The Pros and Cons of Buy and Hold vs. the Next Bear

Market

by the Curmudgeon with Victor Sperandeo

Introduction

(Curmudgeon):

Many

investment advisers now advocate a buy and hold approach to the stock

market. One can certainly appreciate that

in the eighth year of a bull market that has seen stock prices more than triple

from the March 2009 lows.

In

an August 21st NY Times print edition article titled The Obama

Years: The Best of Times to Be a Stock Investor Jeff Sommer writes:

The facts are inescapable: The

Obama years have been among the best of times to be a stock investor, going all

the way back to the dawn of the 20th century.

Since 1900, the Obama

presidency has so far been the third best for stock investors. Using the Dow

Jones industrial average, market performance has been better only during the

presidencies of Calvin Coolidge, a Republican, in the Roaring 20s; and Bill

Clinton, a Democrat, from 1993 to early 2001, years

that encompassed the tech bubble.

A crucial factor (for the stock

market rise under Obama) is that the Federal Reserve, which the president does

not control directly, embarked on an extraordinarily accommodative monetary

policy,

starting even before Mr. Obama took office. On Dec. 16, 2008, for example, one

month after the presidential election, the Fed brought short-term rates sharply

lower, close to zero.

Fed interest rate policy may be

the single most important factor behind the stock market boom.

And even if Mr. Obama does not control the Fed, he did reappoint Ben S.

Bernanke as Fed chairman in August 2009. In October 2013, the president

appointed Janet L. Yellen as Mr. Bernankes successor. Under both, the Fed has

held interest rates very low, which is helping to buoy the stock market and may

be affecting the presidential election, as Ned Davis Research suggests in a

recent note to clients.

Obviously,

not everyone agrees with Buy and Hold.

The venerable Dow Theory Letters (DTL),

published since 1958, states on their website home page:

We believe in market timing.

Our goal is to get you out at the top and in at the bottom of major, long-term

market moves.

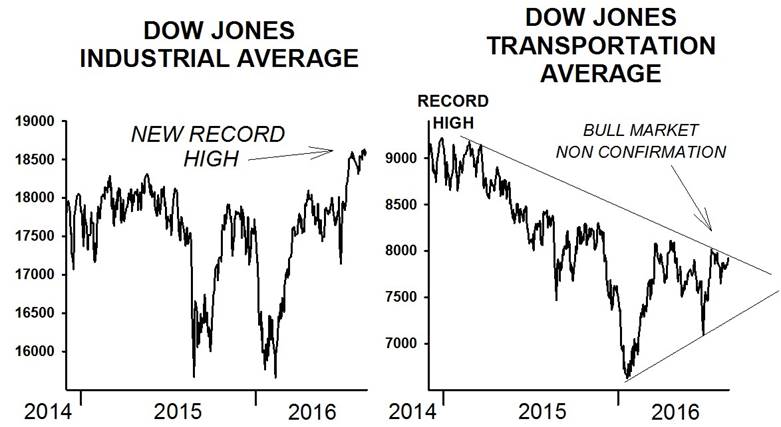

DTL

now says two

of their key stock market indicators are not in sync. Their Primary Trend

Index (PTI) is BULLISH, but the Dow Theory is still on a SELL signal as the Dow

Transports have not confirmed the new high in the Dow Industrial average.

Other

advisory services take a more subdued approach (vs. market timing) by always

maintaining a core position in stocks and varying the percentage invested

according to some combination of fundamental and technical analysis,

valuations, investor sentiment, market cycles, age or earned income of the

investor, etc. The goal is to balance

risk (amount you can lose) vs reward (amount you can gain) in ones allocation

to stocks, ETFs, or equity mutual funds.

Buy

and Hold HAS BEEN a Winner, but Consider the Pain of Bear Markets (Victor):

Certainly

over the last 7.5 years, a "buy and hold" strategy in a broad stock

index like the S&P 500 or the NASDAQ 100 has been a big winner as the NY

Times article noted above confirms.

Since

1982, buy and hold HAS BEEN (emphasis added to imply past tense) a

winning strategy. However, suffering the amount of pain through severe bear

market declines are based on your temperament and your age.

If

you are 22 years old, fresh out of college, working, and secure in your

self-esteem then investing savings over the next 40 years is creates one type of

emotional temperament.

But

at 65+ and in retirement being involved in the equity market is quite another

story. This is called a factual context.

When you need the savings to survive your non-working older years, money

becomes a necessity. Far different than working and beginning a career. Therefore, buy and hold must be perceived in

this context.

Economic

Recoveries Favor Buy and Hold (Victor):

It

should be noted that economic recoveries/expansions have lasted far longer

since Alan Greenspan1 led the Fed kingdom (he was actually knighted)

and he invented aggressive "Central Planning" tactics to keep

recoveries going. Unfortunately, he

didnt mention the eventual costs.

Please see the Sidebar for my thoughts on that.

Note

1. Greenspan was appointed as Chairman of the

Fed on August 11,1987 and served in that position for 19 years.

.

