Are

Americans Now Slaves of Their Banks?

by Victor Sperandeo with the Curmudgeon

Introduction and Disclaimer:

Unknown to almost all Americans, there's a proposal (which

some say could be effected now) that would wipe out customer demand

deposits/savings in a failed, “systematically important” U.S. bank that is

believed to be FDIC insured.

This research paper reviews the bailouts during the last

financial crisis (which were later reported to be MUCH larger than initially

thought), the Dodd-Frank law, and a concept called “bail-in” that was

first implemented in Cyprus in 2013. We

site many references the reader may consult for further investigation of our

main points. As usual, we close with a

historical quote that is extremely relevant today.

The opinions expressed herein, are those of Victor

Sperandeo.

Brief History of the Post Lehman Financial Bailout:

In September, 2008 the U.S. government decided to let Lehman

Brothers fail, just six months after they saved Bear Stearns (via a JP

Morgan arranged take-over that was guaranteed by the Fed). This caused a

cascading set of events that created a heart attack (crash) for many financial

institutions and companies around the world, especially big global banks.

After meeting several times, Congress then voted a program

into law called TARP or "Troubled Asset Relief Program," in an

attempt to prevent a very severe recession from turning into a depression. $700 billion went to bailout banks and

other financial institutions that were big losers of the Lehman bankruptcy.

The Fed also lent huge amounts of money to banks and financial

institutions, but the actual amounts were not disclosed at the time. They were later!

On December 1, 2010, CNN

reported that The Federal Reserve made $9 trillion in

overnight loans to major banks and Wall Street firms during the financial crisis. The loans were made through a special loan

program set up by the Fed in the wake of the Bear Stearns collapse in March

2008 to keep the nation's bond markets trading normally.

That HUGE amount of cash pumped out to the financial giants

was not previously disclosed. All the loans were backed by collateral and all

were paid back with a very low interest rate to the Fed -- an annual rate from

0.5% to 3.5% (nominal interest rates were much higher in Sept 2008 than in the

last few years of ZIRP).

Senator Bernie Sanders, who authored the provision of the

financial reform law that required the Fed's 2010 disclosure, said at the time:

"The $700 billion Wall Street bailout turned out to be

pocket change compared to trillions and trillions of dollars in near zero

interest loans and other financial arrangements that the Federal Reserve doled

out to every major financial institution."

But there was much more to the Fed's largesse than

that! Forbes

reported on September 20, 2011 that The Fed's $16 Trillion

Bailouts Were Under-Reported.

“The media’s inscrutable brush-off of the Government

Accounting Office’s recently released audit of the Federal Reserve has raised

many questions about the Fed’s goings-on since the financial crisis began in

2008. The audit of the Fed’s emergency lending programs was scarcely reported

by mainstream media – albeit the results are undoubtedly newsworthy.”

“The findings of the first ever Fed audit verified that over

$16 trillion was allocated to corporations and banks internationally,

purportedly for “financial assistance” during and after the 2008 fiscal

crisis."

Yet the Fed, meanwhile, does not want any audits? Note that “the affaire” the Fed has with

"the banks" may be a conflict of interest, as the Fed is owned by

Private Corporations (e.g. Federal Reserve Banks and shareholders who

remain secret).

This led to the passing of the "Dodd-Frank

Wall Street Reform and Consumer Protection Act” on July 21,

2010. It was sold as stopping the

government from bailing out the banks.

The concept called "too big to fail" was the theme

of the law. It was used like "hope

and change" - as a slogan to hook the public into a belief that the

government would never again (hope) bail out Wall Street banks which

would finally be accountable. The law's

authors claimed there was not enough regulation (and that had to change).

Dodd-Frank suggested that if a bank fails it would be nationalized

and allowed to go bankrupt with FDIC protection, up to $250,000 per

account. The top management would be

fired or even jailed if there was proof of wrong doing. All that's now changed!

Dodd-Frank Exposed:

This now leads us to what- Dodd-Frank (AKA the "Dodd

Frankenstein" law) really is and what it is not.

First, it has NOTHING to do with ending "too big to

fail." What the law has become

is so "off the wall "that it's hard to believe! I have only met two business people (of

many dozens I talked to each day) who have heard of the new law that covers too

big to fail banks. More on that later in this article.

Second, the Dodd Frank law is bigger than any other law,

according to a report

by the Mercatus Centerwhich,

which states:

"Dodd-Frank's 27,669 rules are five times more than any

other law and more than the total number of new regulations 'for all other laws

passed during the Obama administration put together."

