U.S.

and Global Growth Disappoints Yet Again; Negative Interest Rates?

by the Curmudgeon with Victor Sperandeo

Introduction (Curmudgeon):

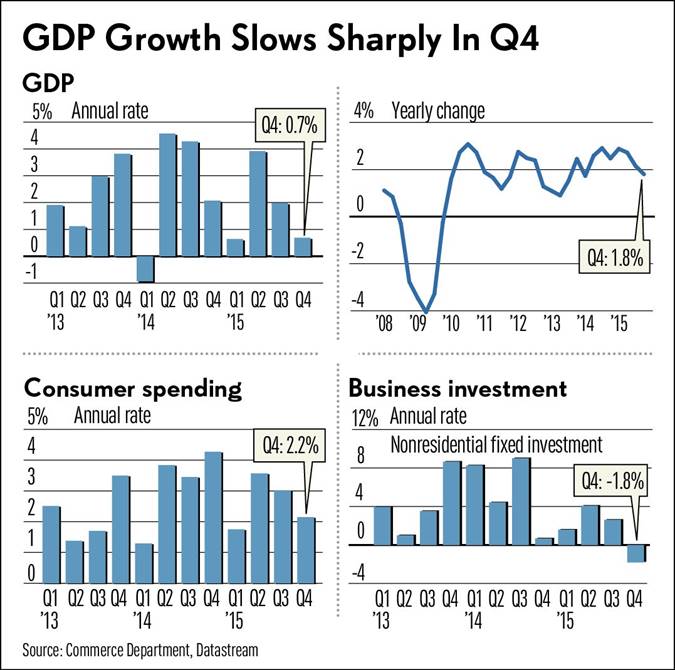

U.S. economic growth decelerated sharply in

the second half of 2015, with GDP up only 0.7% at an annual rate in the fourth

quarter. That's down from gains of 2% in

Q3 and 3.9% in Q2, according to the BEA

report released on Friday.

“The deceleration in real GDP in the fourth quarter

primarily reflected a deceleration in PCE (Personal Consumption Expenditures

price index) and downturns in nonresidential fixed investment, in exports, and

in state and local government spending that were partly offset by a smaller

decrease in private inventory investment, a deceleration in imports, and an

acceleration in federal government spending.”

Real GDP increased 2.4% in 2015 (from the

2014 annual level to the 2015 annual level), which was the same annual rate as

in 2014. In Q4-2015, non-residential

fixed investment fell 1.8%, its first decline since Q3 2012. The energy sector

continued to slash capital spending due to falling oil prices while other

businesses haven’t increased CAPEX to make up the difference. Please see charts below.

Inventories subtracted 0.45 % from GDP

growth in the 4th Quarter, after reducing growth by 0.71% in Q3-2015. Inventory

levels remain high, suggesting they’ll remain a drag on growth in early

2016.

Exports slumped, as a strong dollar and

weaker overseas economies sap demand for U.S. made goods. Indeed, it's a global

economic slowdown with no country growing strongly.

Consumer spending, which accounts for ~ 70%

of GDP, rose at a 2.2% rate in Q4, though that was less than in the prior two

quarters. Economists are perplexed as

to why consumer spending growth hasn’t been much stronger, given the collapse

in crude oil prices since June 2014.

[The NY Times tried to address that issue in a January 21st front page

article titled: “This

Time, Cheaper Oil Does Little for the U.S. Economy.”]

Separately, several U.S. regional

manufacturing reports have signaled economic contraction, including those from

the New York, Dallas, Kansas City and Philadelphia Federal Reserve

districts. Please see John Williams,

ShadowStats remarks below, which imply a national contraction.

Overseas, there were disappointing economic

reports last week from Japan (which now has negative interest rates), Taiwan

(adversely effected by China's slowdown), Russia (oil price collapse), and

several other countries. When Apple

announced lower iPhone sales last week, it blamed weakness in oil-dependent

economies like Russia, Brazil, and Canada.

It's not a pretty picture for those who

believed in robust global growth almost seven years after the last recession

ended. The economic stagnation since

then has been unprecedented.

