Has

the Business Cycle Been Repealed? Mysterious Market Action with PPT Missing!

by the Curmudgeon

Business Cycle vs Phony Economic Expansion:

Financial and commodity markets have been acting as if the

business cycle has been repealed. Six +

years into an economic expansion:

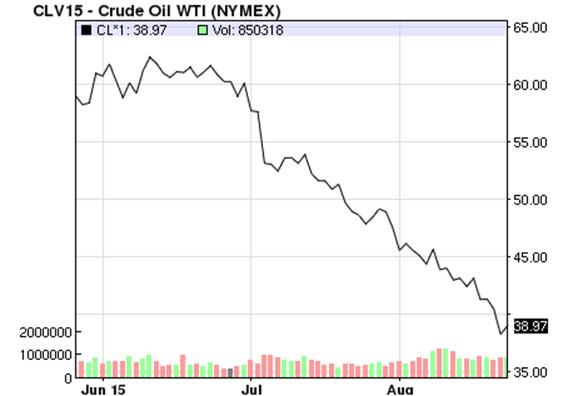

- Commodities and interest rates

should be rising (yet both are declining with commodities at a 16 year low

and oil closing well below $40/barrel today – see chart below).

- Inflation and wages should be

accelerating (not limping along at <2% annual growth),

- Industrial materials and

transportation stocks should be doing well (but have been declining all

year).

- Emerging market stocks and bonds

should be strong (not collapsing), as they tend to experience the fastest

economic growth in a “real” expansion.

- Real corporate earnings should be

growing rapidly (they were down in 2nd quarter and John

Williams of Shadowstats.com forecasts real earnings to be “on track for a

decline in the 3rd quarter”).

Our conclusion is that the entire “economic recovery/expansion”

has been a fake and that the US economy has been much weaker than government

issued GDP reports. It's been more like

a rolling over recovery/stagnation with virtually no real economic growth. John Williams has been saying that for years!

We also believe that Federal Reserve monetary policy

since 2009 has been counter-productive for US economic growth. On that later point, please refer to a white paper or

“essay” by

St Louis Fed Vice President Stephen D. Williamson, who finds fault with three

key Fed policies:

- Zero interest rates (ZIRP) in

place since fall of 2008 that were designed to spark inflation and growth

have actually resulted in just the opposite.

- The "forward guidance"

the Fed has used to communicate its intentions has instead been a muddle

of broken vows that has served only to confuse institutional investors.

- Quantitative Easing (QE) - the

monthly debt purchases that swelled the central bank's balance sheet past

the $4.5 trillion mark - have at best a tenuous link to actual economic

improvements.

"With the nominal interest rate at zero for a long

period of time, inflation is low, and the central banker reasons that

maintaining ZIRP will eventually increase the inflation rate. But this never

happens and, as long as the central banker adheres to a sufficiently aggressive

Taylor rule, ZIRP will continue forever, and the central bank will fall short

of its inflation target indefinitely. This idea seems to fit nicely with the

recent observed behavior of the world's central banks." Williamson wrote

on page 10 of his “essay.”

Strange Market Action Today:

Today's inter-market movements today were confounding. The Euro and Yen rallied sharply against the US $, probably due to expectations that there won't be a Fed rate hike this year and that carry trades were being unwound. Fine and logical. But why then did T notes and bonds rally, gold declined modestly, while crude oil collapsed to a six year low of $38.24 per barrel? Oil's sharp 3 month decline is illustrated in the chart below:

Nothing happened in the oil market in the last 24 hours to

trigger oil's sharp fall today (not even Monday's decline in China's stock

market). Oil has fallen by a third in

the past month and a half, with the price of crude tumbling some 7% in the last

five days alone. The only explanation is

that markets are convinced that global deflation is here and will persist

for a long time!

We were NOT surprised by today's global stock market

sell-off, which was a continuation of last week's drubbing. It's hard to believe that the S&P 500 high

print last Tuesday was 2,103.47 (just 5 trading days ago it was only 1% off its

all-time closing high). Yet, the S&P

closed today at 1,893.21 with an intra-day low of 1,867.01. That's quite a sharp drop in the last week,

especially considering its tight trading range (2120-2040) for many

months.

Disclaimer:

the Curmudgeon has a small short position in the S&P 500 via a

managed futures fund AND an inverse index mutual fund. He had a MUCH, MUCH large short position in

an inverse NASDAQ 100 fund before being stopped out twice after it made a new all-time

high last month.

PPTs Missing in Action?

This brings us to why the CURMUDGEON and many other

professionals have been reluctant to take big short positions in US stocks,

ETFs, futures, or via inverse index ETFs/mutual funds. We had been expecting massive buy side

intervention by any one of the following:

Fed dealer banks, investment banks, the Fed itself, foreign central

banks, and last but not least - the Plunge Protection Team (PPT). In fact, we were expecting such phantom

buying on Friday as well as today. Not

one round, but many!

Last Friday morning, Charles Hugh Smith called for the Plunge

Protection Teams of the World to Unite!

Smith

wrote: “Once

the trap-door opens, there is no bottom without prompt action by the world's Plunge Protection Teams--the

plausible-deniability action heroes of the hyper-speculative status quo who

leap into action when global stock markets threaten to melt down.”

We

thought the world's PTTs would be buying big time today (Monday), after last

week's sharp selloff followed by China's biggest 1 day stock market decline in

eight years today. The question

remains:

Why weren't the PPTs and

global central banks buying stock index futures and index ETFs today? Anecdotal evidence suggests they've done so

many times since Oct 3, 2011!

If anyone has a hint, please email the CURMUDGEON.

Till next time…

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).