China

Government Agencies Bought Stock While Regulator Cracks Down on Brokerages

by the Curmudgeon with Victor Sperandeo

Introduction:

Victor has written extensively that

China's stock market had been rising earlier this year, even as its economy was

tanking. He also noted that the IMF's

rumored decision to include the Yuan/Renminbi in its Special Drawing Rights

(SDR) basket of currencies1 propped up global stock markets this

September as more money would be going into Yuan/Renminbi denominated equities.

Note 1. The IMF executive board is expected to make its

decision on November 30th.

The Renminbi will be included in the new SDR basket of currencies on

October 1, 2016, joining the dollar, euro, yen and pound sterling.

However, there's another reason for

the 28% rally in China's Shanghai Composite stock market off the late August

lows. It was Chinese government

financial entities buying equities to prop up China's stock markets.

China’s ‘National Team’ in Action:

On August 27th,

Bloomberg reported “China

Intervened Today to Shore Up Stocks Ahead of Military

Parade.” The article stated that “China’s government

resumed its intervention in the stock market on Thursday and has been cutting

holdings of U.S. Treasuries this month to support the yuan, according to people

familiar with the matter. Authorities want to stabilize equities before a

September 3rd military parade

celebrating the 70th anniversary of the World War II victory over Japan, said

two of the people, who asked not to be identified because the move wasn’t

publicly announced.”

According to an analysis

by Goldman Sachs, China has spent $236 billion (1.5

trillion Yuan) on its stock market bailout.

The numbers underscore the high cost of Beijing's efforts to prop up

stocks - a response that has been panned by some critics as unnecessary and

counterproductive.

Now, the details of the China

government's stock buying campaign have been revealed for the first time. The November 27th Financial Times (FT) – on line subscription required – reports that “a group of Chinese state-owned financial

institutions owns at least 6 per cent of the mainland stock market as a result

of the massive Beijing-sponsored rescue effort this year to prop up share

prices following the summer equity market crash.”

· China Securities

Finance Corp (CSF), the main conduit for the injection of

government funds, owned 742 different stocks at the end of September, up from

two at the end of June. The market value

of CSF’s holdings increased from only Rmb 692m

($108m) at the end of June to Rmb 616bn three months

later.

· Central Huijin Investment, the holding

company for shares in state-owned financial groups and a subsidiary of China’s

sovereign wealth fund, also bought shares.

The market value of Central Huijin's holdings

fell by Rmb 167bn in the third quarter to Rmb 2tn, mostly reflecting mark-to-market losses on shares

it previously held. That decrease in market value came despite Huijin’s additional share purchases in the period.

CSF and Central Huijin

were the largest of a number of government rescue funds that were ordered to

buy shares when China's stock markets went into a nosedive over the

summer. The Shanghai Composite index

fell more than 40 per cent from its seven-year high on June 12 to its late

August low.

These two state financial

institutions that led the bailout increased their ownership of the Shanghai and

Shenzhen exchanges from 4.6 per cent of total tradeable A-share market

capitalization at the end of June to 5.6 per cent three months later, according

to Wind Info (a financial data

services company in China).

The FT said “the figures were

compiled from the quarterly statements of listed companies, which are required

to disclose their 10 largest shareholders.

The actual size of national team holdings is probably larger, given some

probably hold stakes that are too small to rank in the top 10.”

In a November 26th

article, International

Business Times reports

that “China Stock Market

Regulator Is Investigating Country’s Largest Stockbrokers For

Irregularities.” The article states that there were

injections of hundreds of billions of dollars to prop up China's stock market

this summer.

“The government intervention in

China’s mainland capital markets appears to have worked, at least for now: The

Shanghai Stock Exchange Composite Index has risen more than 25 percent since

mid-August.”

The FT article noted that the

significant role of the China national team in propping up the domestic stock

market has raised concerns about the sustainability of the recent share rally

and about what would happen to the market if the government unwound its

holdings. The IMF has urged Beijing to

quickly unwind its massive state intervention to support falling share prices,

and warned

that the true risk would come from slowing reform.

The Chinese securities regulator

(see Late Update below) this week rescinded a ban on stock sales by brokers'

proprietary trading units, according to leaked documents published by local

media. The brokerage industry association said the group of 21 would not sell

their holdings until the Shanghai Composite reached 4,500. It closed at 3,648

on Wednesday.

Fundamentals also indicate that

China's recent stock market rally may not be justified. Earnings at Chinese

A-share companies fell 16% annually in the 3rd quarter, including a

37% drop for non-financial companies, the worst quarter since 2010, according

to Credit Suisse.

