Federal Reserve Bank “Magic Profits” Exaggerates US

Corporate Profits

by the Curmudgeon with Victor Sperandeo

Introduction:

Can

a US corporation buy government bonds and mortgage securities with money

created “out of thin air?” And then report the interest on those bonds as

corporate income? Certainly not, but Federal Reserve banks do this all

the time. Did you know that their so called "profits" – largely derived from interest on those same bonds

– are included in total US corporate

profits?

We

only learned of this last week, but it’s been going on for many years. Huge increases in Fed bank profits account

for a major portion of corporate profits (see Analysis section

below). It was singularly responsible

for ending the “profits recession” (which really hasn’t ended).

Why

hasn’t the main stream media/financial press reported this trickery? What's happened to investigative financial

journalism and reporting? After

reading this blog post, could someone please ask NY Times financial editor Gretchen

Morgenson.

Background:

Several

years ago, the Curmudgeon wrote an article which asked if the

Fed was a no risk hedge fund or a Ponzi scheme.

We concluded it was both. The

Ponzi scheme is based on the fact that US government issued debt (to fund its

budget deficit) was being purchased by the Fed (a quasi-government agency) with

money created “out of thin air” during rounds of QE and Operation Twist. In other words, the Fed was largely financing

the US budget deficit with “monopoly money1.”

Note 1. The Federal Reserve pays for the bonds it

buys by artificially creating reserve balances held by the banking system. It's an electronic “book entry.” The banking

system must hold the quantity of reserve balances that the Federal Reserve

creates until the purchased securities are sold (which hasn’t happened

yet). The Fed’s balance

sheet (assets-liabilities) has remained a tad over $4.5T since December 17,

2014.

Analysis - BEA Includes Fed

Bank Interest Income as Corporate Profits:

The

Ponzi scheme has been taken one step further by the US Bureau of Economic

Analysis (BEA), which includes Fed bank earnings (i.e. risk free interest

income on its $4.5+ balance sheet) as corporate profits. That makes the US economy appear to be much

stronger than it actually is and has ended the “profits recession,” as noted in

this post

by Wolf Richter.

The

BEA tracks “profits from current production” based on all US corporate

entities. The BEA informs us of the components of corporate profits in Table

13.1—Content of Corporate Profits on its web site (emphasis added):

“These

organizations consist of all entities required to file federal corporate tax

returns, including mutual financial institutions and cooperatives subject to

federal income tax; nonprofit organizations that primarily serve business; Federal Reserve banks; and federally

sponsored credit agencies.”

The

inclusion of Fed bank profits totally distorts the current corporate profits

picture. For the Q1-2016, the Federal

Reserve Banks reported a consolidated profit that had jumped 11% from a year

earlier to a record $24.9 billion. No

risk magic Fed profits (mostly from interest income) has been included in BEA’s

measure of US corporate profits, which increased $8.1 billion in the 1st

quarter.

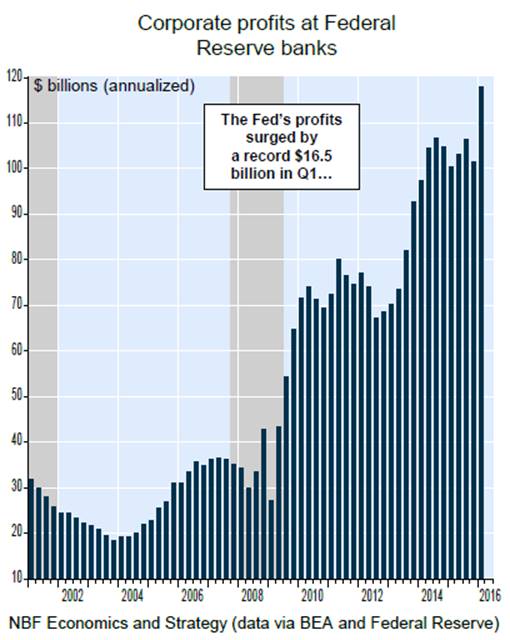

Stéfane Marion, Chief

Economist & Strategist at Economics and Strategy, National Bank of Canada, annualized

the Fed’s profits to make them comparable to the BEA’s annualized corporate

profits. Annualized, the Fed’s profit “surged $16.5 billion in Q1 – to a record

$117.9 billion,” he wrote in a note. “Were it not for this increase, overall profits in the US

would have actually been down for a third consecutive quarter,” Marion added.

