Brexit Reality or Manipulation: Stocks and Bonds Rally;

Treasury Yields at All-Time Lows!

by Victor Sperandeo with the Curmudgeon

Overview:

Who's got it right- stocks or bonds? Markets closed the week with a broad rebound in

global equities tempered by a renewed sense of caution in bonds.

Yields on the benchmark 10-year US Treasury note briefly touched

their lowest level ever at 1.385% Friday, July 1st, while

yields on the 30-year US Treasury bond and 10-year UK government gilts both

closed at record lows of their own, according to data from Tradeweb.

Bond investors are betting the uncertainty sparked by Britains

shock decision last week will keep markets on edge and put pressure on central

banks to pump new stimulus into their economies.

Yet global stock markets are not at all on edge, as evidenced by

a strong four-day rally that saw both the DJI and FTSE close ABOVE their

pre-Brexit highs. Hopes of fresh Bank of

England stimulus lent momentum to a rebound from the sharp two-day UK stock

market decline that followed last week's Brexit vote.

The cash S&P 500 closed at 2103 on Friday July 1st

and is ~1% below its all-time high set in May 2015. Britain's blue chip FTSE 100 index climbed to

a 10-month high on Friday and recorded its biggest weekly increase in 4-1/2

years. The FTSE ended 1.1% higher at 6,577.83, rising for a fourth straight

session. The UKs benchmark stock index rose 7.2% this week, the biggest weekly

advance since late 2011.

How is that possible, after the huge Friday and Monday

sell-offs? In a Friday morning

note to clients, Longford Associates Joan McCullough answered:

The central banks are gonna flood

the globe with liquidity and every form of unlimited accommodation. With a view

towards guaranteeing the stability of the financial system. Around the world.

Until nobody will be able to tell the difference between the rest of the world

and Japan, I suppose

The UK oughta quit the EU

more often, eh?

Victor's Comment and Analysis - Central Banks and the PPT:

The markets were again saved by the central banks, directly and

indirectly. Let's first look at the big

picture, and then get to the specifics on the Brexit induced central banks to

the rescue rally which will likely reoccur.

Former Bank of England Governor (2003-2013) Lord Mervyn King

once said:

"For all the

clever innovation in the financial system, it's Achilles heel (failing) was and

REMAINS the extraordinary absurd-levels of leverage represented by a heavy

reliance short term (and long term) debt."

Source: The End of

Alchemy: Money Banking and the Future of the Global Economy.

Flash forward to post Brexit and a potential failing financial

system "REMAINS." That's after $57 Trillion in newly created global

government debt from 2008!

In a Real Vision TV (subscription only) program named

"Crazy," Grant Williams stated that the "Netherlands 10-year

bond interest rates are at 500 year lows; France 270 years; Italy 209 years; Germany

209 years; Spain 194 years; and the UK a mere 50 years."

The US 10 and 30 year yields also traded at 240 year lows of

1.378% and 2.187%, respectively, according

to BlackRock.

Major Central Banks (the Fed, ECB, BoJ, BoE, and PB of China)

balance sheets now total $17.5 trillion.

Despite that huge and unprecedented monetary stimulus, there's virtually

no global economic growth! Perhaps,

that's why global bonds continue to rally with yields plumbing new all-time

lows. This House of Cards cannot be

allowed to collapse, or the politicians and bureaucrats would lose their power

and jobs.

After the Brexit vote to leave the EU Central Bankers scheduled

a meeting in Sintra, Portugal (one of the most

beautiful and luxurious places on earth) to discuss what to do about it. The

markets virtually always rally before these central bank meetings, assuming

these (short term minded) printing press mad men/women will come to the markets

rescue. Sure enough, on June 28th

the markets rallied.

Fed Chairwoman Janet Yellen canceled her trip to Portugal. The Washington Examiner reported

(emphasis added):

"The Fed

released a statement Friday June 27th (in the immediate aftermath of

the Brexit vote) that it was "carefully monitoring" developments and

PREPARED TO ACT IF NECESSARY."

