What

Caused the Stock Market Rally While Earnings and GDP are Declining?

by Victor Sperandeo with the Curmudgeon

Disclaimer:

As usual, all opinions

expressed herein are those of Victor Sperandeo.

The Curmudgeon has added some additional data on S&P 500 earnings

decreasing while DJI market price to book value rising along with new estimates

of lower GDP and increasing odds of a recession. Also noted is a huge injection of liquidity

into the banking system via Fed reverse repos and the possible spillover into

the stock market via the Fed’s dealer banks.

Just the Facts Please:

The S&P 500 has been up

in 8 of the last 9 trading days. The

rally began on 9/29/15 and has pushed the S&P above the 2000 level, which

it last reached (intraday) on September 17th (after the Fed stated it would not raise rates 25

bps, as some expected).

The spark that ignited the

rally was thought to be the jobs report for September, released on 10/2/15,

which was viewed by most as terrible. That caused virtually every Fed watcher to

assume that there would not be a Fed Funds increase at FOMC meetings in October

or December. Interestingly enough, the

market was down sharply in the morning, but made a spectacular reversal to

close up strongly that day. The momentum

has carried through to the week ending 10/9/15.

The implication of no Fed rate

hike1, implies the U.S. would go into 2016 (an election year) with 7

full years of ZIRP (zero interest rate policy) and beginning the 8th year of government

and corporate America getting the (obnoxious) benefit of zero rates, while

savers got a compounded 1.89% (CPI), less than 0.1% on “high yield savings”

accounts, no cost of living increase in next year’s social security checks, and

a big DECLINE in their purchasing power.

[Fed Chairwoman Janet Yellen actually has criticized the growth of

"Income Inequality," but claimed the Fed had nothing to do with

it. Really?]

Note 1. The CME Fed Watch Tool http://www.cmegroup.com/trading/interest-rates/countdown-to-fomc.html

predicts only an 8% probability of a Fed 25 bps rate rise in October and a 34%

probability in December (the final two Fed meetings of 2016).

Victor - Possible Reason for the Rally:

The continued zero interest

rate policy is associated with the poor jobs report. Since the rally started on 9/29/15 we must ask

if the bad jobs report was discounted, or was there another "reason"

behind the new rally?

To address this question, we

point to a Financial Times article

(on-line subscription required) from 9/28/15 titled: China’s

renminbi creeps closer to global reserve status, by Shawn Donnan:

“The International Monetary

Fund is creeping closer to including China’s renminbi in an elite basket of

reserve currencies, with the US and other major shareholders likely to back the

move unless IMF staff make a surprise recommendation against inclusion.

But remaining technical

hurdles, concerns over Beijing’s heavy-handed intervention in markets and poor

communication of reforms such as the changes to its foreign exchange regime

that set off a bout of turmoil in global financial markets last month, are

causing nervousness within the IMF.”

On August 19th,

the beginning of the equity market decline, the WSJ reported: IMF

Defers Decision on Adding Yuan to Basket of Reserve Currencies:

"The IMF signaled

China's yuan won't be added to its influential basket of reserve currencies for

at least A YEAR." (Emphasis added). This must be the new Common Core math

as "a year" now means 40 days?

China’s President Xi Jinping recently

visited Washington, DC and met with President Obama. Could they have made some sort

of deal with Obama sponsoring China for IMF reserve currency status if and only

if China promises not to hack US Government employees for information anymore?

Victor’s Opinion:

In my humble opinion, China's

reserve currency status is the "primary" reason for the stock market

decline and subsequent rally. Just match

the moves with the dates.

In a previous Curmudgeon post, I

expressed my opinion on why the market declined in mid - August: “China not getting IMF reserve currency

status (widely reported on August 19th) caused stock markets around the world

to decline after China's market plunged.

The contagion spread very rapidly.” It follows that if the Renminbi were to get

IMF reserve status that would definitely boost global stock markets.

