Feds

Market Manipulation and Related Thoughts

by Victor Sperandeo with the Curmudgeon

Disclosure: The views and opinions expressed herein are

those of Victor Sperandeo and Michael E. Lewitt, Editor of The Credit Strategist.

The Fed & Stock Market 2012 to 2015:

On July 11, 2012, Zero Hedge

posted an article about the Fed's HUGE influence on the equity markets. It was titled: "Chart

of the year -- The Fed has Doubled the S&P Admits Fed.

Here's an excerpt:

Prepare to have your minds

blown courtesy of what is easily the most astounding chart we have seen in a

long, long time, prepared by the economists at the, drum roll, New York Fed,

which finds that absent what the Fed calls "Pre-FOMC Announcement

Drift," or the move in the S&P in the 24 hours preceding FOMC

announcements, the S&P 500 would be at or below 600 points, compared to its

current level over 1300. The reason for the divergence: the combined impact of

cumulative returns of in the S&P on days before, of, and after FOMC

announcements

We show that since 1994, more

than 80 percent of the equity premium on U.S. stocks has been earned over the

twenty-four hours preceding scheduled Federal Open Market Committee (FOMC)

announcements (which occur only eight times a year)a phenomenon we call the

pre-FOMC announcement drift.

Well that 80% equity premium

is now 94%! An update of the above concept is titled: "What Hath

the Fed Wrought."

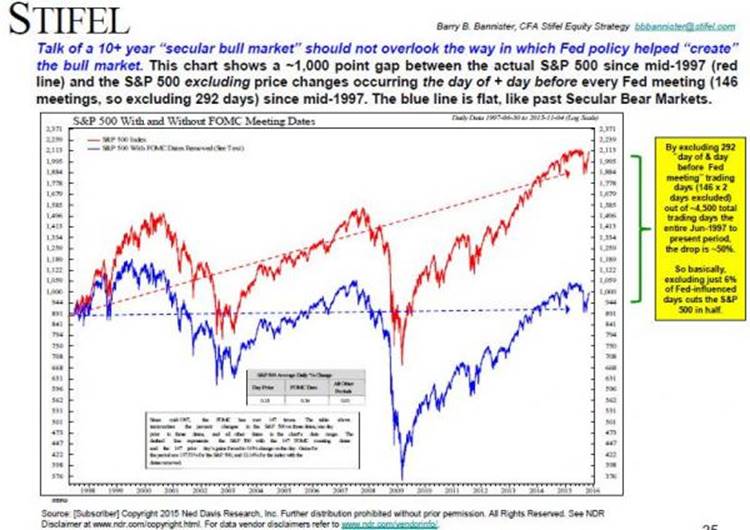

The above chart implies that

~1,000 points of the actual S&P 500 price level came from the day of and

the day before each of the FOMC meetings since mid-1997!

Absent the performance on

FOMC days, the stock market has gone nowhere in 17 years. If you're a believer

in capitalism and free markets, you sit back and think about that statistic for

a moment and ask yourself - 'have I really made any money without The Fed?'

Put another way, Fed talk

+ unknown stock buying actions have doubled the S&P 500 from 1000 to

2000. That

proves to me that the Fed directly manipulates the S&P both by words (what

is seen), but also what is -not seen -buying stocks after the fact of their

meetings.

[The same principle was

applied to the Gold price from the top in 2011.

The result was a (43%) actual decline turned into an (18%) decline when

you subtract FOMC meeting days.]

Santiago Capital's Brent

Johnson warns "never underestimate the power of The Fed" but in the

long-run this is unsustainable as while The Fed has consistently forecast,

promised, guaranteed that economic green shoots are showing up, they have been

horribly wrong... and with December's meeting looming, their credibility is

running on fumes.

A Recent Example of Fed Manipulation:

The latest egregious example

of the Feds market manipulation was on 11/19/15...The stock market was up

about 9 S&P points just before the October Fed meeting minutes were

released. After the minutes revealed the

Fed would likely raise rates at their December meeting the S&P spiked 12 more

points! That implies that raising rates

is bullish for stocks. But previously it was bearish?

I think it was Fed buying

stock futures and/or ETFs (directly or through surrogates) to give confidence

to market participants that what they are going to do is not only OK, but

bullish for stocks!

