Janet Yellens Jackson Hole Speech: The Set Up to Raise Rates?

by Victor Sperandeo with the Curmudgeon

The Feds Game Plan:

In executing Federal Reserve

monetary policy (as in politics), the "modus operandi" is to informally

mention what the Fed is going to do, so it appears they are just

"exploring the thought" in order to be discerning and prudent.

In reality, the Fed will

execute their plan to raise rates when they believe they have enough of what

looks like" evidence to justify what they previously said theyd do. This is what happened last December (25 bps

rate increase) when they were worried about inflation that never occurred.

Its the Fed's desire to

raise short term interest rates this year, which I believe is to permit them to

lower rates in the future if the economy weakens or inflation isnt above their

target 2% rate. Janet Yellen made the

case for a rate increase at her Jackson Hole speech.

In light of

the continued solid performance of the labor market and our outlook for

economic activity and inflation, I believe the case for an increase in the

federal funds rate has strengthened in recent months, Ms. Yellen said.

That was later backed up with

talks on TV by well-respected Fed Vice Chairman Stanley Fisher on Friday

8/26/16. Other FOMC members voiced similar sentiments. However, Yellen once again hedged her remarks

with this statement:

Of course, our

decisions always depend on the degree to which incoming data continues to

confirm the [Federal Open Market] Committees outlook.

Is this picture of three modern day dodo birds? We

explore why in this post.

Is this picture of three modern day dodo birds? We

explore why in this post.

Fed Chairwoman Janet Yellen, center, Stanley Fischer, left, vice chairman of the Board of Governors of the Federal Reserve System, and Bill Dudley, the president of the Federal Reserve Bank of New York at Grand Tetons National Park, north of Jackson Hole, Wyo. Photo Courtesy of the Associated Press.

...

Unpacking Yellens Speech:

Yellen's speech

(of 10 pages) is mostly a rehash of the propaganda of why the Fed does what

they do. Headlines like "The Pre-Crisis Toolkit" (e.g. lower

Fed Funds and buying short term government debt), which adds to bank

reserves. Then later "Our

Expanded Toolkit," which is QE (asset purchases), forward guidance,

and paying interest to banks on their reserves held at the Fed. Apparently, this is now added to the old

toolkit to protect the economy and indirectly the equity markets!

Heres a very important

paragraph from Yellens speech:

Looking

ahead, the FOMC expects moderate growth in real gross domestic product (GDP),

additional strengthening in the labor market, and inflation rising to 2 percent

over the next few years. Based on this economic outlook, the FOMC continues to

anticipate that gradual increases in the federal funds rate will be appropriate

over time to achieve and sustain employment and inflation near our statutory

objectives. Indeed, in light of the continued solid performance of the labor

market and our outlook for economic activity and inflation, I believe the case

for an increase in the federal funds rate has strengthened in recent months. Of

course, our decisions always depend on the degree to which incoming data

continues to confirm the Committee's outlook.

Victors Comment: During

Yellens tenure as Fed Chairwoman, she always seems to say things like the

above. Yet over the years her statements

have proved to be a worthless guideline with little or no meaning. The key question is whether the economy has

strengthened enough to raise rates?

Initially she hints yes, but then she once again says the Fed must be

data dependent to confirm the committee's outlook.

These are all circular words

without reason or logic. Conversely,

Yellen does not say that with a 1.0% GDP growth rate for the past 9 months, the

Fed might cut rates to zero (again) should snails pace growth continue with inflation

remaining below the Feds targeted 2% rate?

The Fed's crystal ball: The forecast for Fed Funds rate is for 0 and 3.25% at the end of next year; 0 and 4.50% at the end of 2018.

...

Victors Opinion:

This is like an actuary

predicting that you are likely to die between 60 and 92 years of age! How can

they not be embarrassed by this latest forecast?

It should be duly noted

that Fed forecasts have been wrong 99% of the time since 2007. Why so wrong?

See Curmudgeons reference

below for WSJs analysis.

I think its because they

use Keynesian models, and do not take into account factors that take away from

Keynes theory. Of course the Fed is not responsible for fiscal policy but they

seem to want to compensate for it when it goes wrong.

The last 7 years of fiscal

policy failures subtracts drastically from economic investment. Increasing

taxes and regulation is not at all supportive of economic growth. A blind man can see this policy has not worked.

