Disappointing

U.S. GDP is Actually Worse Than Reported!

by the Curmudgeon

Introduction:

U.S. real GDP increased at an

annual rate of 0.5% in the 1st quarter of 2016, according to the

"advance" estimate released today by the Bureau of Economic Analysis

(BEA). Economists polled by Reuters had

forecast the economy expanding at a slightly better 0.7% rate in the 1st

quarter. The "second" estimate

for the 1st quarter real GDP, based on more complete data, will be

released on May 27, 2016.

The tepid and disappointing 1st

quarter GDP estimate marked the slowest U.S. economic growth in two years

(since the 1st quarter of 2014).

For comparison, real GDP increased at an anemic 1.4% in the 4th

quarter of 2015.

Curmudgeon Comments:

Growth in household spending,

the main driver of the U.S. economy, slowed to 1.9% in the 1st

quarter from 2.4% in the previous quarter.

That despite a healthier 2.9% increase in disposable income.

-->Whatever happened to

the heavily hyped “tax cut” due to lower oil and gas prices that was supposed

to markedly INCREASE U.S. consumer spending?

The details of the U.S. GDP

report were consistent with the Fed’s mixed assessment of the US economy

(growth weakening; labor market improving) in their April 27, 2016 meeting

monetary policy statement. The Fed

warned that “growth in economic activity appears to have slowed,” even as the

labor market continues to improve.

The reality is that U.S. GDP

has come in below its long term trend rate of slightly more than ~3% during

this entire “economic recovery” which supposedly started in 2009 when the

“great recession” ended. [U.S. GDP

Growth Rate averaged 3.23% from 1947 until 2016, reaching an all-time high of

16.90% in the first quarter of 1950 and a record low of -10% in the first

quarter of 1958.]

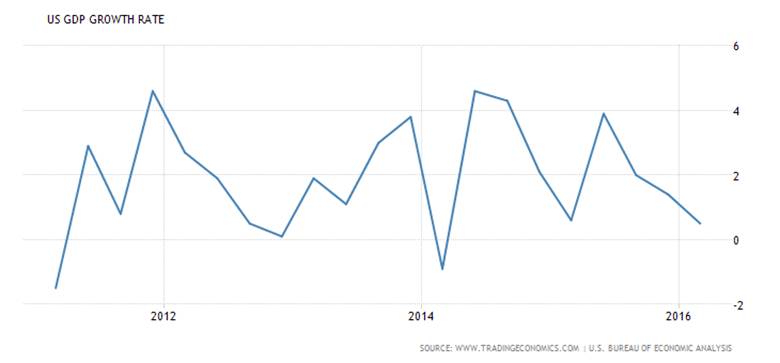

Below is a chart of the U.S.

GDP growth rate over the last five years.

Why don't you compare it to the rise in U.S. stock prices (not shown)

over the same time period? Perhaps then

you'll appreciate “the great disconnect” the CURMUDGEON has been crowing about

since 2011!

The latest slowdown raises

questions about the durability of the seven-year “economic expansion” at a time

of great global uncertainty (think debt build up in China). The U.S. GDP deceleration comes amid sluggish

growth around the world, with the International Monetary Fund (IMF) this month

cutting its global forecasts for the fourth time in a year.

Behind the GDP Number:

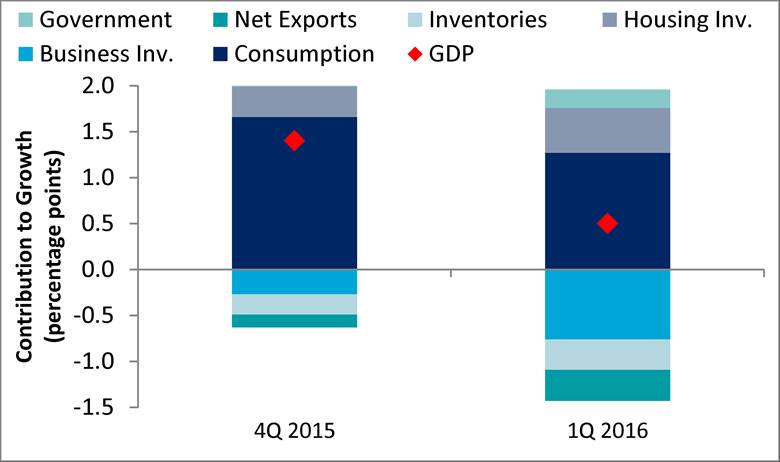

The increase in real GDP in

the 1st quarter reflected positive contributions from personal

consumption expenditures (PCE), residential fixed investment, and state and

local government spending that were partly offset by negative contributions

from nonresidential fixed investment, private inventory investment, exports,

and federal government spending. Imports, which are a subtraction in the

calculation of GDP, increased.

The deceleration in real GDP

in the 1st quarter reflected a larger decrease in nonresidential

fixed investment, a deceleration in PCE, a downturn in federal government

spending, an upturn in imports, and larger decreases in private inventory

investment and in exports that were partly offset by an upturn in state and

local government spending and an acceleration in residential fixed

investment.

The fall in corporate

investment was driven by energy companies cutting back on capital spending

owing to the decline in oil prices. That has ricocheted to the factory sector, with

the demand for items used by oil groups falling. The U.S. trade deficit also

dragged on the numbers as the surging dollar crushed exports, which fell 2.6%.