The same thing happened when

the Fed announced

the end of QE3 while saying that it was not worried about global economic

weakness, low inflation or a decline in the stock market.

This type of bogus and hyped

Fed talk seems to be a hook to get more buyers into stocks. Let's look at the evidence:

· The FOMC has said 2015 would be a time to consider a

gradual increase in the Fed Funds rate from ZIRP (0-25 bps) to 25-to-50 bps.

· The FOMC did not move on rates as expected at their

September meeting citing "global factors."

· At their October meeting, the FOMC removed the key

sentence citing global factors.

· The market based probabilities of a near term end to

ZIRP have increased to almost a sure-thing.

The CME

Fed Watch Tool assigns a 73.6%

probability of a 25 bps rate hike at the December FOMC meeting.

[That's subject to change, of

course, based on new economic data or

Janet Yellen being told to back off by Obama at their weekly meetings via the

Secretary of the Treasury].

Sidebar: The

Credit Strategist, Nov 15, 2015 by Michael E. Lewitt

It would be unusual for the

Fed to raise rates with the manufacturing ISM hovering barely above 50, but

these are unusual times and this Fed is unusually incompetent. In 2011, when the ISM hit 50 the Fed launched

QE 3 and when it hit 50 again in 2012 the Fed launched QE 4. The Fed says it is data dependent but it

doesnt know how to interpret the data on which it depends. It confuses

structural employment trends with cyclical ones and is the only group of people

in the country that doesnt realize that the prices of everyday goods and

services are rising sharply (with the exception of energy-related items). It also hasnt figured out that low interest

rates retard rather than stimulate economic growth because it doesnt

understand the first thing about human nature or behavioral economics (and its

Chair is married to one of the foremost behavioral economists in the world!).

The fact that inflation

expectations are so low is not a sign that investors believe that the prices of

goods and services are rising slowly or threatening to fall; rather, it is a

sign that the world is threatened with a

massive debt deflation caused by the accumulation of too much debt that can

never be repaid except through currency devaluation, massive inflation or

default. The Federal Reserve is, as

I called them last month, a confederacy of dunces empowered to destroy the

world. The only reason it gets away with

it is that very few people even understand what it does, starting with the

dunderheads in Congress.

..

Central Banks Rule Global Financial

Markets & Economies:

Four central bankers (along

with the Japanese Prime Minister) are now primarily controlling the global

financial markets and world economy.

They are: Janet Yellen (US), Mark Carney (UK), Haruhiko Kuroda along

with Prime Minister Shinzō Abe-(Japan), and

Mario Draghi (EU).

A world famous derivatives

expert named "Satyajit Das" or

"Das" for short (whom I know) recently wrote a provocative article

titled: "Central

Bank Lunacy-$26 Trillion Of Government Bonds Now Trading Below 1%."

"In Japan, for example,

interest rates have been around zero for almost a decade. The Bank of Japan has

undertaken nine rounds of QE. The central banks balance sheet is approaching

70% of GDP. It owns a significant proportion of the outstanding stock of

government bonds and equities. But the policies have not restored growth."

Let me stress that 70% of

GDP on the central banks balance sheet, coupled with a "stated" debt

to GDP ratio of 2.30:1.00 (it's higher)

makes Japan officially bankrupt. Japan is a dead nation, but still breathing.

Germany and the EU are

following Japans lead. Germany is

selling 2 year debt at -40 bps, while EU Central Bank President Mario

Draghi wants more QE for the EU!

That won't work, as it didn't

in Japan which is in yet another

recession despite Abenomics.

Conclusions:

So what will happen to the

global economy? For a lesson in economic

destruction, please consider the following:

In 1919, John Maynard Keynes,

later an advisor to Franklin D. Roosevelt, wrote

in his book The Economic Consequences of

Peace:

Lenin is to have declared

that the best way to destroy the capitalist system was to debauch the currency

By a continuing process of inflation, governments can confiscate secretly and

unobserved, an important part of the wealth of their citizens

As the

inflation proceeds and the real value of the currency fluctuates wildly from

month to month, all permanent relations between debtors and creditors, which

form the ultimate foundation of capitalism, become so utterly disordered as to

be almost meaningless

These men were truly knowledgeable in their

observations of how the world works.

Good luck and till next

time...

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative (non-correlated)

investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).