I think the Fed directed the Plunge

Protection Team (PPT) to act!

Of course, admitting PPT action never occurs, and reporters

never ask about it. Why not? It's a grand

manipulation scheme to save equity investors, while preserving the status

quo.

Lets examine the evidence of what occurred during the stock

market decline of 6/24/16 (after it was announced that the UK had voted to

leave the EU).

On June 24th, July VIX1 futures traded

as follows: Open 16.65, High 27.65, Low 16.07, Close 22.65.

Sept. S&P 500 Futures:

Open 2115.05, High 2119.20, Low 1996.40, Close 2021.75.

Note 1. The Volatility

index (VIX) on the CBOE moves opposite the equity markets 99.99% of the

time. If the S&P is up, then the VIX goes down and vice versa. That inverse relationship was demonstrated on

June 24th. As the U.S. equity

markets rallied from Tuesday through Friday this past week, the VIX closed

Friday, July 1st at 14.77 - a decline of -0.86 or 5.50% on the day

and also down on the week.

..

Monday June 27th (the second down day after the

Brexit vote) had this price action on the VIX and S&P 500 futures:

VIX Futures: Open 23.35,

High 23.70, Low 21.70, Close 23.65 (+1.00 from previous days close)

S&P Futures:

Open 2013.70, High 2022.70, Low1979.10, Close 1985.00 (-9,187.50 from previous

days close)

→Note that as the S&P 500 futures declined (-1.8%) the

VIX was up by only one point? For the VIX to be up only one point (e.g. 22.00

to 23.00) is equal to $1,000. on one VIX futures contract.

Opinion: No

one sells the VIX short into a huge equity decline - or no individual that is.

You need to know the horse race is fixed to do this, as the risk is huge.

Who did this? My guess the seller of the VIX was a large investment

bank, which then bought the market via stock index futures and/or ETFs from

6/28-7/1/16. I believe the Fed also

bought S&P futures, and other equity indexes through its representative

surrogates.

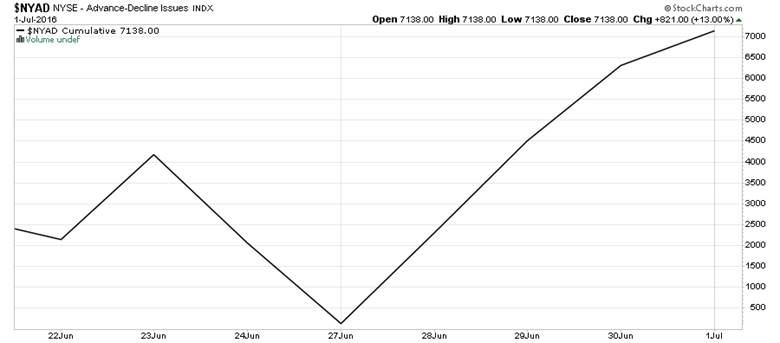

Incredibly, the net breadth of the market (i.e. the cumulative

A/D index) made a new all-time high this past Friday. Heres a stunning chart (created by the

Curmudgeon) of the cumulative NYSE Advance/Decline line that youre not likely

to see anywhere else:

..

Real buying, if it had occurred, would've been from "stock

pickers." That's because GDP was up only 1.1% for the 1st

quarter, and corporate earnings have been declining for four consecutive

quarters. In such an environment, true

professionals buy stocks on unique value or growth prospects.

Curmudgeon Note: Several long/short equity funds that use

relative value to choose stocks to buy/sell were DOWN this past week. I own COAGX and OTCRX which both declined

modestly this past week as the market rallied strongly.

..

Buying "the market" in lieu of selective stock

purchases is yet another sign of government manipulation. Since the Federal Reserve is not a government

agency you cannot get the freedom of information act documents to prove they or

their surrogates bought stocks. The

Fed seems to have all the angles covered?