Curmudgeon - Another Possible Catalyst for a Stock

Market Rally:

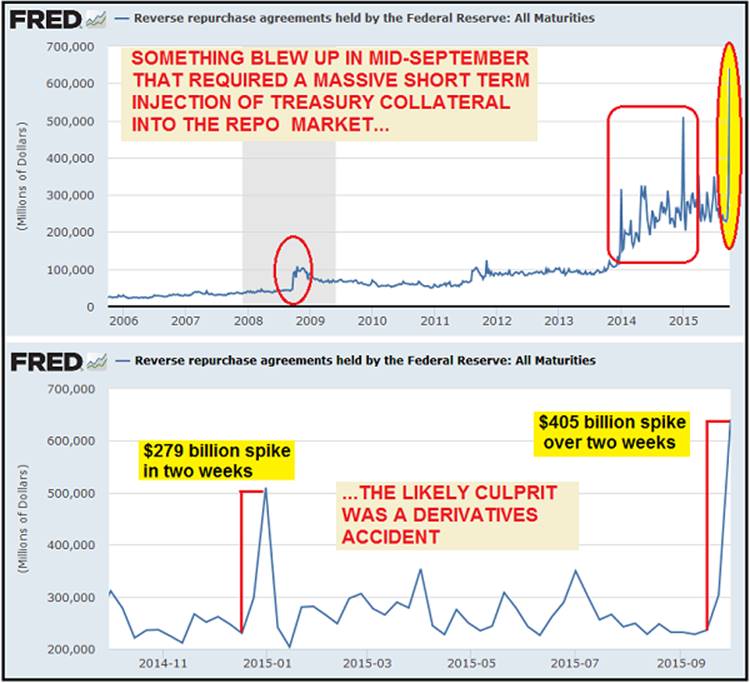

An October 6th

Investment Research Dynamics article titled: A

Liquidity Crisis Hit the Banking System In September states that the Fed

engineered a massive reverse repo2

operation in order to force the largest ever Treasury collateral injection into

the repo market.

Note 2. A reverse repurchase

agreement, also called a “reverse repo” or “RRP,” is an open market

operation in which the NY Fed Open Market Trading Desk sells a security to an

eligible RRP counterparty with an agreement to repurchase that same security at

a specified price at a specific time in the future.

The article states: “What’s even more interesting is that the spike-up in

reverse repos occurred at the same time – September 16 – that the stock market

embarked on an 8-day cliff dive, with the S&P 500 falling 6% in that time

period. You’ll note that this is around the

same time that a crash in Glencore stock and bonds began. It has been suggested by analysts that a

default on Glencore credit derivatives either by Glencore or by financial

entities using derivatives to bet against that event would be analogous to the

“Lehman moment” that triggered the 2008 collapse……..Without a doubt, the graphs

above are telling us that something “broke” in the banking system which

necessitated the biggest injection of Treasury collateral in history into the

global banking system by the Fed.”

Could that extra dose of liquidity have contributed to

the recent stock market rally? And did

the Fed’s dealer banks help keep it going?

What Does a Fed Rate Rise (after 7 years of ZIRP)

Really Mean? (Victor)

Meanwhile, a 25 bps increase

in rates off a zero base means nothing for the real economy, but it has a big

psychological effect on the markets. No

rate rise has boosted emerging market currencies, bond and stock markets. Indirectly, continued ZIRP likely helped the

U.S. stock market too. According to Barron’s,

the current S&P 500 P/E is 20.3 versus the year before P/E of 18.49. Also from Barron’s: the Market Price to Book

Value of the DJI is currently 3.13 vs 2.87 one year ago.

S&P Earnings are Declining (Curmudgeon):

· Again referring to the October 12th

Barron's, the 12 month trailing

earnings of the S&P 500 is $99.25 and the previous real 12 month earnings

were $103.11.

· Dennis Slothower’s

On the Money commentary said: “Analysts’ projected earnings for S&P 500

members dropped 6.9% for the third

quarter.”

· Meanwhile, Factset reports: “For Q3 2015, the blended earnings decline is -5.5%. If the index reports a decline

in earnings for Q3, it will mark the first back-to-back quarters of earnings

declines since 2009.”

à UPSHOT: Real S&P earnings are DECLINING year over

year, while P/E's (and stock prices) are RISING!

GDP is also Declining, while Odds of a Recession Have

Increased (Curmudgeon):

The Federal Reserve Bank

of Atlanta publishes a weekly, "real-time" look at the

economy in their GDPNow economic forecast model for

real GDP growth (seasonally adjusted annual rate). As shown in the graph below, the model currently

forecasts a significantly weaker 3rd quarter GDP (only 1.0%) than even the most

bearish current consensus estimate.

