Weak

Productivity: The Untold Story of the U.S. Economic Recovery

by the Curmudgeon with Victor Sperandeo

BLS Productivity

Report Overview:

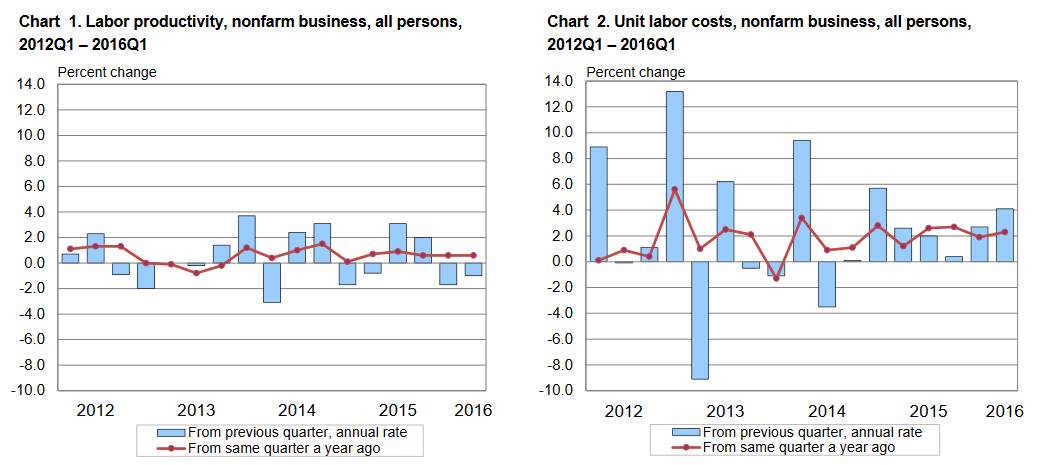

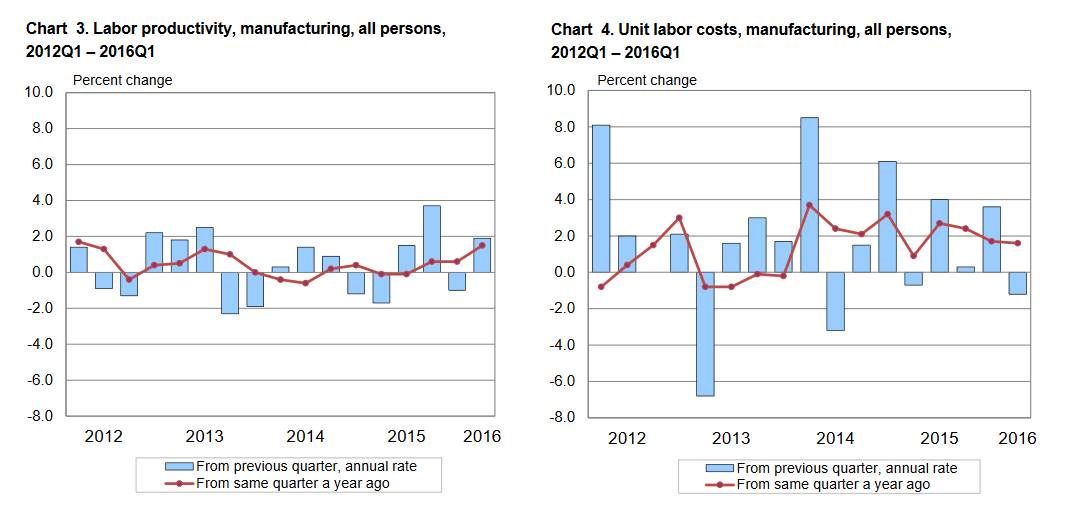

Non-farm business sector labor productivity1,

the lifeblood of living standards, decreased

at a 1.0% annual rate during the 1st quarter of 2016, the U.S.

Bureau of Labor Statistics (BLS) reported today (May 4,

2016). Output increased 0.4% while hours

worked increased 1.5% (on a seasonally adjusted annual basis).

Meanwhile, productivity fell

at a 1.7% rate in the 4th quarter of 2015, initially reported as

a 2.2% drop. From the first quarter of

2015 to the first quarter of 2016, productivity increased only 0.6%.

Note 1. Labor productivity, or output per hour, is calculated by

dividing an index of real output by an index of hours worked of all persons,

including employees, proprietors, and unpaid family workers.

Chart Courtesy of Bloomberg:

Unit labor costs2 in the nonfarm business sector increased 4.1% in the 1st

quarter of 2016, reflecting a 3.0% increase in hourly compensation and a 1.0%

decrease in productivity. Unit labor

costs increased 2.3 % over the last four quarters.

