Is

the Stock Market Rally Based on Improving Fundamentals?

by Victor Sperandeo with the Curmudgeon

Introduction

(Curmudgeon):

Is technical and fundamental analysis of stock prices

obsolete? One might think so when a

confirmed bear market spins on a dime and rallies sharply - without basing or

testing the lows. In the first quarter

of 2016, U.S. stocks recovered from a 10.8% loss to rally 13.2%, ending the

quarter up by 1%. The roller coaster

ride for emerging market stocks was even more dramatic. Initially down 10.1% in February, emerging

market equities then rallied 17.7% to post a nearly 6% gain for the first three

months of 2016.

After the Fed stated in January that it planned to raise

short term rates a full percentage point in 2016, the U.S. central bank has

softened its stance. In a speech last

week, Fed Chairwoman Janet Yellen said that falling bond yields were helping to

offset the tightening in financial conditions brought about by the slide in

equity markets and the widening of credit-risk spreads, which many pundits

attributed to the central bank's 25bps rate hike in December – the first in

nine years. Global economic developments, notably the weakness in China and

emerging economies, also served as headwinds to the steady but lethargic pace

of U.S. economic growth.

Meanwhile, U.S. economic growth is weakening. Forecasts for 1st quarter 2016 GDP

by blue chip economists in early January were between 2% and over 3%, with the

“consensus at 2.5%. Atlanta Fed’s GDPNow

forecast,

a strictly data-driven model, forecast growth in Q1 would come in at or above

2.5%. By March 24th the

GDPNow forecast had dropped to 1.4% growth.

After last week's report on consumer spending and the contribution of

exports to GDP, it plunged by more than half to 0.7%! The GDPNow forecast drop from 2.5% to

0.7% in the last few weeks, coincided with a strong stock market rally. As might be expected, corporate earnings are

also declining (see Curmudgeon comments below).

Victor recaps recent U.S. stock market movements and

monetary policy, while the Curmudgeon examines why corporate earnings are no

longer the main driver of stock prices as they once were. Victor then analyzes

the current economic and financial market environment, noting the extreme

disconnect that has gotten much wider since we first called attention to it

several years ago.

Review of U.S. Stock Market & Monetary Policy in

Q1-2016 (Victor):

The Dow Jones Industrials (DJI) made a primary

intermediate low on January 20th, thereby confirming a bear market

according to Dow Theory. Many other long

term indicators also shouted “bear market.”

For example, the long term moving average (MA) slope was clearly down,

with stock prices trending below the MA.

Lower closing lows came several weeks later on February

11th with the DJI at 15,660.18 and the S&P 500 at 1829.08. The two

benchmark stock indexes closed this Friday 17,792.75 (+13.62% off the lows),

and 2072.78 (+13.32% off the lows), respectively. This rally does not change the bear market

primary trend, but it is very surprising because there were no fundamental

economic improvements to cause this type of move (at least as far as I can

determine).

Let's review monetary policy to develop a context. Janet

Yellen has changed her mind on raising rates. Here's an example of her strong dovish talk at

her March 29th speech at the Economic Club of NY:

Due to “...slow global growth and the significant

appreciation of the dollar since 2014... We have to take into account the

potential fallout from recent global economic and financial developments, which

have been marked by bouts of turbulence."

The U.S. economy is weakening. GDP growth has been further downgraded 0.2%

this year with estimates of 0.7% in the 1st quarter. Oil prices are

a headwind that's holding back the Fed’s target inflation rate of 2%. The Fed

(somehow) does not count the Core CPI inflation rate of 2.36% ending February

2016 year over year. Why not? Also the CPI Core rate (excluding Food and Energy

prices) has been +1.9%-to-2.0% since September 2015 with the average being

2.10% for the last 6 months.

A brief review of Fed Policy is worthwhile, as the

Fed seems to be singularly responsible for market movements today. As the Curmudgeon notes below, corporate

earnings are declining and no fiscal stimulus is even discussed by the Obama

administration or Congress.

