The

Bear Market in Commodities Continues

by Victor Sperandeo with the Curmudgeon

Commodity Prices and the

Dollar:

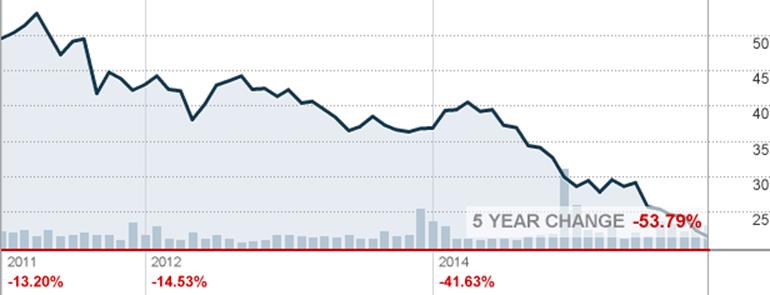

The Bloomberg Commodity Index ETN (DJP), which

tracks everything from lean hogs and coffee futures to natural gas and gold,

sank 0.7% to an all-time low of 21.45 on Friday. It's down

(25.6%) YTD. A paradox that few experts discuss

is the five year continuous commodities decline (from 12/31/10) with compounded

annual DJP loss of (15.27%),

while the S&P 500 is up +9.86% compounded!

Chart courtesy of CNN

Money

The S&P GSCI,

formerly the Goldman Sachs Commodity Index (GSP), is down (38.1%) YTD due to

its high energy weighting. January Crude

Oil closed at $35.36 on Friday December 11th, a level last reached

in February 2009 and down from a 2015 high of $65. Brent crude, the international oil benchmark,

dropped $2.37 to $37.36 a barrel — the lowest since December 2008. Oil prices are a third of the level they were

18 months ago and they have fallen almost 11 per cent since a rancorous OPEC

meeting a week ago saw the cartel remove even the pretense of production

restraint.

One interesting aspect of

these commodity lows are that the dollar is off its intra-day highs (on

12/3/15) and is weakening. Another is

that the lows are occurring just before next week's FOMC meeting, where the

media has assured us of a 25 bps increase in the Fed Funds rate.

CURMUDGEON Notes:

1. In all other late stage economic expansions,

commodities rose strongly due to demand to build more real things and

infrastructure. Interest rates also rose

sharply due to increased credit demand, building inventories and inflationary

pressures.

2. Victor's opinions below

are in italics font.

U.S. Interest Rates and

the Fed:

On October 23rd

T-Bills yielded 1 bps (0.0001), while this Friday the yield was 23 bps. Meanwhile, the 30 year U.S. government bond

yielded 2.90% then vs 2.88% on Friday.

To say the yield curve is flattening is missing the point. It screams the that it will be "one

(increase) and done" on the Fed Funds rate and almost assuredly the Fed

will have to reverse the increase in the near future. Also note that "Junk Bonds" are in

free fall -down (19%) from the 2014 highs- according to the SPDR Barclay High

Yield Bond ETF (JNK).

Certainly, the U.S.

economy is NOT the reason for a rate hike.

One can make the case that the U.S. is very weak. It is a political rate

hike -like everything else in the U.S.! The Fed has to raise rates so they can

have some power to lower them later.

I strongly believe QE 4 is

not going to happen, since the Fed owns too many bonds already. Of course, the Fed will say that future rate

increases will be “data dependent" which is “bull-oney.” The data is fudged and the Fed can use

propaganda to sway policy anyway they wish. For example, do we have a 5%

unemployment rate with 94+ million people not in the work force and the lowest

worker participation rate since the 1970's?

Honestly, can the Fed really say we have "low unemployment?”

China's Economy and IMF

Reserve Status:

The other critical long term

factor, besides the U.S. dollar increase causing the down-trend of commodities,

is China's very weak economy. Also, the

IMF granting China reserve currency status will NOT help China's economy in the

short run since the "effective date" for IMF reserve status is

October 2016. The 10.92% allocation was

less than the expected 14% which implies less Yuan/stock buying next year. So

although the dollar high has been made, in my view, China is in for a

"Cyclone Roller Coaster” ride (think of the iconic Coney Island roller

coaster in Brooklyn, which has an 85-foot drop at its highest point).

Conclusions:

The fall in commodity prices

is causing financial market anxiety, because investors are worried that it

signals a slowdown in global demand and that any economic benefit from cheaper

costs for consumers and businesses is being counteracted by the cutting of

investment and jobs by the natural resources sector of the global economy.

The CURMUDGEON believes the

huge global commodity bear market is largely due to tepid global demand which

is a direct result of weak economic growth (if any). The

argument that the entire world has been transformed into an information

services economy is bogus. There is

still the need for infrastructure in developing countries and also in the U.S.

Victor says that

commodities are down due to U.S. government policy and massive new regulations,

especially the Dodd- Frank law which the Fed oversees. That law created lower institutional demand

for commodities. The Fed also kept

interest rates low, so it could execute ZIRP and three rounds of massive

QE. Although a bear market in

commodities still exists, we should always remember commodities are cyclical

and they can't go "bankrupt."

Perhaps, the words

of David Ricardo (a great classic economist) are worth remembering:

"Gold and silver, like other commodities, have an

intrinsic value, which is not arbitrary, but is dependent on their scarcity,

the quantity of labor bestowed in procuring them, and the value of the capital

employed in the mines which produce them.”

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been

involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).