Thereby, I'm going to pass on shorting stocks, as the Fed is got the

game fully rigged. I'd rather be long gold and silver, which did quite well

this week.

UK Global Central Banker Uses Moral Suasion:

Post Brexit, investors around the world are rediscovering their

faith in central banks, which continue to hint theyre willing to dig deep into

their arsenal to spur confidence.

In his first speech after the Brexit vote, Mark Carney, the

governor of the Bank of England said: The charge that central banks are

out of monetary ammunition is wrong.

Carney told bankers and business leaders that the result of the EU referendum

is clear, but its implications for the UK economy are not.

The economic outlook has deteriorated and some monetary policy

easing will likely be required over the summer. According

to the Guardian,

that suggests a cut in the benchmark UK interest rate, currently at a record

low of 0.5%, is in the cards.

Carney only used the threat of action which is "Moral

Suasion. Yet the UK stock market

rallied strongly as the Curmudgeon notes above.

Carney did not disappoint investors!

Curmudgeon Note: Besides myself, there are plenty of skeptics that dispute

Carney's remark about central banks still have monetary ammo. Here's one of many quotes: "This is a

fundamentally more profound problem than central banks and monetary policy can

handle," said Tony Roth, chief investment officer of Wilmington

Trust.

Economic Reality of Brexit:

The Brexit vote will surely have a negative impact on economic

activity, and almost certainly cause a recession for the UK and EU, as business

is in limbo till the details of the UK's exit from the EU are spelled out and

new trade laws are promulgated.

The WSJ reports:

As Britain prepares to negotiate its future relationship with the EU bloc,

economists have warned that Brexit could harm the global economy.

Furthermore, another European country is almost sure to

"leave" the EU, as more referendums are lining up. Most importantly, France is going to vote to

leave the EU next year if Marine Le Pen (National Front leader who endorsed

Donald Trump) wins in the April/May 2017 France Presidential election. With Francois Hollande's at a new low

approval rating of 14% (as of April 14th) while Le Pen is at 28%,

Hollande is not likely to be re-elected.

If France leaves as I expect, the EU will collapse and the Euro single currency

will be history.

Victor's Conclusions:

The next time someone says we live under "Capitalism and

Free markets, I suggest you emulate Cher in the movie "Moonstruck"

by slapping them in the face and saying "snap out of it!"

What's going on today is the epitome of Central Bank Planning to

serve themselves and the rich stockholders. It's odd that the Fed can say with

a straight face that their extraordinary monetary policy has nothing to do

with inequality."

So what the central banks have declared is the Hell with the

long run." With really no bullets left in their arsenal what will they

actually do? Neither QE or ultra-low or negative

interest rates2 have been effective in stimulated economic

growth.

Note 2. Federal Reserve

Vice-Chair Stanley Fisher said the

Fed has no plans for negative interest rates).

Here are some potential new policies central banks could try:

- Victor:

Use newly printed money to buy stocks via futures/ETFs?

- Curmudgeon:

Provide a guaranteed income to all residents? (Switzerland overwhelmingly voted that

down last month).

- Curmudgeon:

Drop money from helicopters (as Ben Bernanke suggested years ago) which some

now advocate. With

unconventional approaches such as QE and negative interest rates not

working, out-of-the-box measures like helicopter money might be worth a

try, but to which neighborhoods? :-))

End Quotes:

Let's end with a couple of quotes from Jim Grant- publisher of

Grant's Interest Rate Observer and former Barron's interest rate columnist:

Understandably, its only the selling kind of panic to which

the government dispatches its rescue apparatus. Few object to riots on the

upside. But bull markets, too, go to extremes. People get carried away, prices

go too high and economic resources go where they shouldnt. Bear markets are

natures way of returning to the rule of reason.

"Capitalism without financial failure is not capitalism at

all, but a kind of socialism for the rich."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian,

economist and financial innovator who has re-invented himself and the companies

he's owned (since 1971) to profit in the ever changing and arcane world of

markets, economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters and

other factors.

Copyright © 2016 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).