Keeping rates artificially

low so companies can issue bonds at under 3% hardly compensates for bad fiscal

policy. It gets worse when companies

borrow money at ultra-low rates to buy back stock, pay executive bonuses or

shareholder dividends rather than invest for future growth.

So the Fed doesn't change,

but rather continues the same ultra-easy money policies for longer.

...

Curmudgeon Reference- to support Victors Fed comments above:

WSJ: Years

of Fed Missteps Fueled Disillusion With the Economy

and Washington

From that WSJ article:

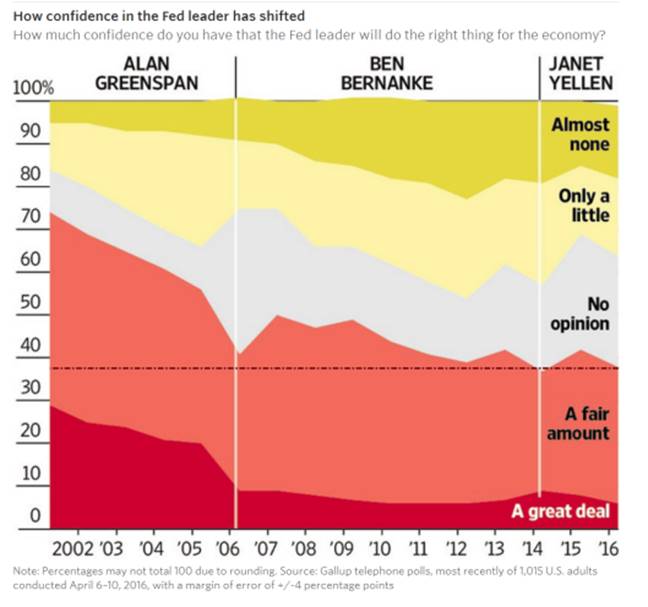

In

the early 2000s, confidence in Chairman Alan Greenspan often exceeded 70%. An

April Gallup poll found 38% of Americans had a great deal or fair amount of

confidence in Ms. Yellen, while 35% had little or none (count me as part

of the 35% who has no confidence in the Fed).

...

US Fiscal Policy Missing

in Action:

I certainly myself couldnt

have imagined six, seven years ago that we would be employing the policies we

are now, Fed Chairwoman Janet Yellen said to a packed ballroom in New York

earlier this year. She lamented the government has leaned so heavily on the Fed

to stimulate the economy while tax and spending policies were stymied by

disagreements between Congress and the White House.

Yellens Jackson Hole speech

suggests the Fed finally admits that fiscal policies have been lacking. She

said that more productivity growth is needed. Also that "improving our

educational system and investing in worker training; promoting capital

investment, and research spending and looking for ways to reduce regulatory

burdens, WHILE PROTECTING IMPORTANT ECONOMIC, FINANCIAL, AND SOCIAL

GOALS."

This is like saying I

want to marry you as long as I can go out with other people.

Are the Feds reasons for the

anemic 1.5% GDP growth since 2008 reflected in the above proposals (implying

theyve been absent till now)? Or is Yellen hinting that new fiscal policies

are needed to stimulate future economic growth?

If so, permit me to say

this is horse crap! These fiscal policy suggestions will not increase GDP. Instead they are a political statement for

the assumed future Democratic President to consider.

Curmudgeon- Other Voices:

Yellens speech came at a

time of intense speculation on Wall Street over whether the Fed is ready to

pull the trigger and raise rates at its next meeting on September 21st. While Yellen didnt address the timing, Fed

Vice Chair did by hinting that a September rate rise was a real

possibility. Heres what others said:

Anthony Karydakis,

chief economic strategist at Miller Tabak, said he

saw nothing in the remarks to suggest that a rate rise in September was indeed

a reasonable risk.

For something like that to

happen, it would take another striking employment report in early September and

other accompanying data to remain unflinchingly solid theoretically still

possible but quite unlikely, he said.

It appears that, barring a

case where the economic reports hit an unexpectedly soft patch, December is a slightly

better than even bet at this point those odds also subject to the ebb and

flow of the incoming data.