The GDP deflator rose

by 0.7% annualized or 1.3% year-on-year in 1Q, consistent with consensus

projections. The total PCE deflator rose by 1.0% year-over-year as some of the

drag from the 2014-15 commodity price collapse disappeared. The core PCE

deflator, defined as total PCE less food and energy, rose by 1.7%

year-over-year, marking the fastest pace since 1Q 2013.

Current-dollar GDP - the market value of the goods and services produced

by the nation’s economy less the value of the goods and services used up in

production - increased 1.2%, or $56.3 billion in the 1st quarter to

a level of $18,221.1 billion. In the fourth quarter, current-dollar GDP

increased 2.3 %, or $104.6 billion.

Chart Courtesy of Citi

Velocity

.………………………………………...…………………………………………….

Expert Opinions:

Economists have said that the

model used by the government to strip out seasonal patterns from data is not

fully accomplishing its goal despite recent steps to address the problem. However, they didn't comment on whether

improved seasonal adjustments would've raised or lowered the 1st

quarter GDP “advance” estimate.

Michael Gapen,

chief United States economist at Barclays said: “Economists view

productivity growth and technological change as driving improvements in

standards of living over time. A permanent slowdown in productivity growth

would suggest that living standards rise more slowly.”

Gapen noted that productivity had been increasing at an

annual rate of about half a percentage point over the last five years. That is

well below the Internet-driven 2.5% gains recorded annually in the second half

of the 1990s, and below the more typical 1.5% rate of productivity gains in

previous decades. Productivity growth

determines future living standards.

“We have been slowing down

since last year — this is not a one-quarter phenomenon,” said Joseph LaVorgna at Deutsche Bank. “It is surprising that

the consumer has not done better given strong jobs growth and low energy

prices.”

Brian Schaitkin,

an economist at the Conference Board, said: “Since the end of the Great

Recession . . . first-quarter GDP growth figures have shown a consistent

pattern of being weaker than those for the rest of the year, which suggests

that a small rise is in store in 2016.”

“It doesn’t look like there’s

any danger of recession, but the global economy and commodities are weak,” said

Kevin Logan, chief United States economist at HSBC.

Citi Group wrote in April 27th and 28th reports to

clients:

“Supportive

domestic financial conditions generally promote slack absorption and lower the

risks of a slowdown, but, inflation pressures have not risen enough to warrant

an early resumption of interest rate normalization. We recognize a significant

loss of growth momentum at the end of 2015 and in the first quarter of 2016,

and have downgraded our growth forecast.”

U.S.

and global political events this summer may generate additional drag on GDP

that would lower our projected growth in 2016 to potential growth (1.5%) from

1.7%.

Currently,

there is little evidence that consumer prices are accelerating fast enough to

reach the Fed's target before 2018. We believe the FOMC would not consider

changing its policy stance (i.e. no rate increases) until they are assured that

inflation's trajectory has shifted to a much faster pace of increase, supported

by evidence of broad-based cost (wage) increases.”

Citi anticipates a gradual

increase in consumer prices back to the Fed's 2% target over the course of the

next two years. They say that the Fed's removal of the March policy statement

mention of faster inflation from the April policy statement, suggests that the

Fed is also expecting only a gradual rise in core consumer inflation ahead.

ShadowStats Assessment:

In an April 28th

report to subscribers, John Williams noted:

1. Summary & Overview:

·

First-Quarter

GDP Growth of 0.5% Was Absolute Nonsense

·

Residential

Investment Contributed 0.5% of the 0.5% Headline Growth,

·

Yet,

Housing Starts Contracted Quarter-to-Quarter

·

Annual

and Quarterly GDP Growth Slowed to Two-Year Lows

·

Meaningful

Downside Revisions Loom for the GDP

·

Declining

Velocity of Money Reflected Slowing GDP Activity

2. Intensified FOMC Waffling Could Reach a

Flipping Point:

A

further interest rate hike is on hold until after the U.S. presidential

election (the Curmudgeon has long agreed with John's assessment). With that

election effectively five months off, the U.S. economy and the global financial

system likely will face extreme difficulties and turmoil in the interim period.

Accordingly, the question well may be whether the Fed’s next monetary action

will be one of tightening, or perhaps one of moving back into a more-intense

form of quantitative easing. With the economy taking a hard hit, even in the

context of fluffed-up first-quarter GDP numbers, odds increasingly favor

renewed easing, with increased liquidity likely to be needed both by the global

banking system and by the U.S. Treasury.

3. Nonsense GDP Reporting:

Aside

from the headline 0.5% ―advance estimate of annualized real quarterly

growth in 1st quarter 2015 GDP being no more than statistical noise,

the detail was nonsense in the context of the otherwise built into the headline

guesstimate by the BEA. A clean (BEA) report would have shown a headline

quarterly GDP contraction well in excess of 1.0% (-1.0%).

Closing Quote from John

Williams:

“We have been in a recession

for the last year. It just has not been recognized yet. First-quarter 2016 GDP would have been down by

more than 1% if the reporting were clean.

The hard numbers on the goods side all were negative, the soft numbers

on the services side all were positive.

The 1st quarter 2016 should go negative in revision in the

next month or two. Mid-year benchmark revisions

should take other recent quarters into contraction. Formal recession recognition should follow.”

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).