Stock Market Bears Frustrated by Record Highs Despite Struggling U.S. Economy

by The Curmudgeon

The U.S. economy continues to deteriorate as we've been reporting in recent

posts. Today, it was reported that the Institute for Supply Management’s

factory index fell to 51.3 in March from 54.2 in February. Any reading above 50

signals expansion. At the same time, the new-orders index, a gauge of future

demand, fell to 51.4 from 57.8 in February. The production index dropped 5.4

percent to 52.2. In addition, the Chicago PMI Index unexpectedly fell from 56.8

in February to 52.4 in March. New weekly unemployment claims jumped by 16,000

last week.

The loss of momentum in sales and production could be an

indication of an economic slowdown in the second quarter. Economists

expect U.S. economic growth to slow to 2.2 percent from an estimated 2.8

percent in the first quarter. And corporate profits are still being

downgraded by analysts.

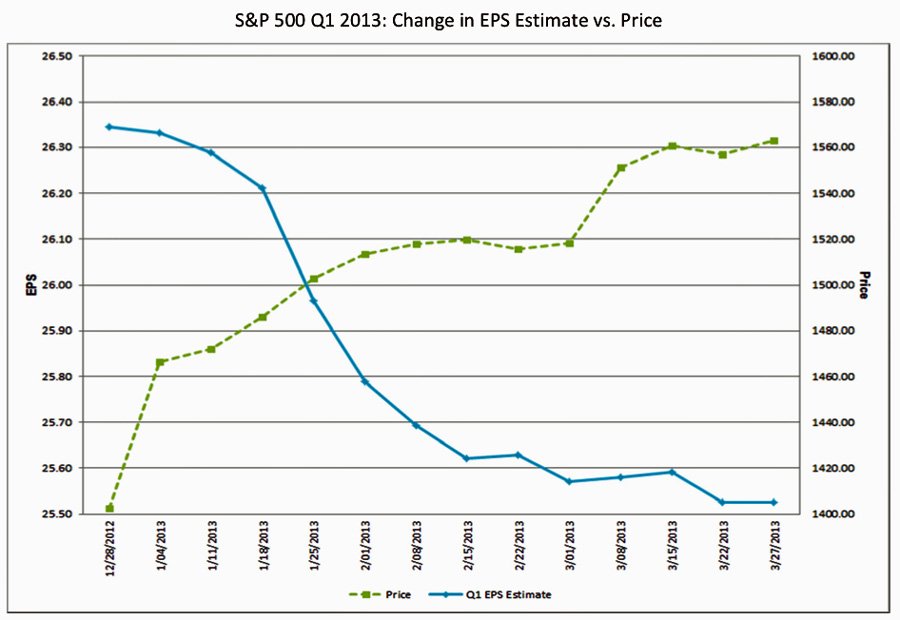

But the stock market continues to advance nonetheless, as P/E ratios have expanded. Many fundamental-oriented stock market bears have centered their investment theses based on deteriorating earnings (i.e. profits and profit expectations coming down). And while those bears have been right about profits weakening, many didn't expect investors to pay an increasing premium for stocks.

Here's a chart showing how stocks rose as earnings expectations fell. This certainly has frustrated the bears beyond belief:

It's somewhat surprising that defensive

stocks again led the charge last week along with healthcare, utilities,

and consumer staples. Meanwhile, financials, industrials, and technology

lagged, especially in today’s trading. In a healthy bull market, one

would expect to see the relative strength of the more cyclical stocks

improve as that would reflect expectations of future economic growth. But

we are in a Fed driven liquidity bull market that doesn't pay much attention to

economic fundamentals.

But that pales in comparison to what one pundit is

saying: That the way to achieve real economic growth is for Central Banks

to inflate asset prices to make consumers feel better and spend more. In today’s

Financial Times, Roger Farmer wrote an Op Ed piece titled:

Here are a couple of quotes:

"Since

households spend more when they feel wealthy, one way to get people back to

work is to reflate the asset markets. Central banks and treasuries should

actively intervene to reflate the asset market bubble."

"A

further increase in equity prices, engineered by government, will benefit us

all. As the economy recovers, employment will rise, tax revenues will rise and

the need for austerity will fade. For example, the Bank of England, backed by

the Treasury, does not need to print money to restore full employment – a move

that would potentially be inflationary. They need simply to absorb the risky

assets that private markets are unable to absorb by swapping debt for equity

held by the public."

At this point, the CURMUDGEON is so flummoxed and bewildered

that he's willing to consider the above opinion as reasonable.

Nonetheless, we've always favored true Keynesian economic stimulus, especially

for building infrastructure, to create jobs and make the economy grow.

Let's see if the incredible stock market complacency will be

ended by a very sudden and unexpected wake-up call.

Till next time.....................................

The Curmudgeon

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.