Barclays bank took a slightly

different view. We read Chair Yellens comments as in line with other Federal

Open Market Committee communication in recent weeks which has consistently

sounded hawkish, said Michael Galen, an economist at the investment bank.

In our view her statements

were as strongly worded as possible. We maintain our call for a September rate

hike, subject to another solid employment report for August.

Rob Carnell, chief

international economist at ING, noted that buried at the end of the speech

Ms. Yellen had proposed an enhanced role for fiscal policy.

She talked about the need for measures designed to improve productivity fiscal, not monetary as well as enhancing fiscal automatic stabilizers, he said. A cynic might paraphrase the speech as things are looking brighter, but if it all goes wrong, dont panic theres always fiscal policy.

...

Probability of a Fed rate

hike:

Interest rate futures moved

to price in a roughly 24% chance of the US central bank increasing rates at its

September meeting, down from 30% before Ms. Yellens speech, according to

Bloomberg calculations.

The probability of a December Fed Funds rate of 50 to 75 bps (up from the current 25 to 50bps) is 44.4%, according to the CMEs Fed Tool Watch.

Victors Bottom Line:

The fix is in such that the

government will spend about 1.5% of GDP in the current quarter, and thereby get

to a total of 3% GDP growth by September 30th, which is reported at

the end of October. The current top

analyst predictions for real GDP (annualized) are +2.2% to 3.7% and 3.4% by the

Atlanta Fed.

It is my strong view that

the Fed will do nothing at the September 20 21, 2016 or the November 1 -2,

2016 meetings, because of the upcoming Presidential election.

But theres a strong

possibility for a rate increase at the FOMCs December 13th-14th

meeting. I will update any changes in a future post.

The markets believe the rate

hike is coming; possibly as soon as September. The 5-year T-Note yield went

from 1.16% to 1.23% on Friday, while the Dollar Index rallied 75/100ths of a

cent with the range being 94.20 to 95.585.

However, the 30-year T bond yield only moved up 1 bps to 2.28%. If you

recall, the 30 year yield on December 16, 2015 was 3.0% (in anticipation of Fed

rate hikes which never happened)!

What this market is saying

is the Fed is trying to mislead the markets about why they are raising rates! There is no economic growth anywhere and

inflation is well below the Feds 2% target, despite the recent increase in

wages. Further, a 25 bps hike really

means nothing for the economy. The Long term bond market knows this and think a

potential quarter of a percent Fed Funds rate increase is purely a

psychological tactic.

End Quote:

A quote by an unknown writer

is very appropriate here. It recently

trolled on the new Fed's Facebook page1 (which The American

Banker dubbed "disastrous," as comments were almost all

negative). Heres the quote:

"The goal of the Federal

Reserve is to make your friends rich, at the expense of the common worker,

through slow and steady INFLATION, under the guise of providing stability and

low employment."

Amen!

...

Note 1. For those who

dont have a Facebook account, we share a Comment and Fed Rebuttal on whether

the Fed is privately owned or not, via copy and paste:

Jacques W Coquetel: My favorite part is how you named yourself

"Federal", as if you aren't privately held. And that Christmas break

in 1913, December 23, when you saddled us with your private kosher Ponzi

scheme, that was special too.

Board of Governors of the Federal Reserve System-REPLY on August 25 at 8:02am:

We are often asked Who owns

the Federal Reserve?

The Federal Reserve System is

not "owned" by anyone. Although parts of the Federal Reserve System

share some characteristics with private-sector entities, the Federal Reserve was

established to serve the public interest.

The Federal Reserve derives

its authority from the Congress, which created the System in 1913 with the

enactment of the Federal Reserve Act. This central banking "system"

has three important features: (1) a central governing board--the Federal

Reserve Board of Governors; (2) a decentralized operating structure of 12

Federal Reserve Banks; and (3) a blend of public and private characteristics.

Victor's Comment: To say the Federal Reserve is not "owned

" by anyone is more than a lie. It is a ridiculous factual disproven

lie! If readers express interest, I will

expand on this in a future post. In the meantime,

email the Curmudgeon if you'd like to know my reasons.

Curmudgeon

Reference:

Is the Fed a No Risk Hedge Fund or a Ponzi Scheme?

...

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating,

copying, or reproducing article(s) written by The

Curmudgeon and Victor Sperandeo without providing the URL of the original

posted article(s).