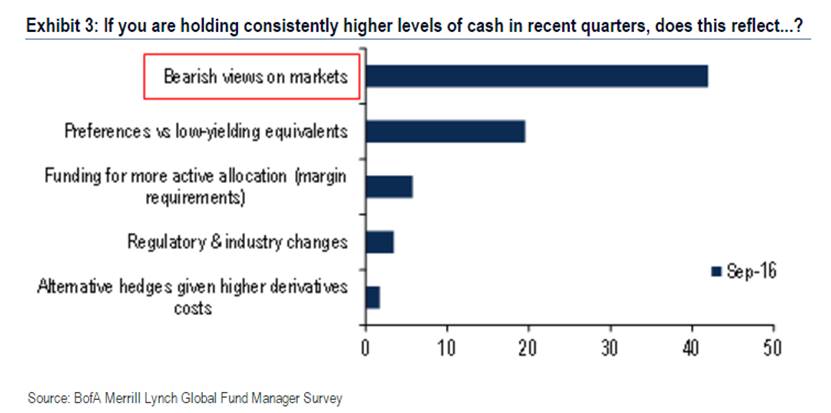

Fears of

overvaluation drove money managers to cash at the start of the month, with

investors increasing their cash holdings to 5.5% in September, up from 5.4% in

August. 20% of respondents said they

would rather hold cash than low-yielding equivalents such as government bonds/notes,

whose prices have been driven to record highs in recent months. More than 40% of money market managers said

they were prompted to shift into cash by a gloomier market outlook amid a

worldwide hunt for higher-yielding assets.

Thats reflected in this chart:

Chart courtesy of the Financial Times

.

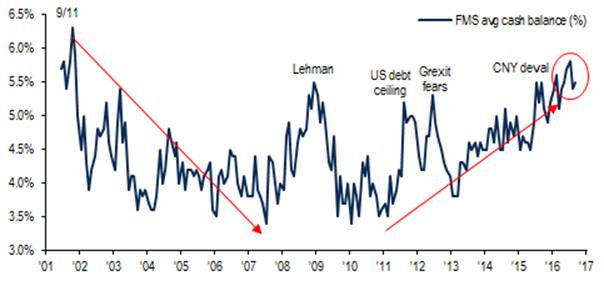

The chart

below shows the trend in Fund Manager cash levels since 2001. Note the uptrend

since 2013:

Chart

Courtesy of BoAML

.

BoAML

- Negative Bond Shock Possible:

Investors

see an unambiguous vulnerability to bond shock among risk assets, with the

most crowded negative interest trades and EM equities susceptible should the

Fed and especially the BoJ fail to reduce bond volatility in September, said

Michael Hartnett, chief investment strategist of BoAML.

Manish Kabra, European equity quantitative strategist, added that,

European investors have increased cash allocations to cover their sector

underweights in Banks and Commodity sectors. Macro optimism is firmly at

pre-Brexit levels, with economic growth expectations at their strongest since

June.

Heres an

edited excerpt from the BoAML FMS: Unambiguous vulnerability to bond shock:

·

83%

believe BoJ & ECB will maintain negative rates next 12 months.

·

82%

admit bond prices in developed markets are "frothy."

·

US

Treasuries seen as biggest driver of stock prices next 6 months.

·

FMS

hedge fund exposure to stocks jumped to the highest since May 203 "taper

tantrum, which underscores the markets vulnerability to a bond shock.

·

Combined

valuation of bonds and stocks at or very close to an all-time high (overvaluation

of stocks highest since May 2000).

·

Most

vulnerable longs are all "Negative Interest Rate Policy (NIRP)

winners."

·

Most

crowded trades are all "NIRP-winners": long High Quality stocks; long

US/EU Corporate bonds; long Emerging Market debt.

·

September

FMS shows first meaningful reduction in bond proxy exposure (staples,

utilities, telcos), as well as reduction in

"high growth" US stock market.

·

Both

REITs & tech stocks remain big, stubborn longs.

·

Emerging

Market equity overweight at its highest level in 3.5 years.