I think the law (which is still constantly being written and

added to) is not a "BAIL-OUT," but will actually morph into a "BAIL-IN.”

In a recent blog post, John Manning provides the

rationale:

“The FDIC has only approximately $25 billion in its

deposit-insurance fund, which is forced by law to maintain a balance equivalent

to only 1.15 percent of insured deposits. The Dodd-Frank Act (Section 716) now

bans taxpayer bailouts of most speculative derivatives activities. Drawing on

the FDIC’s credit line with the Treasury to cover a bulge-bracket bank’s derivatives

losses would be equivalent to a taxpayer bailout, which the FDIC’s member banks

cannot afford to service. Many EU and US banks threaten to wipe out federal

deposit-insurance funds, and this risk is driving the impetus for these “bail-in”

policies and rules, which places the burden on the institutions’ unsecured

creditors, including depositors, instead of taxpayers.”

Now the REALLY BIG NEWS:

In an August 27, 2014 blog post titled: Big

Banks Getting Ready to Plunder Customers, Bob Allen wrote:

“The big banks are putting the finishing touches on their

plan to rip off their own depositors to cover their stupidity, instead of

taxpayers." How nice!

The gist of the article is that if your bank goes bankrupt,

you may not (immediately or ever) get your money back, even though you've been

led to believe it's federally insured!

“What this means is that, when your bank goes belly up, they

will steal your deposits to cover the loss and give you a bond—partial

ownership of an income stream from the bank. What happens in many cases is that

the value of the bond plummets as the true extent of the bank's failure is

revealed. So you simply end up owning a worthless piece of paper instead of

having money in your account.”

Fed Vice-Chairman Stanley Fischer talked about this

topic during an August 11, 2014 speech in Stockholm Sweden. A transcript of

Fischer's Stockholm speech was posted that day on the Fed's

website.

Mr. Fischer spoke about the steps that have been taken

internationally in order to “strengthen the financial system” and to reduce the

“probability of future financial crisis,” Fischer said that the U.S. was

preparing proposals for bank bail-ins for “systemically important banks.”

Under a section of his speech titled “The Post-Crisis

Regulatory and Supervisory Environment” he said:

“Additional steps have been taken in some countries. For example, in the United

States, capital ratios and liquidity buffers at the largest banks are up

considerably, and their reliance on short-term wholesale funding has declined

considerably. Work on the use of the resolution mechanisms set out in the Dodd-Frank

Act, based on the principle of a single point of entry--though less

advanced than the work on capital and liquidity ratios--holds the promise of

making it possible to resolve banks in difficulty at no direct cost to

the taxpayer.

As part of this approach, the United States is preparing a proposal

to require systemically important banks to issue bail-inable long-term debt that will enable insolvent banks

to recapitalize themselves in resolution without calling on government funding--this

cushion is known as a "gone concern" buffer.”

Under the proposed bail-in scenario, the failure of a “systematically

important bank” will receive no government funding to stay afloat. In order to

keep their doors open, a “too big to fail” bank will ask their ‘loyal

depositors’ to help out by taking whatever percentage of the depositors’

money they need to stabilize the bank in exchange for an IOU.

Bail-In's: A

Proposal or Implementable Now?

While Fischer described it as a “proposal,” Federal Deposit

Insurance Corporation (FDIC) and Bank of England officials have said that bail-in legislation could be used today, according to

GoldCore in a Zero Hedge blog post.

GoldCore wrote in that same Zero Hedge blog

post: “The U.S. already has in place

plans for bail-ins in the event of banks failing. Indeed, the U.S. has

conducted simulation exercises with the U.K. in 2013 and again this year...The

Bank of England’s Tucker, who has worked with U.S. regulators on the

cross-border hurdles to taking down an international bank said that “U.S.

authorities could do it today -- and I mean today.”

Our research reveals that Dodd-Frank

Title II - Orderly Liquidation Authority specifies

guidelines for Federal authorities to address financial distress at companies

that could have a significant impact on U.S. financial stability. Many scenarios are described.

The FDIC, in conjunction with

the Treasury Secretary, will implement policies, procedures and mechanisms to

PREVENT U.S. taxpayer bailouts of “too large to fail” banks. However, the SPECIFIC PROCEDURES are not

stated in Title II (see References).

That being the case, what will the “Federal authorities” do in the

event of a big bank failure?

