Analysis

of U.S. Employment Report/Fed Rate Rise, ECB QE Policy and the End Game!

by the Curmudgeon with Victor Sperandeo

U.S. Employment Report

& Fed Rate Hike (from ZIRP):

Friday's BLS employment report

of 211,000 new jobs added, with a steady 5% jobless rate, increases the

probability of a 25 bps increase in the Fed Funds rate (from 0 to 25 bps or “ZIRP”

to 25 to 50 bps) at the December 16th FOMC meeting. Both the NY Times and Wall Street Journal had

reported in Thursday's print editions that “Yellen Signals Fed on Track to

Raise Rates.”

Indeed, the CME

Fed Watch Tool now indicates a 79.1% probability of a rate hike at the

December FOMC meeting, up from 71.7% last month. Note that rates have been at zero for an

unprecedented seven full years. An

excellent study of the Fed's experience with very low interest rates is here.

The November payroll increase

was widespread, with a solid 46,000 rise in construction and healthy gains in a

wide array of services totaling 197,000.

Employment increased by 244,000, while the number of unemployed workers

edged up by 29,000. There were also

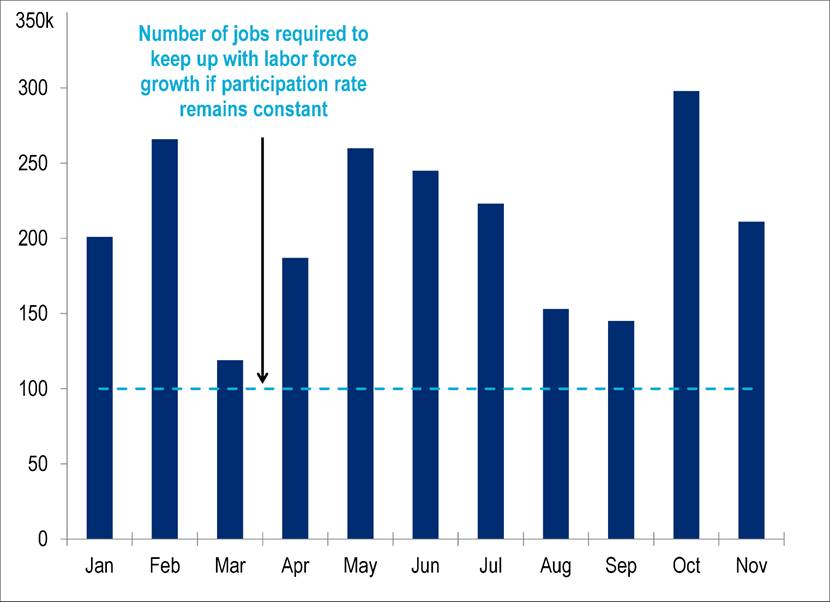

upward job number revisions for previous months totaling 35,000. Since the last FOMC meeting in November, the

two intervening employment reports averaged 255,000 as shown in the graph

below.

Chart Courtesy of Citi

Investment Research

Employment gains are

averaging 210,000 month thus far this year.

That's down from 260,000 last year, but the two year trend seems strong

enough to convince the Fed that the labor market can withstand a 25 bps

increase in short term interest rates.

In addition, average hourly earnings rose 2.3% from a year earlier in

November and are up 2.6% from January to November. That's the strongest cumulative growth since

the Labor Department began tracking data in 2009. The Fed likes to see wage gains above 2%,

because it's their current inflation target (which hasn't been met for several

years).

On the downside, there were

594,000 discouraged workers in November, which was little changed from a year

earlier. (The data are not seasonally adjusted.) Discouraged workers are

persons not currently looking for work because they believe no jobs are

available for them. The labor participation rate was up a tad, but little

changed at 62.5%. The employment-population

ratio was unchanged at 59.3% and has shown little movement since October 2014.