From

1982 to date (34 years), the "average" economic recovery is 92

months. With much longer economic recovery from 1982 till today, a buy and hold

strategy was the correct policy as stocks rise during economic expansions

(especially the current one which is the weakest in all of US history!).

Lets

digress to look at past economic recoveries/expansions:

According

to the National Bureau of Economic Research

(NBER) Business Cycle Dates, the length of the recoveries has been

- 92 months 11/82-7/90;

- 120 months 3/91-3/01;

- 73 months 11/01-12/07;

- 86 months and counting for the current economic expansion (6/09-?)

Astonishingly,

the median length recovery was a mere 27 months from 1854 to 1982! Of the 33 occasions before 1982, only two

recoveries lasted for a long time in relative terms: 80 months and 106 months.

Fed

chairs Greenspan, Bernanke, and Yellen have extended the recoveries by 3.5X's

from the median in the last 129 years to 1982. This suggests "buy and

hold' WAS a very successful strategy.

Warren Buffett is living proof, as he bought and held stocks from the

1974 lows. Hes the second or third

wealthiest ranked man in the world!

.

Sidebar:

Whats the End Game for Fed Policy?

(Victor)

But

at what future cost? As Captain Kirk,

captain of the Star Ship Enterprise in Star Trek, put it..."and boldly go

where no man has ever gone before."

The

control and use of the printing press has gone beyond anything the imagination

could have dreamed, as the Fed held rates lower for longer, while the federal

government increased its massive government debt. The (privately owned) Fed printed money (by

creating additional bank reserves via book entry) to buy government debt and

mortgages, which thereby permits the creation of more debt.

The

cost of all this has been pushed into the future (AKA kicking the can down the

road). The negative consequences may be

realized under a different Fed Chair, who will be condemned for what others

before primarily caused. It will be paid for by all citizens rich and poor

someday. It is such a bizarre, and an outlandish policy that one has to ask

if the objective is to take down the country with a crash?

Recent

Fed policy seems analogous to a Fabian strategy.2"

Note

2. The Fabian strategy is a military strategy

where pitched battles and frontal assaults are avoided in favor of wearing down

an opponent through a war of attrition and indirection. Fabian Socialism, the ideology of the Fabian

Society which originated in 1884 and launched the Labour

Party in the United Kingdom in 1904, utilizes the same strategy of a "war

of attrition" in their aim to bring about a socialist state.

The

only "fundamentally driven" reason for the extraordinary easy Fed

monetary policy is to believe that the Fed would never allow a recession after

2008, i.e. they would do whatever it takes to prevent one. If one believed and understood this

mentality, then that person is the smartest man in the room.

Also,

to believe that the US would not put fiscal policy on the table, when monetary

policy has empirically been an abject failure, was not assumed by anyone I have

seen or read. In particular, the absence

of any tax policy to help improve the economy from its managed decline (or its

death spiral) seems to be due to an ideological agenda of those in power.

.

Coping

with Severe Bear Markets (Curmudgeon):

As

Victor notes above, many investors cant maintain a buy and hold strategy,

because they cant emotionally and/or financially suffer through a prolonged stock

market decline. At some pain point or stop loss limit, investors will sell

stocks to prevent further losses.

Theres an immediate feeling of relief that many seasoned investors (who

have been through severe bear markets) can certainly appreciate. If nothing else, the gut churning and worry

stops -at least for a while.

Here

are a few noteworthy examples of severe bear market declines:

1. September 1929 to June 1932

The

stock market crash of Oct. 29, 1929, marked the start of the Great Depression and

sparked America's most famous bear market. The S&P 500 fell 86 percent in

less than three years and did not regain its previous peak until 1954.

S&P

500 high: 31.86, Low: 4.4, Loss: 86.1%, Duration: 34 months

2. January 1973 to October 1974

Israel's

Yom Kippur War and the subsequent Arab oil embargo sent energy prices soaring,

sparking a lengthy recession. The annual consumer inflation rate topped 10

percent. The Watergate scandal forcing President Nixon to resign.

S&P

500 high: 119.87, Low: 62.28, Loss: 48.0%, Duration: 21 months

3. August 1987 to December 1987

After

a prolonged bull run, computerized "program trading" strategies

swamped the market and contributed to the Black Monday crash of Oct. 19.

Investors were also nervous after a heated debate between the U.S. and Germany

over currency valuations, sparking fears of a devaluation of the dollar. As a

result, the Dow fell 22.6 percent -- the worst day since the Panic of 1914. Yet

while the days after the crash were frightening, by early December the market

had bottomed out, and a new bull run had started.

S&P

500 high: 337.89, Low: 221.24, Loss: 33.5%, Duration: 4 months

4.

March 2000 to October 2002

The

bursting of the dot-com bubble followed a period of soaring stock prices and

exuberant speculation on new Internet companies. Companies with little or no

profits had market values that often equaled or exceeded that of established

"old-economy" corporate giants. The Nasdaq composite index, which

soared in value thanks to the listings of hundreds of tech start-ups, plunged

over 50% in nine months.