The S&P 500 topped in May 2015 and tested the highs

in July. The Fed put out hints of raising rates in September, but they

chickened out due to "global volatility," a standby excuse these

days. Finally, after 9 years of no rate increases, the Fed raised short term

rates 25 bps on December 16, 2016. That

was exactly seven years to the day of zero short term rates, because of rising “inflation

expectations,” according to the Fed. It

should be noted that 30 year U.S. Government bond yields were 3.0% on that day,

while the 10 years T-Note was at 2.3%.

The Fed projected FOUR further Fed Funds rate increases

for 2016, which would bring the Fed funds rate to 1.25% at the end of the year

2016.

·

On

January 29th -the end of the month- the 30 year U.S. bond yield was

2.75%, and the 10 year 1.92%.

·

At its

March 16th meeting, the Fed hinted strongly there would only be TWO

rate increases due to declining inflation expectations. The 30 year was then

yielding 2.71% and 10-year at 1.92%.

·

At the

end of March, the 30-year bond was now 2.62% and 10-year 1.78%.

·

It may

be of interest that the

low yield for 10 year Treasuries for 220 years is 1.45% in July 2012. That's only 33 bps away from the current

yield.

One may infer from Yellen's speech last week that rate

hikes have been lowered to zero, or perhaps one rate hike in December of this

year? The Fed seems fickler than a

female teenager buying a prom dress!

Decline in Corporate Earnings (Curmudgeon):

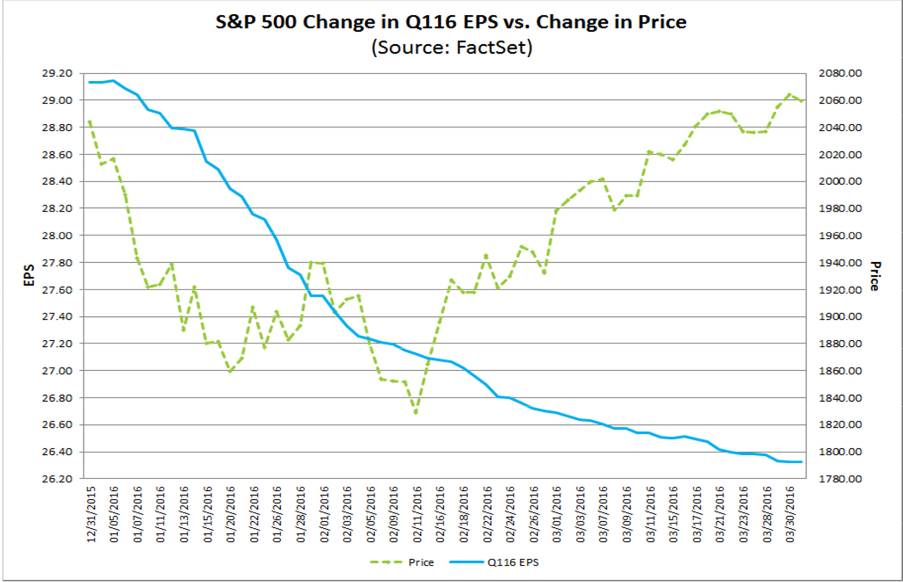

Factset reports:

“For Q1 2016, the estimated earnings decline for

companies in the S&P 500 is -8.5%. If the index reports a decline in

earnings for Q1, it will mark the first time the index has seen four

consecutive quarters of year-over-year declines in earnings since Q4 2008

through Q3 2009.

·

During

the first quarter, analysts lowered earnings estimates for companies in the

S&P 500 for the quarter. The Q1 bottom-up EPS estimate (which is an

aggregation of the estimates for all the companies in the index) dropped by

9.6% (to $26.32 from $29.13) during this period. How significant is a 9.6%

decline in the bottom-up EPS estimate during a quarter? How does this decrease

compare to recent quarters?

·

During

the past year (4 quarters), the average decline in the bottom-up EPS estimate

during a quarter has been 4.4%.

·

During

the past five years (20 quarters), the average decline in the bottom-up EPS

estimate during a quarter has been 4.0%.

·

During

the past ten years, (40 quarters), the average decline in the bottom-up EPS

estimate during a quarter has been 5.3%.

Thus, the decline in the bottom-up EPS estimate recorded

during the first quarter was larger

than the 1-year, 5-year, and 10-year averages. In fact, this was the largest percentage

decline in the bottom-up EPS estimate during a quarter since Q1 2009 (-26.9%).”