Comment and Analysis:

It's important to understand that if one large money center

bank fails, they all fail (as per Lehman's September 2008 failure effected so

many large financial institutions all over the world). The contagion is almost instantaneous, such

that government officials must act very quickly to prevent cascading bank

failures.

Here's the sequence of events in the new proposed plan:

1- A big bank folds (perhaps as a result of derivatives

blowing up);

2- It takes the depositors and savers money as capital the

next day;

3- In exchange for deposits, bank customers get Gone

Concern Loss Absorption Capacity (GLAC) bonds. That's what Fischer calls

the “Gone Concern Buffer.”

Bottom Line: The taxpayer will

not be bailing out the “too big to fail” bank(s). Neither will the bank(s) or the U.S. federal

government. Instead, the bank customers

(depositors and savers) are ON THE HOOK TO THE BANKS!

Corroboration/References:

For those who are skeptical and don't believe what I've

written (with the Curmudgeon's help!!!), here are a few references for

you to research:

The Bail-In : How you and your money will be parted during the next banking crises, by San Diego Free Press

Yes, Feds

Can Take Your Deposits, by Jerome R, Corsi

(Global trend sparked by Cyprus' confiscation of accounts balances)

Why Bail-In ? And How! by Joseph

H Sommer, assistant VP and COUNCIL at the New York

Federal Reserve Bank

Banking:

Rebuilding the System Through a Bail-in Policy?

by John Manning

(Dodd-Frank)

Title II Overview: Orderly Liquidation Authority (many hotlinks to important

documents),

Title II of

Dodd-Frank establishes an "Orderly Liquidation Authority

Are

Your Savings Safe From Bail-Ins? Zero

Hedge

New

G20 Rules: Cyprus-style Bail-ins to Hit Depositors AND Pensioners

Chapter

E: The US versus EU resolution regime (see item 4 on Global loss-absorbing

capital (GLAC)), by BBVA Research

2014

Symposium on Building the Financial System of the Twenty- First Century: An

Agenda for Europe and the United States, Symposium report

PROTECTING

YOUR SAVINGS IN THE COMING BAIL-IN ERA Report (requires name and email address to

download)

Conclusions:

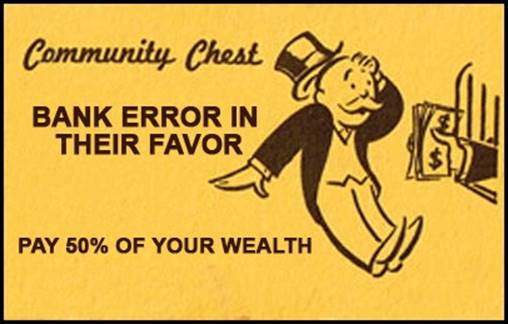

Almost no one knows that the banks, who for the last 6.66

years have paid zero interest on deposits, may now legally be able to

confiscate or seize all the wealth held in trust if they fail. Depositors are forced to accept an IOU. This seizure stands until the banks wish to

repay you with real money instead of “monopoly game paper” called GLAC bonds!

This begs the question: Why do we have money in a bank? Is it for safety and convenience? If so,

consider that virtually all the capital in big banks are now ipso facto “up for

grabs,” based on the mistakes that banks and the U.S. government may make in

the future.

One can argue that from 1776 to Dec.16th 1933

(the founding of the FDIC), that when you put your money in a bank it was at

risk. True, but the people were aware of that risk, and took precautions.

How many people know about this proposed law? One of two people I found who knew this law

existed said: "But they won't execute it." Really? Why is it now law

around the world then?

I strongly suggest you all take steps to protect

yourself. [Please contact your banker

or financial advisor, as neither I nor the Curmudgeon provide financial

advice.]

In closing, ponder the words of one of the U.S. founding

fathers- Thomas Jefferson, who was one of the greatest thinkers and leaders in

history. Jefferson warned

the nation to beware of the power of the banks:

“I believe that banking institutions are more dangerous to

our liberties than standing armies,” Jefferson wrote. "If the American

people ever allow private banks (i.e. THE FED today) to control the issue of

their currency, first by inflation, then by deflation, the banks and

corporations that will grow up around them will deprive the people of all

property until their children wake up homeless on the continent their Fathers

conquered."

“The issuing power of currency shall be taken from the banks

and restored to the people, to whom it properly belongs.”

Written over 200 years ago, there is some concern

over the authenticity of the above quote.

That really doesn't matter, because it's truer today than

ever before!

Good luck and till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).