Note 2. BLS calculates unit labor costs as the ratio of hourly

compensation to labor productivity. Increases in hourly compensation tend to

increase unit labor costs, and increases in output per hour tend to reduce

them.

.

.

Curmudgeon

Comment & Analysis:

This and previous productivity reports are NOT BULLISH FOR AMERICA!

·

For all of 2015,

productivity rose just 0.7%, marking the fifth straight year of weak gains.

·

Productivity has

now decreased for two consecutive quarters, while it has only risen in two of

the last six quarters.

·

Productivity has

averaged 0.8% over the past four quarters and 0.6% over the past five years.

·

Productivity has

advanced at a meagerly annual rate of less than 1.0% percent in each of the

last five years.

The last similarly weak stretch was in the early 1980sa

worrying signal for the broader economy, which barely managed to eke out growth

in the 1st quarter (which Shadowstats.com John Williams says will

later be revised to negative growth). The

economy has continued to produce (low paying) jobs despite anemic output

growth, in part because firms are hiring more workers to compensate for tepid

growth in worker productivity.

Compare the recent productivity numbers to the 2.2% average

annual productivity gains over the past 68 years. Without improved productivity and higher pay,

the U.S. economy is unlikely to break out of its current straitjacket of sub-3%

annual GDP trend growth. The economy hasnt reached 3% growth since 2005, the

longest barren stretch in the post-World War II era!

Whats happened to account for this multi-year slump in

worker productivity? Werent all the new

technologies, like mobile apps, social networking, cloud computing, big

data/analytics, e-commerce, mobile payments, and multi-tasking using tech

gadgets & tricks supposed to make employees more productive? Well, it surely hasn't happened!!!

Economist

Opinions:

Productivity is pretty weak, theres no question about

that, said David Sloan, a senior economist at 4cast Inc. in New York.

Still, the report does give a hint that wage pressures are starting to build

because of the strong labor market, so that is of significance.

Peoples living standards are derived really more than

anything else by the rate of productivity, Stephen Stanley, chief economist at

Amherst Pierpont Securities LLC in New York, said before the report.

Over time, if productivity growth is lower, then wage growth should be lower

as well.

Laura Rosner, an economist at BNP

Paribas, said that U.S. productivity growth has averaged just 0.5% over the

past five years, compared to 2.5% to 3% growth per year in the previous

economic expansion. She called the

slowdown a "disturbing trend with negative implications for the growth

outlook."

John Williams of Shadowstats.com: Neither the U.S.

GDP nor the employment numbers are meaningful, and taking a ratio of something

based on those data does not add to the quality of the reporting. That generally is why I do not cover the

productivity series.

Other Voices:

The NY Times says:

Some

economists believe the recent slowdown in productivity is partly the result of

a drop in business investment in new equipment.

They are forecasting acceleration in productivity once business

investment picks up. But other economists say that the country may be stuck in

a prolonged period of weak productivity growth.

In a Macro Bulletin paper

published last month, William Van Zedghwhe, an

economist at the Federal Reserve Bank of Kansas City attributed weak

productivity growth to the changing industry mix, which has seen a shift from

manufacturing and energy production toward the production of services. The KC Fed paper concludes by stating that

the decline in manufacturing led to a 0.25% decrease in overall productivity,

while mining's travails subtracted 0.5%.

We think the analysis is flawed and a total cop-out!

The bottom line is that soft productivity has significantly

lowered the U.S. economy's long-run potential for growth and has failed to

improve living standards for most Americans.

Victor's Conclusions:

The decline in productivity is a sign and symptom of a

decline in the U.S. economic system.

Rising "productivity" comes from capital to buy tools and

machinery to increase output per unit of input.

The objective is for the worker to produce more per hour with the new

machine than the man without that machine.

The culprit for low economic and productivity growth might be

a government that taxes savings, income, and capital gains at high rates, and

also regulates businesses to the point that it discourages investment in new

plant and equipment.

For several years now, the capital that would normally be

earmarked for business investment has been diverted to unproductive purposes,

such as buying back a company's stock, which reduces the float, increases

earnings per share, but also shrinks economic growth and productivity. It is a lose-lose outcome, as less workers

are hired and the economy goes into decline.

As Stafford

Cripps put it:

"Productive

power (productivity) is the foundation of a country's economic strength.

Consistently low productivity, like persistently bad health,

is a sign that economic death is pending.

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development platform,

which is used to create innovative solutions for different futures markets,

risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).