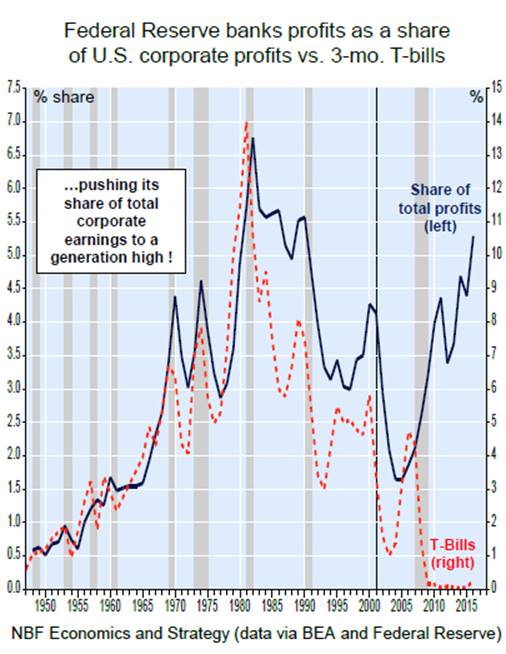

On an annualized basis, the Fed’s “magic profits” accounted

for 27.2% of US financial sector profits and for 5.3% of total US corporate

profits (sharply rising blue line in the chart below), “the highest level in a

generation.”

Marion summed up: “An improvement in corporate profits that

is driven by the central bank is not a sign of a healthy economy.” What do

you think?

BEA’s

Justification:

It appears the BEA is actually justified in their inclusion

of Fed Bank profits as corporate profits.

The System of National Accounts,

the international guidelines for GDP accounting, instructs countries’

statistical agencies to include central banks in the corporate financial

sector. The Curmudgeon spoke to BEA’s

Thomas Dail last Thursday who followed up with an

email the next day:

“We follow

these guidelines as closely as possible in part to make U.S. data comparable

with other countries’ data. Here is the reference from the latest

version (SNA 2008- pg. 76):

“As long as

the central bank is a separate institutional unit, it is always allocated to

the financial corporations sector even if it is

primarily a non-market producer.”

By showing

Federal Reserve Banks’ profits separately in our data (sent to Victor yesterday),

we allow analysts to determine how the Federal Reserve Banks affect overall

corporate profits and how corporate profits would look if they were

excluded.”

The most recent BEA table of US corporate earnings is here. Note line 11. Federal Reserve banks. There you'll see that 1st

Q-2016 profits were $117.9B. Compare

that to 1st quarter 2014, when they were only $97.3B. That’s consistent with the two eye opening

charts shown above.

Did you know that?

Again, we ask why the main stream media/financial press hasn’t picked up

on this chicanery?

Victor’s

Comments:

The US Bureau of Economic Analysis (BEA) calculates corporate

earnings, among many other US economic reports including GDP. As the Curmudgeon explains above, the BEA

calculation of total corporate earnings includes the earnings of the 12 Federal

Reserve Banks, under the logic that they are "private corporations."

For perspective, how profitable is the Fed? How does the

Fed's profitability compare to America's other gigantic businesses? Joshua M Brown wrote about The Insanely Profitable Federal Reserve

in a 2014

blog post:

"For

starters, the $90 billion or so in total interest income the US central bank's

portfolio paid out is equal to about one-third of all corporate dividends paid

by US companies in 2013 ($311.8 billion).

The Federal

Reserve, after operational costs, is earning double the profits of Exxon Mobil

($44 billion) and Apple ($41 billion), and those two companies are doing a

combined $600 billion in global revenues! The Fed is in a much better business

than finding oil or making phones - instead it merely sits atop a $4 trillion

(today $4.5 trillion) portfolio of mostly risk-free bond investments and is the

de facto ultimate decider of what the interest payments are going to be. Not

bad work if you can get it."