·

All of

the above are vulnerable should the Fed and especially BoJ fail to reduce bond

volatility in September.

.

To underscore

the overvaluation and risk in bonds we quote from the latest BoAML

CIO Report:

The quest for yield, driven by low global rates and

insatiable investor demand, has forced the classic (fixed income) risk/reward

ratio to record levels. By some measurements, risk levels are at or near

historic highs, while on the reward side interest rates and income from

fixed income securities have been steadily moving lower for 35 years. We

believe this is not the time to take excessive risk in order to capture

additional yield. However, opportunities do exist and strategies can be

constructed to maximize returns in this low-return environment. We suggest that

investors proceed with caution.

.

US

Worker Wage Gains Coming From Those Who Earn the

Least:

Real average

hourly earnings for all employees decreased 0.1% from July to August,

seasonally

adjusted, the

U.S. Bureau of Labor Statistics reported on Friday,

Sept 16th. Real average weekly earnings decreased 0.4%

over the month due to the decrease in real average hourly earnings combined

with a 0.3% decrease in the average work week.

However, its

not been widely reported that US worker wage gains are not being spread evenly

amongst all employees. Its well known

that executive pay has gone off the charts, but what about wage gains for other

workers? From a Sept 13th Washington

Post article:

Since 2014,

increases in wages have accelerated for the one in five workers earning the

least, according to new research by Bank of America. In this group, wages

are now increasing at roughly 4% year over year.

The BoAML

report suggests that the little wage growth there has been in the US is due to

increased minimum wages and has thus benefited the working poor rather than

the middle class. Thats hardly the

sign of a resilient, growing economy!

The pace is

sub-par and closer inspection shows a two-tier market in which low-pay sectors

are seeing the strongest wage gains, with slower trends elsewhere, BoAML

states. Upward wage pressure is due to state-level minimum wage increases and

a shortage of young/less-educated workers; factors unlikely to trigger a

breakout in wages more broadly.

A July 6th

USA Today article titled: Low-paid

workers are leading in wage gains corroborated the above point.

An unusual flurry of minimum wage increases took effect

Friday in Maryland and Oregon, as well as in 13 cities and counties, including

Los Angeles, San Francisco, Chicago, Washington DC and Louisville, Ky.,

according to the conservative Employment Policies Institute and liberal

National Employment Law Project. The initiatives will boost minimum pay to as much

as $13 to $14.82 an hour in parts of California. And the latest studies underscore that their

efforts have been stunningly fruitful, with the pay of low-wage workers rising

far more rapidly than their higher-earning counterparts.

By driving

down % returns on workers savings and squeezing their fixed income pension

fund investments, unconventional monetary policies (QE, ZIRP, NIRP, etc.)

raise the risk that standards of living will drop after todays workers become

tomorrows pensioners, wrote Henny Sender in this Saturdays Financial Times

(on line subscription required).

ShadowStats

John Williams says: Consumer income and liquidity remain seriously

distressed.

- Consumer Conditions

Continue to Deteriorate

- 2015 Household-Income Boost Reflected New Surveying of IRA Withdrawals and

Census-Gimmicked Interest Income

- Consistently Surveyed, 2015 Household Income Remained Shy of Its Level at the

2009 Trough of the Economic Collapse and Held Below Levels of the Late-1980s

and-Early 1970s

- Real Consumer Credit (Ex-Student Loans) and Household-Sector Debt Outstanding

Are Down Respectively by 13.7% (-13.7%) and 12.6% (-12.6%) from Pre-Recession

Peaks

- August 2016 Annual Inflation Firmed by 0.2% to 0.3%, with CPI-U at 1.1%,

CPI-W at 0.7% and ShadowStats at 8.7%

- August Real Retail Sales Plunged by 0.5% (-0.5%) Month-to-Month, with Annual

Growth at a 30-Month Low, an Intensifying Recession Signal

- August Real Earnings Fell by 0.3% (-0.3%)

- Markets Increasingly Seem to Anticipate a Rate Hike

Well end on

that note.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).