ShadowStats

Commentary on Fourth-Quarter GDP, Consumer and Monetary Conditions:

Annualized Real GDP Growth Slowed to 0.69%

in Headline Reporting,

- Poised for Headline Contraction in February 26th

First Revision

- Difference Between the Headline Fourth-Quarter GDP

Growth and an Outright Quarterly Contraction Was Not Statistically

Significant

- Worst Real Trade Deficit in Eight Years

- Velocity of Money Slowed; January M3 Annual Growth

Slowed Markedly; Monetary Base Has Stabilized

In Commentary No. 783 to subscribers, John

Williams wrote (bold font emphasis added):

“The 'advance' estimate of 0.69% annualized growth in

real fourth-quarter 2015 Gross Domestic Product (GDP) was no more than

statistical noise. Simply put, there was

no statistically-significant difference between the “advance” headline

quarterly gain and an outright quarterly contraction. An outright contraction likely looms in

the first (GDP) revision.

Given the accelerating downside trend in most near-term,

headline economic reporting, including the durable goods orders detailed in

yesterday’s Commentary No. 782, the consensus outlook for broad economic

activity should be shifting rapidly to the downside. Negative expectations for the first

revision to fourth-quarter GDP on February 26th, and the actual reporting of

same should follow.”

Discussion (Victor):

The economies of countries in the world

that are not already in recession are heading lower. The monetary policy tactic most used to

combat economic weakness is best exemplified by a Saturday WSJ article titled:

“Bank

of Japan (BOJ) Launches Negative-Rate Policy”

“The Bank of Japan will adopt a negative interest-rate

policy for the first time as a sputtering economy, stubbornly low inflation and

turbulent financial markets world-wide threaten to undermine Prime Minister

Shinzo Abe's revival plan. The central bank said it cut the deposit rate paid

on cash parked at the BOJ by commercial banks in excess of legally required

reserves to minus 0.1% from the previous plus 0.1%."

The BOJ policy board voted 5-4 to cut

rates. This looks like the U.S. Supreme

Court decisions of late, or the reality of the "fifth fool."

Selected

excerpts

from a similar article in the Saturday NY Times are worth noting:

“With

the global economy looking increasingly fragile, Japan is now taking a more

aggressive step by cutting interest rates below zero on Friday…Moving to

negative rates reflects a measure of desperation on the part of central banks. Their

traditional tools have been largely exhausted, as most countries’ interest

rates have been pushed to almost nothing.

With

weak prospects for economic growth in many countries, businesses are reluctant

to borrow for practically any new projects…In a global marketplace, Japan’s

decision could have ripple effects, further clouding the outlook for the world

economy. The move to negative rates, for

example, weakens the yen. That, in turn, creates a potential problem for China

as Beijing struggles to contain outflows of money and prop up its own currency.

The People’s Bank of China, the

country’s central bank, said last month that it was shifting away from pegging

the value of its currency, the Renminbi, closely to the dollar. Instead, it

preferred to link the renminbi to a basket of currencies, with the yen playing

one of the largest roles after the dollar. If it ends up doing so, it could

result in a weaker renminbi, as the yen falls.”

Let's examine what this BoJ negative

interest rate action means to a typical Japanese saver. We'll use U.S. dollars (rather than Japanese

Yen) for simplicity. Assume you have $100,000.00 ($100K) in Japanese "Bank

Sake." After Friday's BoJ announcement on negative interest rates, your

account would be debited 10 bps over one year. So to hold cash at a bank would

now cost the Japanese saver $100 per year in this example. The BOJ is doing

this to stimulate savers to "spend your money" and for businesses to

increase capital spending.

But will a charge of $8.33 (=$100/12) per

month do that? If not, the BOJ will

accomplish nothing. It is intended to be psychological. The implication is that

if you don't spend your money we will charge you more of a penalty until you do

so. Do you think that will work?

It's astonishing that "negative

interest rates” are being used by many central banks to counter the economic

declines all over the world (instead of tax cuts which would be a refreshing

change from austerity based fiscal policies, especially in European countries

with high debt/budget deficits).

The European Central Bank (ECB) became the

first to cut deposit rates below zero in June 2014 and now charges banks 0.3%

to hold their cash overnight. The ECB was followed by Denmark, Switzerland and

Sweden. Government bond yields in Europe

and Japan fell further below zero on Friday. Negative yields now account for a quarter

of JPMorgan’s index for government bonds.

...............................................................................................................

Sidebar:

Cashless Society

Of course, you can take your money out of

the bank, as this central bank's absurd method of thinking believes it can

create greater penalties until you spend. The government's answer to you taking

your money out of the bank is to create a "Cashless Society." That was first promoted by Andrew G Haldane who

is the Chief Economist at the Bank of England and Executive Director, Monetary

Analysis and Statistics. He is a member

of the Bank’s Monetary Policy Committee. He also has responsibility for

research and statistics across the Bank.

