Alternative

Strategies Have Failed – Part II. Liquid Alts

by the Curmudgeon

Executive Summary:

This is the second of a two part series on alternative strategies that are aimed at producing absolute returns which are not correlated with those of stocks or bonds. The first article on Hedge funds is here:

Bottom Line: We have concluded that very few types of “Liquid Alt” mutual funds are worth investing in. [One Long/Short equity fund candidate is described below.] The main reason is that with the exception of Bear Market funds, which decline when stock prices rise, there is no “downside capture” during a severe correction or bear market in global equities. Hence, you lose money (albeit less) when traditional asset classes are declining in price.

Liquid Alt fund expenses are less than hedge funds and the after tax returns are higher, but the expenses are still significantly greater than stock, bond or hybrid mutual funds. The investor MUST ask themselves if those expenses are justified when there is little or no downside protection in an age where almost all asset classes are highly correlated with global equities on the downside!

The recent proliferation of Liquid Alt mutual funds suggests that many are too new to have a track record which can be seriously evaluated. That makes it difficult to justify paying the high fees (especially for managed futures funds). Also, the trading strategies used, such as risk parity, can be quite difficult for even experienced investors to understand.

Among the sub categories of Liquid Alts we've examined:

-Long/ Short Equity (some funds also use options/derivatives)

-Hedged Equity (long positions are hedged with index puts)

-Convertible & Merger Arbitrage/Market Neutral

-Equity Market Neutral (~50% long & short but Beta of individual issues is often neglected)

-Multi-Alternative (multiple strategies)

-Global Macro (directional bets based on fundamentals)

-Multi-Currency (absolute return using currencies)

-Unconstrained/Non-Traditional Bond (go anywhere, including SHORT positions, swaps, and derivatives)

-Risk Parity (goal is equal returns with lower volatility)

-Volatility Plays (usually based on VIX index)

-Commodity (including risk controlled- long bias)

-Managed Futures (Long/Short with minimal leverage)

-Energy Limited Partnerships/MLPs (oil and gas; alternative energy)

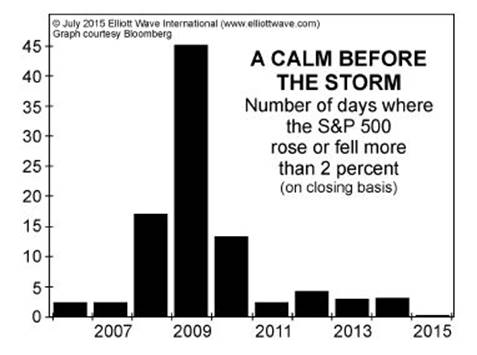

As we've indicated in recent posts, we expect stock market volatility to remain high- even after the Fed meeting next week. Here are two charts from Elliott Wave International that depict: 1] Eerily calm stock trading from 2011 till August 17, 2015, and 2] Spike in volatility in late August.

Chart Courtesy of Elliott Wave International

Chart Courtesy of Elliott Wave International

Wouldn't it be terrific to find alternative funds that could smooth out the expected increased volatility? Don't hold your breath!

Stress Test During Two Time Periods:

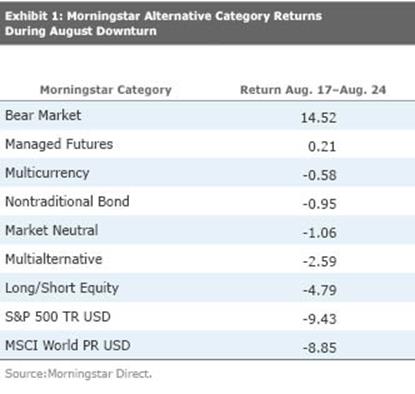

Morningstar reported (see reference below) that during the sharp down stock market period from Aug 17-24, 2015 only the Managed Futures category was positive with a miniscule 0.21 % return.

The biggest losses came in the long-short equity which lost 4.79% and the multi-alternative category which lost 2.79% (note that more than 90% of multi-alternative funds have negative total returns this year, according to Morningstar Category Returns).