John Williams Analysis -

Not So Sanguine:

In a Saturday note to shadowstats.com

subscribers, Mr. Williams wrote:

- Fourth-Quarter

Real Trade Deficit on Track for Worst Showing

- Since

Third-Quarter 2007, Suggestive of Hit to GDP

- Year-to-Year

Payroll Growth Dropped to 18-Month Low

- Employment

Gain Was All in Part-Time for Economic Reasons;

- Full-Time

Employment Was up by just 3,000

- Broader

November 2015 Unemployment Rates Increased: U.3 held at 5.0%;

- U.6

and ShadowStats Respectively Notched Higher to 9.9% and 22.9%

- Construction

Spending “Surge” Was in Rising Inflation, Not in Physical Activity

- Broad

Annual Money Supply Growth Fell to 5.2% from 5.5%

- Rate

Hike Is Far from Certain: Fed’s Primary Concerns Center on

- Risks

of Severe Systemic Instabilities not on Lack of Economic Recovery

“Nothing in the Latest Economic Reporting Supports a

Rate Hike, but the Economy Is not the Fed’s Primary Concern. The latest round

of domestic economic news was not happy—suggestive of a deepening ―new

recession—despite some headlines to the contrary in the popular media. On the

labor front, the seasonally-adjusted November payroll gain of 211,000 was

stronger than consensus, but it suffered the regular upside reporting biases

and consistency issues seen with this series. That left the headline detail as

a positive number for financial-media consumption, as an excuse for the Fed

finally to tighten at its December 15th to 16th FOMC meeting, but otherwise it

was of little actual significance.

More meaningfully, unadjusted

year-to-year growth in payrolls softened to an eighteen-month low. The

narrowly-defined, headline unemployment rate U.3 held at its

―post-recession‖ low of 5.0%, as expected. That also was

misleading, where the broader U.6 and ShadowStats measures notched

higher, to 9.9% and 22.9%, respectively. The headline 5.0% rate reflected more

employed and unemployed, but with no jobs growth in full-time employment. All

the employment gain was in part-time employment for economic reasons, with

people seeking full-time jobs having to settle for available part-time work. Separately, Fed Chair Janet Yellen’s favorite

indicator of labor market health—the Labor Force Participation Rate—showed no

meaningful movement, holding near its all-time low.”

Financial Times - ‘No

limit’ to ECB action, vows Draghi:

From a page 1 article in this

weekend's FT (on-line subscription required):

Mario

Draghi has said there is no limit to how far the European Central Bank (ECB)

will go to hit its targets in a sharp response to market criticism that his

latest stimulus package did not go far enough.

The ECB pledged on Thursday to continue its €60bn-a-month bond buying

quantitative easing plan until March 2017 and cut a key interest rate to a

record low of minus 0.3 per cent. But those measures disappointed investors

that have come to rely on Mr. Draghi to exceed expectations. There was a

broad market sell-off after the ECB failed to deliver deeper cuts and an

increase in the pace of QE. (See Victor's Comments below).

In

an attempt to reassure markets that the ECB has more firepower should inflation

remain low, Mr. Draghi said in New York that the central bank had “the power to

act, the determination to act and the commitment to act. There cannot be any

limit to how far we are willing to deploy our instruments, within our mandate,

and to achieve our mandate.”

Mr.

Draghi added there was “no doubt that if we had to intensify the use of our

instruments to ensure we achieve our price stability mandate, then we

would.” The ECB President acknowledged

that the package was “not a revolution” but was “exactly the right one.” He

added: “It was not meant to address market expectations, it was meant to

address our objectives for inflation.”

Draghi

indicated that the markets had failed to appreciate the importance of the

decision to reinvest the proceeds of the ECB’s €1.36tn bond purchases it plans

to make under its quantitative easing program. This, he said, would provide an

extra €680bn in liquidity to the euro-zone economy by 2019. There was “no

specific limit” for the size of the ECB’s balance sheet, which is likely to

exceed the size of the Federal Reserve’s as a portion of gross domestic product

under the measures announced by Euro-zone policymakers yesterday.

Victor's Comments:

A

Fed Funds rate increase should have been done many years ago, because zero rates

and QE were said to be "emergency" measures to prevent a

depression. Like morphine used to stop

the temporary pain of a war wounded victim, it has turned the Fed into a "ZIRP/QE

addict." The Fed's reckless

monetary policy will cause serious negative consequences that are not

understood yet by so-called “economists.”

The

real result of this outrageous policy gamble is that it did not work!

U.S. real GDP grew at a historical record low of 2.1% from June 2009, or the

official end of the recession, to date.

Yet the Fed balance sheet is now $4.5 trillion while Gross debt has

nearly doubled. Will the Fed attempt QE4

if the economy weakens after the presumed December rate hike?