A Cashless Society would prohibit you from

countering the government from charging greater fees and thus force you to

spend at some point. If you wanted your cash, you could only get a check to

deposit in another bank. This is being talked about in several countries,

especially Socialist dominated countries.

Note:

David Haggath, A Curmudgeon reader, has written a blog post on this

topic which you can read here.

Only a politician would think of this form

of controlling the masses. It would never work, and would rather lead to the

purchase of gold, silver, real estate, precious stones etc.

...............................................................................................................

As the Curmudgeon reports above, U.S. 4th

quarter GDP ('advance' estimate) was only 0.7% at an annual rate. The price

index for gross domestic purchases increased 0.3% in 2015, compared to 1.5% in

2014. Note that the CPI Core rate was + 2.13% for 2015.

The U.S. economy is weakening in almost all

areas and forecasters have taken notice.

"The chance of the U.S. sinking into a

full-blown recession now stands at 18%,” according to a CNN

Money survey of economists released this week. That's nearly double what the nation's top

economic policymaker predicted only a month ago. Federal Reserve chair Janet

Yellen put the probability of a recession in 2016 at about 10% during her

December 2015 press conference after the Fed raised interest rates for the

first time in years. The above

referenced CNN article states: “Yellen has said repeatedly that she thinks a

recession is not on the horizon. The

U.S. has enjoyed two years of incredibly strong job growth -- the best since

1999 -- and the economy is expanding at a healthy pace of around 2% a

year."

In addition, negative nominal rates have

not worked for the EU and won't work for Japan.

However, it does drive currencies down and stocks up (temporarily). For example, the S&P 500 rallied from an

oversold condition on Friday to be up 46.88 points or 2.48%. The yen was down

1.91% vs the dollar.

This mentality of trading reminds me of the

late 1970's when we all watched Money Supply, which the Federal Reserve was

trying to control. Increases meant “buy

stocks” while decreases said “sell.” This led to "higher interest

rates," which was OK as long as money supply expanded. It eventually ended in a painful death as

higher rates helped bring on the double dip recession in 1980 and 1981-82.

Today, "lower rates" means “buy,”

the Fed/ECB/BoJ doing nothing means “sell.” This is all ridiculous because

after 6+ years of lower/negative rates global economic growth is extremely slow

(or negative in some countries).

Slow growth leads to economic declines,

until a central bank lowers rates. Then markets rally, while the economy

yawns. Yet nothing changes economically.

It should be stressed that the U.S. 30 year- long term government bond yields

are 2.75%, which reflects a recession.

The fact that the equity markets are

disconnected from the economy has been pointed out by us many times. Several

years ago, the Curmudgeon called it “the great disconnect.” Eventually, both

the economy and stock market will be back in sync (on the downside).

Are there any countries whose economies are

doing well? China, the EU, Japan, the U.K., the U.S., Brazil, Canada, Russia,

emerging Asia nation's, most of South America and Australia are all struggling

or already in recession. A great deal of

the cause is declining commodity prices especially oil and gas. This is scaring

many creditors to believe that defaults are on the way. The high yield and corporate

bond markets also reflect this. It is

a risk the Fed will have a tough time fixing.

The earnings picture for the S&P 500 is

not bright, according to David Stockman's January 28, 2016 blog post titled “Death

Throes of the Bull." Here's an excerpt:

Reported GAAP earnings peaked at $106 per share on the

S&P 500 more than a year ago for the LTM period ending in September 2014.

By the most recent reporting period they were down by

14.4% to $90.66 per share, and there is no reason to believe that this slide

will rebound when the Q4 numbers are actually tallied.

Here’s the thing. This exact pattern occurred during the

2007-2009 collapse. While the Wall Street hockey sticks were projecting

earnings of $120 per share or more for 2008, actual GAAP earnings starting

falling in the June 2007 LTM period, and kept plunging until they hit bottom at

$7 per share in June 2009.

Victor's Conclusions:

I've been a bear on the U.S. economy to the

point I believe it cannot be fixed. The equity markets in the U.S. have a rally

left in them, which will end when the Fed sings "it will not be raising

rates," which everyone should know by now, despite Yellen's rhetoric. That day will be fully discounted and will

cause an intermediate high. The market will top that day and fall 10-20% before

the Fed has to come up with another scheme to cause a rally. After all, it's an election year.

To best describing the current economic

situation everywhere you look here's a quote from a well-known book titled

"The Law," which was

written by Frederic Bastiat, in 1850:

"...when plunder is abetted by the

law, it does not fear the courts, your police, and your prisons. Rather, it may

call upon them for help." – Bastiat

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).