Under the guise of helping the economy (without costs to

anyone), the Fed bought US government and mortgage debt (under the arcane label

of "QE") with money printed out of thin air! That increased its

balance sheet to over $4.5 trillion.

Interest on the purchased debt is paid to the Fed, which remits the proceeds

(after subtracting expenses) to the US Treasury Dept. That “magic income” is then added to total

earnings of all other corporations for the total compiled by BEA. That compares with the grand magic trick of

making an "elephant “appear out of thin air!

Let's take it a step further with a hypothetical

scenario. Suppose the Fed bought the

other $14.8 trillion in US government debt outstanding. The interest on the total Fed debt would

swell Fed bank profits such that US corporate earnings would grow by an

estimated 330% - without any costs to anyone!!!

I hope you all

see the impeccable logic of this form of accounting. It is legal fraud.

The same flawed logic applies to why "student loans” are not included as part

of US government debt, as they are off budget. Why? I have no idea of the

reason or excuse?

Housing also is not counted as spending or debt. However, the

earnings from Fannie Mae and Freddie Mac

are counted as US government income, which lowers the yearly budget deficit,

but does not raise the debt?

Who Controls the Mainstream Media?

Why doesn't the general media (print/newspapers, Internet,

TV, radio, etc.) report on this kind of clear deception, along with the Fed's

lack of candor and transparency?

Perhaps, it is because the mainstream media is controlled by

the puppet masters. Who are the "puppet masters"?

Let’s start with family dynasties, like John D. Rockefeller

(net worth $340 billion), Rothschild (net worth $350) billion, and JP Morgan

($41 billion net worth). One assumes

those families own part of the Fed, because they helped start it. But the actual Fed owners2 are never disclosed. Again,

that’s a lack of transparency?

Note 2. The Curmudgeon has

reported what’s public knowledge: The owners of the 12 regional Fed banks are

local commercial banks (and other undisclosed entities) who get a 6% dividend

per year on the Fed stock they own. But

there is no information on what that dividend is based on, i.e. Fed bank net

earnings for a given year, the Fed’s balance sheet, an assessment of the Fed’s

net worth or “book value,” etc.

……………………………………………………………………………………………………………….

Dennis L. Cuddy, Ph.D. wrote on page 21 of his book "The

Road to Socialism and the New World Order:”

"In March 1915 the JP Morgan "interests" ...

got together 12 men high up in the newspaper world and employed them to select

the most influential newspapers in the US and sufficient number of them to

CONTROL generally the policy of the daily press.... These 12 men worked the

problem out by selecting 179 newspapers...they found it was only necessary to

purchase the control of 25 of the greatest papers."

The average salary (adjusted for inflation) was $16,063 in

1915. The net worth of the family

dynasties allowed them to control anything they wished.

Could that CONTROL of the press and on-line/TV media still be

the case today? If so, the press is

under the thumb of those same wealthy families that helped create the Fed and

is not free.

Victor’s

Conclusions:

Many excuses, rationalizations, and outright lies are

espoused to make people have faith in government. Elected officials want to make us all believe

that they'll do the right thing for the people so that we should all vote for

our favorite "political personalities."

The essence of why government tries to make people feel they

will help them is to get the

politicians who run the government elected or re-elected. With rare exceptions, this desire for

government power is not to help the people, but rather it's a lust for power,

control, and the money/wealth which follows it.

We have many times discussed the ways the US government

attempts to fool the people and lie (or be silent) about reality when it is not

pleasant or contradicts previously stated official positions. We haven't even talked about the military

deception, like

US troops supposedly no longer fighting the Taliban in Afghanistan. Really?

The more you look into government matters of any kind, the

more corruption, deception, chicanery, double dealing, and charlatan tactics

you will find. As John Perkins author of

"The Confessions of an Economic Hit Man" wrote:

"This empire, unlike any other in the history of the

world, has been built primarily through economic manipulation, through

cheating, through fraud, through seducing people into our way of life, through

the economic hit men. I was very much a part of that."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the Curmudgeon

and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).