Chart courtesy of FactSet.

…………………………………

The push to raise the minimum wage to $15, which gained

further impetus in New York and California last week, will probably add to the

squeeze on profit margins. Hence, we

must conclude that corporate earnings are no longer driving stock prices as

they are now inversely correlated!

It's also surprising that 6% of S&P 500 companies

make 50% of all U.S. corporate profits, according

to USA Today:

“As corporate earnings were

shrinking in 2015, an elite group of U.S. companies found a way to grab a

bigger piece of the smaller-profit pie.

Just 28 firms in the Standard & Poor's 500 collectively hauled in

more than half the total net income reported by U.S-based companies in the

stock index last year, according to a USA TODAY analysis of data from S&P

Global Market Intelligence.”

Victor's Analysis:

What does all this demonstrate? It shows the psychology

of people and or investors trumps logic! “Investors” have been trained and

conditioned -like Pavlov’s dogs -to buy stocks on rate cuts (that happen

anywhere in the world). Worse, they buy

stocks when the Fed doesn't raise rates after saying they would! Evidently, that translates to a rate cut – or

does it?

The fact remains that the U.S. and world economies are

weakening at this stage of the business cycle, even after the Fed was at zero

rates for seven years with rounds of QE beyond reason. The Fed Funds is at 25-50bps for the last three

months with economic growth slowing. A

large number of nations of the world are at negative rates, which have not

done a damn thing to cause normal growth!

So how can these brilliant PhD’s and philosopher

kings not see that monetary policy is a complete failure under these conditions

and fiscal policy is the problem?

Moreover, the Fed and foreign central banks really have

only "moral suasion" left in their tool box. For example, talk of doing QE4 in the U.S. or

the talk in Europe to give away money to the masses.

Currently 30-year US bond rates are at 2.62%, and

screaming economic weakness! As the

dollar goes lower headline inflation will rise. So what you'll get is

stagflation.

Here's an April 1st quote

from Reuters:

"The U.S. economy is

growing at a 0.7 percent pace in the first quarter following data that showed

construction spending unexpected fell in February but rose more than previously

reported in January, the Atlanta Federal Reserve's GDP Now forecast model

showed on Friday. This was a bit faster than the 0.6 percent annualized pace

for U.S. gross domestic product seen for the first three months in Fed's prior

estimate on March 28, the Atlanta Fed said on its website."

Victor's Conclusions:

When an economy weakens and the Fed has a normal

environment of interest rates to work with that would be bullish for the

economy and stocks (e.g. the Fed lowers interest rates to stimulate borrowing

which would spur economic growth). This

economic recovery has been the slowest in the history of the U.S. (just 2.1%

since June of 2009). “Nuclear bombs” of

stimulus and accommodation have been thrown at it, yet economies (U.S. and

world- wide) continue to slow. The Fed

is out of real bullets except “talk” which is like firing blanks. How then will the real economy and stocks

mystically rise?

All of this in the face of declining real earnings, with

the S&P 500 industrials at a very high 26.56 X's trailing earnings and

S&P 500 P/E at 22.9 (see April 4th Barron's page M51). As noted above, profit margins are declining.

So again we must ask: why would the markets rally?

This is beyond the definition of a bubble, which is based

on over enthusiasm, and over valuation when earnings are "rising"

(not falling) and the economy is overheating. This is a different type of

bubble. It's based on the irrational

belief in an institution (i.e. the Fed) that CAN'T save the day as it has no

power left. QE 4 is not in the cards as

it would create shortages of debt and put Repo's in danger. It seems akin to the pied piper leading

lemming “investors” off a cliff.

I leave it to the reader to ponder other answers as to

why markets are so disconnected. By my reading the traits of crowds, they have

taken the Fed bait: to buy because the Fed is forever the savior.

Let's end with a quote

from THE CROWD, by Gustave Le Bon:

"It will be remarked that among the special

characteristics of crowds there are several as: impulsiveness, irritability,

incapacity to reason, the absence of judgment and of critical spirit, the

exaggeration of the sentiments, and others besides-which are almost always

observed in beings belonging to inferior forms of evolution...."

Good luck and till next time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).