S&P

500 high: 1527.46, Low: 776.76, Loss: 49.1% Duration: 30 months

5. October 2007 to March 2009

A

long-feared bursting of the housing bubble became a reality beginning in 2007,

and the rising mortgage delinquency rate quickly spilled over into the credit

market. By 2008, Wall Street giants like Bear Stearns and Lehman Bros. were toppling, and the financial crisis erupted into a

full-fledged panic. By February the market had fallen to its lowest levels

since 1997.

S&P

500 high: 1565.15 on Oct. 9, 2007, Low: 682.55 on March 5, 2009, S&P 500

loss: 56.4%, Duration: 17 months

→Now

ask yourself (objectively): could you stomach another 40% + decline in your

stock portfolio?

Victors

Perspective: Holding stocks for the long

term (quotes from 1992)

From

Victors famous 1992 interview with Jack Schwager in the classic New

Market Wizards book:

Schwager: "What's the greatest misconception

people have about the stock market?"

Sperandeo: "The idea that if you buy and hold

stocks for long periods of time, you will always make money. Here are two specific counter-examples:

1. From 1896 low to 1932 low (36 years)

From

1929 to 1932, the market dropped an average of 94%.

2. From 1962 low to 1974 low (12 years)

During

the 1973-74 bear market, the "nifty fifty" stocks lost greater than

75% of their value.

Curmudgeon

Note: Also from December 1965 DJI high of 969.26 to

the August 12, 1982 DJI low of 776.92 (almost 17 years), you would've lost

money in the stock market-even including dividends! Note that in 1982 there was only one stock

index mutual fund- the Vanguard Index

Trust (S&P 500 Index).

Schwager: "Could we get a bear market that would

be far worse than most people could imagine?"

Sperandeo: "Exactly. People who have the notion that buy and hold

for the long term could easily go bankrupt."

Curmudgeon

Note: The

above interview was conducted long before ZIRP, QE, negative interest rates,

Central banks buying ETFs and stock index futures, and other clandestine and

stock market supporting monetary policies.

.

Victors

Update and Thoughts on the Next Bear Market:

The

depth, duration and recovery length of a bear market is not predictable. It is

based on government fiscal and monetary policies to get the economy back on a

growth trajectory. For hundreds of years that was the 2+2 model. After the

Obama agenda that might no longer be true.

It

is my very strong opinion the next bear market will be the worst in all of

history. Why? The US federal government is out of ammo.

- The interest rate tool is of no use at zero and the Fed has

said it wouldnt take rates negative.

- QE does not work at this stage -it was over used and has

caused a scarcity of debt at higher coupons (as the BoE experienced

recently).

- Cash Flow concerns: financial institutions like pension funds

and insurance companies need cash from coupons to pay beneficiaries. They don't need above par appreciating

bonds caused by QE.

- Tax cuts can't be used aggressively when deficits are in

Never Never Land! How has that model worked for

Japan? [Curmudgeon: whatever

happened to Japan Inc.?]

So

forget using the history to judge past bear markets in order to gauge future

bears. This is a whole new ball game!

Stock

Market vs the Economy (Victor):

Recently,

US equity markets have gone up

substantially for no obvious reason. With

the weakest US economic recovery ever, with 1st half GDP at only 1%,

the US stock market has rallied strongly off its Feb 11th low this

year.

Curmudgeon

Note: One explanation

we saw this past week via Zero Hedge was from Barclay's chief equity strategist

Keith Parker. His answer: stock index futures

buying (which has traditionally been associated with central bank

intervention). To the tune of $60bn notional since March 2016. That has surpassed the amount of buying

between October 2011 and May 2013.

Together with short-covering, it has more than offset the $128bn of

outflows from US equity mutual funds since mid-March 2016.

.

In

a great article that gives us a clue to what may be ahead, Lee Adler wrote:

Joe Granville once asked, and

answered:

What does the stock market

have to do with the economy? Absolutely nothing!

I would only partly agree.

Because the Fed follows and ultimately will react to strengthening economic

data by beginning to tighten monetary policy in earnest.

Curmudgeon

Note: Fed

tightening, if it persists, is not bullish for the market! However, Victor and I dont see any sustained

Fed tightening anytime this year.

End

Quote:

This

quote from someone who later became the 2nd US President shows how

cynical our Founding Founders3 felt about men in power, even when it

was themselves. John Adams said

"I have accepted a seat in the House of

Representatives, and thereby have consented to my own ruin, to your ruin, and

to the ruin of our children. I give you this warning that you may prepare your

mind for your fate."

Note

3. The U.S. Founding

Fathers include George Washington, John Adams, Thomas Jefferson,

James Madison, Alexander Hamilton, James Monroe and Benjamin Franklin. John

Adams (not John Quincy Adams) served as George Washington's Vice President

for two terms before he became the second President of the United States.

Victors

Closing Comment:

Power

is the most cut-throat and number one desire of mankind. In the quote above, John Adams clearly

recognized that. But do our current

leaders?

And

we allow the Fed -a private bank -to run our paper currency, set interest

rates, and do whatever it wants in secret without even an audit?

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).