The

Rise of New Tech Companies: Unicorns, FANGs, and the Nifty Nine

by the Curmudgeon

Introduction:

The

last several years have seen the rise of a “new” information economy based on services,

mobile apps, social networking, e-commerce, and cloud computing or

storage. The “old” IT driven economy,

based on engineering design, development and manufacturing, has effectively

been outsourced to Asia (China and Taiwan Original Development Manufacturers

(ODMs) and smart phone/tablet vendors).

Here's

proof: considering

that Apple makes all of its smart phones (and tablets) in China, 8 of the top 9

smart phone vendors are in China or South Korea. Microsoft, which acquired Nokia's phone division

in 2014 is the only non-Asian vendor in the top 10.

Both

the private and public equity markets have stupendously driven up the values of

“new tech” companies, creating huge mega-bubbles that have inflated to extremes

that rival the dot com boom (and subsequent bust). We examine both private and public “new

tech” in this post.

Unicorns: Sky High Valuations vs Exit Price?

Business

Insider reports

that the number of private tech companies

valued at $1 billion or more (so called “unicorns”) has surged so much

this year that on average 1.3 unicorn companies have been created every week in

2015. In spite of Silicon Valley

insiders' fears of a tech bubble, that number doesn't seem to be

declining. The number of new unicorns doubled

in the 3rd quarter of 2015 compared to the same quarter last

year. There were seven new U.S. unicorns

and three new Asian ones in Q3-2015.

CB Insights provides a real time list. There are now 144 unicorns, which have a

cumulative valuation of $505B.

However,

all is not wine and roses in unicorn land.

As noted in a previous Curmudgeon post, a Financial Times article

titled “Unicorns face end of the ‘steroid

era’”, said that Silicon Valley unicorn valuations may be seen as ‘marketing

numbers’ in the face of the reality of an IPO.

CB

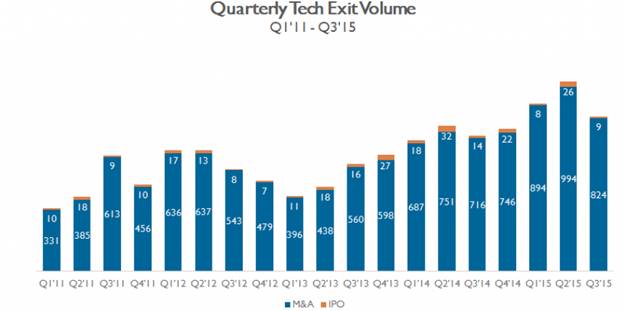

Insights recently released a global

tech exits report

for Q3-2015, which tracks M&A and IPO activity among tech companies. Q3 saw

a slowdown and one of the first quarters in a long time with no billion dollar

exits. Corporate M&A clients say that Silicon Valley valuations for tech

companies have them slowing down while they wait for things to come back to

reality. In Q3'15 exits declined 18%

quarter-over-quarter to 833 M&A and IPO exits. There were only 9 IPOs in Q3’15,

including 5 IPOs outside the US, including IPOs in Singapore, Japan, and New

Zealand.

Chart Courtesy of CB Insights

As a wave of tech companies prepare to launch IPOs over the next two years,

these headline valuations are starting to intersect with reality — a process

likely to be both painful and disappointing.

Today’s “tech” bubble may not burst violently, like the dot com boom in

2000. But many observers expect that headline valuations, along with private

share prices, will deflate over the next 18 months.

This

week, the Economist weighed

in with the following:

“Valuations

for private technology firms are rising at a slower clip than they were six

months ago. On November 24th Jet, an e-commerce competitor to Amazon, announced

that it had raised $350m (valuing the firm at $1.5 billion), a big sum for a

loss-making startup, but a lower one than it had first hoped for. Airbnb, a

fast-growing room-rental firm, recently raised $100m, but reportedly stayed at

its recent valuation of $25 billion, instead of rising further. Fred Giuffrida of Horsley Bridge, a firm that invests in

private-equity funds, reckons that the valuations in late-stage rounds of

financing have declined by around 25% in the past six to eight months. These

rounds are also taking slightly longer to complete.

In

the last quarter several mutual funds, including Fidelity, have marked down the

value of some of their unicorn holdings in unlisted tech firms. Fidelity wrote

down Dropbox, a cloud-storage firm, by 20%; Snapchat, a messaging app, by 25%;

and Zenefits (software) and MongoDB (data bases) by

around 50% each.

Many

investors in unicorns had bet that a new generation of technology firms would

unsettle the old guard, but that has not happened as quickly as they had

predicted. Tech giants like Amazon, Google and Facebook (see section on FANGs

below) have continued to grow impressively, especially considering their

already large size; and they have been adept at entering new markets that

start-ups might otherwise have claimed. For example, Facebook has bought and

built messaging apps that compete with Snapchat, and Dropbox has a rival in

Amazon, whose cloud computing and storage business (Amazon Web Services or AWS)

is large and growing quickly.

With

investors, until recently, throwing money at them, the unicorns have got into

the habit of burning through their cash in an attempt to buy market share.

Lyft, a taxi-hailing firm that is a rival of Uber, reportedly suffered losses

of nearly $130m in the first half of this year, on less than $50m in revenue. Instacart, a food-delivery firm, is rumored to lose around

$10 on each order it fulfills. Such practices are only likely to stop when the

funding for these firms dries up, or investors whip them into shape.”