However, that's also true for the

U.S. stock market where corporate earnings have fallen for two consecutive

quarters and are not likely to recover in the current quarter, as the Wall

Street Journal and numerous other publications have pointed out recently.

Victor's Closing Comments:

One must never forget China is a

communist country. Although they have

had to mix some capitalism into communism in order to feed 1.4 billion people

they control virtually everything. As

all communist countries have shown, this type of controlled social system

always fails. The USSR is the greatest example of failure. For the reasons why

-please read "The Road to Serfdom” by Friedrich Hayek or "Human

Action," by Ludwig von Mises.

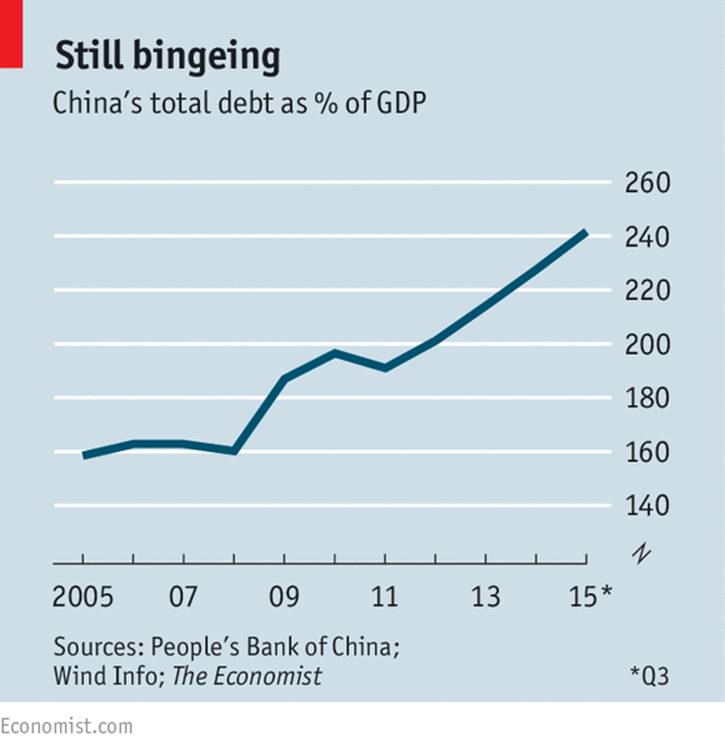

Also, China's DEBT IS MASSIVE, according

to The Economist magazine.

"This means that China's

overall debt-to-GDP ratio is continuing its steady upward march (see chart

below). Debt was about 160% of annual output in 2007. Now, China's debt ratio

stands at more than 240%, or 161 trillion yuan ($25 trillion).”

Forbes magazine says it's higher! As of May 5th 2015, China's debt to GDP ratio was 280%, according to Forbes.

However, China's actual debt and debt

to GDP ratio is really unknown, because China's economic numbers can't be

trusted by professionals who don't believe them to be accurate.

This is the scary part of China having

a hard landing recession. Like most of the world, huge debt and zero or very

low interest rates create a potential “end of days” like scenario when interest

rates rise (as they usually do during a real economic expansion).

This is why owning stocks to help keep markets up is a no win game in the long run, but makes governments feel good in the short run.

Like all "games" that

governments play they can't control all events. The most common surprise reason

interest rates rise is war. Like the

recent Turkey shoot (no pun intended) of a Russian fighter jet that briefly

flew over Turkey's air space.

Accidents and unknown problems can

and do occur. As the old saying goes,

when manipulators try to artificially prop up stocks and then want to sell, the

question is always to who? Will everyone

find a chair when the music stops?

Late Update: China stocks fall sharply on regulatory

crackdown

The Shanghai Composite index

dropped 5.5% on Friday, November 27th, marking its biggest drop

since August. The rise in the Shanghai

Composite Index since late August along with Friday's sharp decline is

illustrated in the chart below, courtesy of Big Charts.com:

Late on Thursday, it was announced

that China's securities regulator was investigating the country's largest

brokerage, Citic Securities. The firm is being probed over the possible

breaking of market rules. Rival

brokerage Guosen Securities is also being investigated, and shares in both

Citic and Guosen fell by 10%, the maximum allowed in one day. In addition, trading in China Haitong Securities shares was halted and later in the day

the firm also confirmed it was under investigation.

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974

bear market), became an SEC Registered Investment Advisor in 1995, and received

the Chartered Financial Analyst designation from AIMR (now CFA Institute) in

1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).