It is my view that the Fed cannot do QE4, because they own

too much of the outstanding U.S. government bond market. So more QE would make

the bond market illiquid and cause another big problem.

With this ultra-Keynesian (Frankenstein) policy of

ZIRP+QE [and in Japan +QQE which

includes buying other assets aside from bonds, such as stocks] it becomes a

habit and this can only lead to hyperinflation, as I've discussed in previous

Curmudgeon posts.

More

importantly, the ECB did less than expected to keep the EU economy growing. ECB

President Mario Draghi only cut the bank deposit rate 10 bps from a -20 bps to

-30bps. In the short run, this is a

foreboding signal and disappointed the markets.

Why? Because the effective

additional TAX on European savers (via negative interest rates) was only was 10

bps! This was seen as not enough to make savers spend their money to buy goods

and services and thereby increase economic growth.

Draghi

only extended ECB QE till early 2017, while he did not add to its scope. The

market result was the Euro was up 400 bps against the U.S. dollar. That's the biggest move +/- which I can

ever remember in a single day! Also, U.S. bonds were down 400 bps, and

global equity markets were down various percentage points depending on the

index. All that because "expectations"

were less than wished for! One wonders how the markets will react when the central

bankers really "blunder".

Today,

governments think they can control money (and markets). Yet history is very clear that it can't work

in the long run! The assumption that paper is money is accepted by those who

WISH it to be so, but that is a fallacy.

For example, in the first sentence of the U.S. Chamber of Commerce

pamphlet series on "The American Competitive Enterprise Economy"

states: "Money is what the government says it is."

Source: Economic Research Department, Chamber of Commerce of the

United States, The Mystery of Money (Washington, DC.:

Chamber of Commerce, 1953), p. 1.

In

response, Murray N. Rothbard wrote on

May 23, 2015:

“It is almost universally believed

that money, at least, cannot be free; that it must be controlled, regulated,

manipulated, and created by government. Aside from the more strictly economic

criticisms that I will have of this view, we should keep in mind that money, in

any market economy advanced beyond the stage of primitive barter, is the nerve

center of the economic system. If, therefore, the state is able to gain

unquestioned control over the unit of all accounts, the state will then be in a

position to dominate the entire economic system, and the whole society. It will

also be able to add quietly and effectively to its own wealth and to the wealth

of its favorite groups, and without incurring the wrath that taxes often

invoke. The state has understood this lesson since the kings of old began

repeatedly to debase the coinage.”

The

attitude to keep paper money (fiat currency not backed by gold) is evidently

quite widespread. From a December 2,

2015 NY Times print article titled “A

Dollar Fixed in Gold" by Binyamin Appelbaum:

In 2012, the University of Chicago asked

40 leading economists whether a gold standard would improve the lives of

average Americans. All 40 said no.

“You can do a lot better than a

gold standard,” said Michael Bordo, an economist and

director of the Center for Monetary and Financial History at Rutgers

University. He described the political interest in the precious metal as

“pretty crazy.”

The gold standard was invented to

constrain government spending. Nations that agreed to exchange money for gold

thought twice before printing more money.

The

purpose of the gold standard was to create a "long-term" stable

economic and political system. It was

never intended to "prevent" the normal business cycle.

Victor's Conclusion:

This is the game since 1933 till another financial

"BLUNDER" arrives. Moreover, this is about the government having

power, not about liberty for "we the people." IMHO, it will never change unless there's a

crash of the financial system caused by too much paper money.

Late Update - Yet Another BIS

Warning to its Global Central Bank Clients:

Central

banks must not let market volatility halt their plans to retreat from

crisis-fighting monetary policies, the Bank for International Settlements (BIS

or the bank for central banks) has warned ahead of the expected first rate rise

by the US Federal Reserve in nine years.

The BIS has long believed that what it describes as “unthinkably” low

interest rates are fueling instability in global financial markets. They've issued warnings over the years which

central banks have totally ignored. Here's

one we wrote about in

September 2014.

BIS

views its clients’ aggressive monetary policies as a source of instability for

inflating and blowing up credit bubbles in financial markets. While asset

prices have surged, economic conditions — notably inflation — remain weak

across advanced economies. Claudio Borio, head of the BIS’s monetary and economic department

told the FT that the gyrations following the ECB’s announcement of more

monetary easing this week showed “markets remain unusually sensitive to central

banks’ every word and deed.” Amen!

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).