The

tech industry’s herd of unicorns contains many that look very similar to each

other, and/or to longer-established firms (e.g. Jet vs Amazon). Yet many are

being valued -in as much as the valuations are believable - as if they were

guaranteed to be among the long-term winners in their line of business. In

fact, not all can survive. Weaker firms have been able to keep going because

money has been so easy to raise1.

Their spendthrift ways have made it harder for stronger rivals to

control their own costs and make a decent profit.

Note

1. In an April 16th interview

with the New York Times, Slack CEO Scott Butterfield said: “This is the best time to raise money ever.

It might be the best time for any kind of business in any industry to raise

money for all of history, like since the time of the ancient Egyptians. It’s

certainly the best time for late-stage start-ups to raise money from venture

capitalists since this dynamic has been around.”

What

most observers seem to have missed is that there are much fewer exits. 2015 tech

IPOs as a percentage of all IPOs have been the lowest level in seven

years. Also, high flyers like Zynga,

Box, GoPro and Twitter are all trading below their IPO price of one or more

years ago!

A

recent example of a down round exit was mobile payment darling Square (SQ),

which had to price its recent IPO much lower than late stage private equity

investors paid. The stock popped 45% on

its first day of trading November 19th to close at $13.07. However, that was its high close to date

(Friday's close was $12.05).

It

seems that raising money to obtain a billion plus dollar private equity

valuation (i.e. becoming a unicorn) and exiting or remaining at the same or

higher valuation (via IPO or acquisition) are two very different things.

FANGS

and Nifty Nine vs. Nifty Fifty (1970s) and Four Horsemen of the Internet (late

1990s):

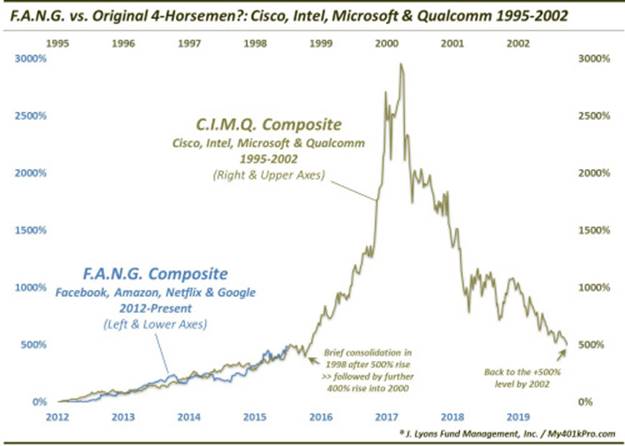

John

Authers weekend FT column (on-line

subscription required) called attention to the FANG stocks - Facebook,

Amazon, Netflix and Google – while Ned Davis refers to a Nifty Nine (Note that

Apple isn't included). If made into

indexes, research by the FT statistics group shows that either group of stocks

would have gained about 60 per cent this year.

“The

success of the FANGs is a symptom of the rise of a new (information) model for

the economy that revolves around services rather than manufacturing. But it is

best not to get carried away. All these companies are richly valued (Ned Davis

puts the Nifty Nine’s collective price/earnings ratio at 45, double that of the

S&P 500). They also look expensive when compared with their sales.

Hype

and excitement around a few big companies, and eclipse for riskier small

companies, are classic symptoms of the top of a bull market. For comparison,

look at the “Nifty Fifty” companies of the early 1970s, or the first wave of

web companies during the dot com boom of the late 1990s — when it was

fashionable to talk of a new economic paradigm.” That's illustrated in the chart below:

Chart courtesy of the

Financial Times

In a Zero

Hedge Post titled: “Diversification

Is For Dummies - The Nifty Nine Never Mattered More,”

“From the 4-horsemen of the

dot com exuberance (and apocalypse), to today's so-called FANG and NOSH stocks,

and now 'Nifty Nine', investors could be forgiven for ignoring the benefits of

stock market diversification that every commission-taking, fee-gathering

asset-collector promotes and going all-in on a few 'easy to select' stocks to make

the quick buck that everyone believes is their right as an American taxpayer.

While the S&P languishes unchanged in 2015, these small groups of

overwhelmingly propagandized stocks are up on average over 60%, but with a

collective P/E of 45, they are not cheap….”

The exuberant upside of the

FANGs or Nifty Nines is always obvious after the matter, as shown by the chart

below:

Conclusions:

The Curmudgeon has been

watching the U.S. stock market for over 53 years- since July 1962. We have never seen such a total disconnect from

reality than today's “new tech” unicorns and mega-cap tech stocks [the FANGs +

LinkedIn, Apple, Microsoft (via its Azure cloud computing services)].

What very few realize is that they're all about

software (web + mobile apps) and information services, rather than real

engineering technology. Yes, Apple does

the industrial design of its iPhone and iPad in the U.S., but they outsource

the detailed engineering design and manufacturing to several Chinese companies. That was first disclosed

in 2012, but few paid attention.

While Amazon, Google,

Facebook, Netflix, LinkedIn, et al are all viable “new tech” companies, they

are much overvalued compared to the rest of the stock market.

As for the “new tech”

unicorns, we predict that 80% or more will be wiped out in the next five years

causing use damage to the VC's, hedge and mutual funds that were looking to

make big money “investing” in them. Most

depend on advertising to monetize their services, but advertising dries up in a

severe recession. You read it here

first!

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development platform,

which is used to create innovative solutions for different futures markets,

risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).