On October 9th,

Bloomberg reported http://www.bloomberg.com/news/articles/2015-10-09/a-u-s-recession-just-got-a-little-more-likely that the

consensus recession probability estimates for the next 12 months rose to 15% -

the highest level in 2 years. The median

probability had held at 10% for 13 consecutive months, so the pop to 15% was a

50% increase in the probability of a recession in the coming year.

John Williams’ Shadowstats.com October 6th

commentary noted that a widening trade deficit would have a negative impact on

3rd quarter GDP. He

estimates “a negative trade-based contribution from the net-export account of

roughly 0.5% (-0.5%) to the "advance" estimate of the aggregate,

annualized real third-quarter 2015 GDP growth rate… Broad economic activity has entered a period

of renewed downturn, one that eventually should gain recognition as a

"new" recession.”

Does the Fed Realize the Stock Market is in a Bubble?

(Victor)

The undoing of fundamentals to prices is the definition

to a "bubble" which the Federal Reserve is 100% responsible for

creating and inflating.

More intriguing is the Feds

rhetoric on why rates weren't increased. In the October 9th NYT’s

article titled: Concerns About Weak Growth Abroad Influenced Fed's Decision Not to

Raise Rates, by Patricia Cohen: "Worries that inflation would continue to

lag because of weaker economic growth abroad, particularly in China (growth in

China has been declining for 2.25 years), helped nudge members of the Federal

Reserve to postpone dialing back on their stimulus campaign last month, according

to the official summary of a meeting released by the central bank on Thursday."

As mentioned, in the

previously referenced Curmudgeon post about a new Fed mandate for the China

Stock market, and now an additional (phantom) mandate on "growth"

overseas? Such propaganda words by the

Fed show they can say (make-up) anything they want on why it changes its guidance.

Does the Fed assume the world is a bunch of suckers

that believe this nonsense and its poor attempt at deception? The Fed is showing its lack of knowledge and

lack of independence here. It seems to

be influenced by politics, and this only means this group of bureaucrats are

extremely dangerous to believe in. A

group of people that have an answer for everything and predict nothing

correctly! This is government at its

worst.

In addition, the Fed talks too much. In so doing

confuses the market as its members like to feel powerful via their opinions. The greatest Fed Chairman, William McChesney Martin (1906-1998), who served under five

presidents (1951-1970) said: "You don't tell the markets anything. You

just implement policy — slowly and smoothly."

That was the communication

policy of late Fed Chairman William McChesney Martin

as recalled

by finance professor Lewis

Spellman of the University of Texas at

Austin.

"How the communications

policy of our Fed has changed, and not for the better. In one recent week

alone, more than 15 different Fed officials were making speeches on the economy

and monetary policy. The market is confused by all this talk. And why not?

Depending on which Fed official you hear, you get a different and often

conflicting message. What other major organization speaks through 15 different

spokespeople?"

For example, widely quoted NY

Fed President William C Dudley (x-Goldman Sachs executive) changes his mind

more often than a teenager changes who they have a crush on!

Victor’s Conclusions:

The market is watching the

now FECKLESS Fed when the financial markets are in bubble (dark) territory,

listening to worthless language that emotionally creates day to day (or minute

to minute?) trades. In lieu of anything

more from me, the reader should decide if this market is worth

"investing" or not?

Perhaps, the famous

words of George Orwell’s "1984" are appropriate: "Political

language... is designed to make lies sound truthful and murder respectable, and

to give an appearance of solidity to pure wind."

Good luck and till next time…

The

Curmudgeon

ajwdct@sbumail.com

Follow the

Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has

been involved in financial markets since 1968 (yes, he cut his teeth on the

1968-1974 bear market), became an SEC Registered Investment Advisor in 1995,

and received the Chartered Financial Analyst designation from AIMR (now CFA

Institute) in 1996. He managed hedged equity and alternative

(non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from

duplicating, copying, or reproducing article(s) written

by The Curmudgeon and Victor Sperandeo without providing the URL of the

original posted article(s).