Global-macro type funds struggled more than many of the other risk-aware strategies. For example, MFS Global Alternative Strategy (DVRAX) was down 4%, more than a percentage point lower than the category average.

The top-performing multi-alternative fund in the downdraft was multi-manager Absolute Strategies (ASFAX) with a +3.54% return. That reflected the bearish stance taken by the portfolio manager in recent times, as the fund's beta had drifted into negative territory. However, its YTD return through Sept 11th is only 0.56%, its 2 year annual return is -0.54%, and its 5 year annual return is only 2.61%. [The CURMUDGEON bought this fund of funds when it first came out in 2005, but has sold most shares over the years and is currently left with a very tiny position].

In an August 28th WSJ article titled: ‘Alternative’ Mutual Funds Providing Limited Protection, the authors noted that not even one alternative fund category had a positive total return from the May 21th S&P 500 top to August 25th. The Journal followed that up with a September 11th piece titled: Some ‘Alternative’ Funds Come Up Short which stated that many alternative funds didn't deliver decent returns which aren’t tied to those of stocks or bonds.

For example, funds that invest in a variety of commodities fell an average 7.5% a year over the past five years—and a steep 17.1% in the period when the S&P 500 fell 11.9% this year.

Over the five years through Sept 10, 2015, the average managed-futures fund returned only 1% a year, according to Morningstar. That compares with 14% for the S&P 500 and 3.4% for the average intermediate-term bond fund.

The average multi-alternative fund showed a 0.89

correlation to the S&P 500 in the past five years, according to

Morningstar. The high correlations

probably mean that many of these “alternative” funds have a fair amount of

exposure to equities or other strategies that have correlations to the

market. An example is event-driven

strategies, which invest in securities that may be affected by corporate

activity such as bankruptcies and mergers.

To the Curmudgeon, such a high correlation to the US stock market

totally defeats the purpose of this asset class! How can it be called a “multi-

alternative” when it has an 89% correlation to the S&P500?

“Too many advisers have started to get the idea that the alternative investments are ways to magically remove risk from a portfolio or to get them very low correlations with stock and bond returns,” said Liam Hurley, chief investment officer at Summit Financial Strategies Inc. in Columbus, Ohio. Mr. Hurley told the WSJ he's found it difficult to find long/short and multi-alternative funds that can overcome their high expenses to produce a “solid, dependable” return.

Long/Short Equity fund characteristics and COAGX:

1. Long/Short equity funds are expensive, with supposedly high fees for selecting short sales (plus dividends on short sales and 12b1 fees). Consider the Mainstay Marketfield fund. It has ~$ 4B in assets, but has a net expense ratio of 2.73% for its class A shares. Many L/S equity funds have even higher total expenses!

2. L/S equity funds are usually highly correlated to US equities, with an average “beta” of about 0.5, according to Morningstar. That means an investor would generally expect half of the magnitude of any stock-market index up or down movement.

-->However, a 0.5 beta could be achieved at a MUCH, MUCH

LOWER cost by putting ½ of one's stock market assets in stock market index

funds (like Vanguard's S&P 500 or Total Market Index) and the other ½ in

cash. You'd save ~2.5% per year in

expenses doing that vs putting 100% in the average Long/Short equity fund.

3. The Long /Short equity mutual fund space grew in popularity after the market crash in 2008 and subsequent suppression of interest rates. During the recent market downturn (from the May 21st S&P 500 top), many L/S equity funds have performed poorly, with average losses of -6% to -7%. This under performance is indicative of a lack of hedging and/or directional inflexibility within either the fund structure or management style. The portfolio managers embraced market risk (i.e. LONG STOCKS), which helped their performance during the bull market, but is a huge negative in a severe correction or bear market.

While any portfolio manager will have periods of

underperformance, it is notable that most L/S equity funds have not provided

the downside protection investors expected during the current stock market (and

all asset class) downturn.

4. The CURMUDGEON has been invested in Caldwell & Orkin Market Opportunity fund (COAGX) since 1997, based on the fund's flexible portfolio positioning, steady returns in bull and bear markets, and an excellent professional relationship with the firm's principal Michael Orkin, CFA.

Unfortunately, most Long/Short equity mutual funds really don't provide any protection during a severe correction or bear market, because they almost never position their portfolio to be net short. Some L/S equity funds use index puts and derivatives to provide downside protection, but often the derivative protection is negated on the downside by the beta of their longs. COAGX is a different breed, because they do actually go net short during sharply declining markets.

Here are COAGX % total returns during recent bear market years vs the and NASDAQ, respectively:

COAGX S&P 500 NASDAQ

|

2000 |

26.67 |

-9.10 |

-39.28 |

|

2001 |

-3.81

|

-11.93 |

-21.04 |

|

2002 |

2.97 |

-22.06 |

-31.52 |

|

2008 |

-4.66 |

-37.00 |

-40.54 |

|

2015* |

6.82 |

-4.75 |

1.82 |

*YTD through Sept 11, 2015

Note that COAGX may badly lag other L/S funds in strong bull market years like 2009 and 2013, but it's the end result over a full bull/bear market cycle that really counts!

Complete COAGX annual performance table vs S&P and NASDAQ is here.

We thank the Caldwell and Orkin portfolio managers for the information they've provided and suggest readers check out their website which has a lot of useful information, including conference call transcripts.

References & Suggested Reading:

http://www.wsj.com/articles/some-alternative-funds-come-up-short-1441995044

http://www.iijournals.com/doi/full/10.3905/jwm.2015.18.2.035

http://abcnews.go.com/Business/wireStory/hedge-funds-masses-stress-test-33672065

http://news.morningstar.com/articlenet/article.aspx?id=713266

http://www.wsj.com/articles/alternative-mutual-funds-providing-limited-protection-1440525717

http://www.wsj.com/articles/the-success-and-dangers-of-liquid-alternative-mutual-funds-1428375823

http://advisor.morningstar.com/uploaded/pdf/Alt_Long-ShortEquity.pdf

http://www.investmentnews.com/article/20150825/FREE/150829950/liquid-alts-funds-pass-first-real-test-with-flying-colors (CURMUDGEON DISAGREES!)

Postscript from last Curmudgeon: ETFs on Trial:

Tim Quast, President of ModernIR - a big data/analytics market analysis firm - emailed the CURMUDGEON his very illuminating experience confirming the lack of liquidity in ETFs:

“Great piece,

Curmudgeon and Victor. On Aug 24th,

my inbox was flooded with about 1,500 volatility halts, most in ETFs. I’d

delete 200 and before they cleared, another 200 would arrive. I sent a note to

a Bloomberg reporter asking, “Are you seeing this? Ask the NYSE what the heck’s

going on.”

They told him there

were 1,300 volatility halts, a thousand of them in ETFs. ETFs are heavily borrowed – volumes are

routinely well over 50% short (that is, the liquidity is effectively provided

on credit). Things dependent on credit

fare poorly in crises. How do you redeem

ETF units when they’re borrowed? To

wit: right now 49% of all daily equity

volume is short – borrowed. There is

NO liquidity for moving big positions.

A 100 bps spread between owned and borrowed liquidity is a very fragile

condition, indeed.

Every bit of this is

true and provable. I still have all those volatility halts. I estimated it was

more – nearer 1,700. But the exchange would know the exact number.”

That's scary! Will the next bear market result in a new movie, “ETF Nightmare on Wall Street?”

Till next time….

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a historian,

economist and financial innovator who has re-invented himself and the companies

he's owned (since 1971) to profit in the ever changing and arcane world of

markets, economies and government policies.

Victor started his Wall Street career in 1966 and began trading for a

living in 1968. As President and CEO of Alpha Financial Technologies LLC,

Sperandeo oversees the firm's research and development platform, which is used

to create innovative solutions for different futures markets, risk parameters and

other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).