Downward

Revisions to GDP Show Economic Stagnation, Not Recovery

by the Curmudgeon

Summary of U.S. GDP & Related Economic Reports:

As widely expected, U.S. 2nd quarter GDP increased by 2.3% annualized, according to Thursday's BEA “advanced estimate” report. That was marginally shy of Wall Street forecasts of 2.5 % annual growth in the quarter. The "second" estimate for the 2nd quarter, based on more complete data, will be released on August 27, 2015. In the 1st quarter, real GDP increased 0.6 % (revised up from -0.2 %).

- The 2nd quarter GDP rebound was led by a revival in consumer spending (+2.9% annualized) and exports. Consumer spending was bolstered by goods, especially car purchases.

- Exports rose at a 5.3% annualized rate, outpacing growth in imports of 3.5% and thereby ensuring net trade gains made a positive contribution to GDP, despite the strong U.S. dollar. The rise in exports produced the first positive contribution from net exports in two quarters.

- Residential investment continued to expand at a sprightly pace and spending by state and local government increased by 2% annualized rate after declining ~ 1% in the 1st quarter.

- The advance in overall GDP was capped by a decline in Federal government spending, and continued weakness in nonresidential investment in structures and computers investment. Both defense and nondefense Federal government outlays were down in the quarter.

- The drop in nonresidential investment in structures was less pronounced after the oil price shock caused a massive pullback in energy sector investment in the 1st quarter.

- Inventories cut 0.1% annualized from the headline number.

- The price index for personal spending rising at a 2.2% pace in the second quarter. Core prices were up 1.8%.

- Wages and salaries for U.S. workers rose by the smallest amount for a quarter since 1982. The labor department reported on Friday a scant 0.2 rise in employment costs vs. 0.6% expected by Wall Street economists.

BEA Revisions to Previous Years Numbers:

The far more interesting BEA notes were in the revisions over the 2011-2015 period that revealed a slightly slower pace of real GDP growth, but a somewhat faster pace of underlying inflation. It suggests that the U.S. has had an even more sluggish recovery than previously reported.

The BEA's historical revisions revealed that real GDP and GDI (Gross Domestic Income) were both lower over the 2011 to 1Q 2015 period. By implication, U.S. productivity (the life blood of standard of living) is also lower than earlier assessments.

- From 2011 to 2014, real GDP increased at an average annual rate of 2.0 %. In the previously published estimates, real GDP had increased at an average annual rate of 2.3%.

- From the 4th quarter of 2011 to the 1st quarter of 2015, real GDP increased at an average annual rate of 2.0 % - down 0.2 % from previously published estimates.

- The percent change in real GDP was revised down 0.1 percentage point for 2012, down 0.7 percentage point for 2013, and unrevised for 2014.

The two biggest areas contributing to the overall revision down were consumer spending, where average annual growth was revised lower by two-tenths of a per cent to 2.3 % over the period, and government spending, which fell 0.9 % and is now down 1.6 %.

The graph below, courtesy of Shadowstats.com, illustrates the previously reported GDP numbers along with the revisions.

Explanation from John Williams: “The primary downside revisions were in 2012 and 2013, where better information was available. Even with re-acceleration seen in first and second-quarter 2015 growth (likely downside revisions in the next year or two), the new second-quarter level didn't catch up with where the pre-revision, contracting first-quarter was last month.”

The core PCE deflator over the 2011 to 2015 period was

revised upward by an average of 0.1%. While the 2nd quarter reading

was 1.2% year-over-year, the average rate of inflation over the 2012 to 2014

span was still notably higher. The pace in 2012 to 2014 was closer to 1.5%

year-over-year, instead of the pre-revision pace of 1.3% previously reported.

Comparison to Past Economic Recoveries:

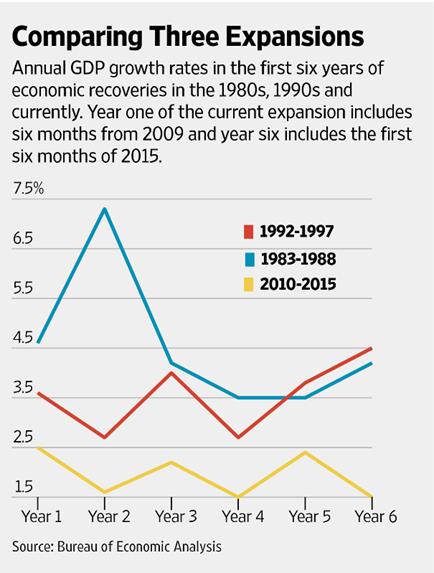

The graph below (courtesy of the WSJ) compares this expansion to the growth periods in the 1980s and 1990s, showing what might have been. Real GDP growth averaged 4.6% in the first six years of the Reagan expansion, and more than 3.6% a year in the first six years of the George H.W. Bush-Bill Clinton expansion (gaining speed after that). Had the current expansion been as robust as the average expansion since 1960, GDP would be some $1.89 trillion larger today, according to Congress’s Joint Economic Committee.

Chart courtesy of the Wall Street Journal

Strong or Weak U.S. Economy?

1. Cheerleaders:

“The improving jobs market, alongside the boon to households from low inflation and falling oil prices, has been key to the economy’s ability to sustain strong growth,” said Chris Williamson, an economist at Markit. “The new data, and the first quarter revisions in particular, remove a worrying sense of doubt about the health of the economy.”

“The economy seems to be gathering momentum," said Scott Hoyt, senior director of consumer economics at Moody's Analytics...Wage growth should accelerate as the labor market improves, giving workers more money to spend. Happier consumers with more income should generate more spending," he added.

“The economy is back this morning, better than ever, having fully shaken off those cold winter weather blues at the start of the year….Don’t like 2.3%, not good enough? Well, think again, it is the consumer that is in the driver’s seat always, and they continue to spend at an even faster rate of 2.9%. In short, there is nothing in today’s report that keeps the Fed from raising rates the first time in September. Nothing at all. The economy is stronger than you think. Bet on it.” –Chris Rupkey, MUFG Union Bank

2. Realists:

“The first 23 quarters of the recovery to the first quarter of 2015 now show 2.1% annual growth instead of 2.2%, said Jim O’Sullivan of High Frequency Economics. “The pace of growth remains extremely weak by past recovery standards, but it appears to be sufficient to keep unemployment coming down,” he added.

“Business investment contracted 0.6% [quarter over quarter], reflecting a 4.1% drop in equipment investment and a 1.6% [quarter over quarter] fall in structures investment…Today’s GDP report, including its revisions, will give the Federal Open Market Committee more confidence that the soft-patch in the first quarter was less significant than previously thought. The story on the economy remains consistent: strong consumption, weak investment. We are looking for this trend to continue in the second half of the year where we anticipate growth accelerating above 3.0%.” –U.S. Economics Team, BNP Paribas.

Jeffery P. Snider of Alhambra Partners wrote a blog post titled: Stealth Recession? The GDP Benchmark Revisions Show 5-Quarters Of 1% Growth

“The downward trajectory is significant in its own right through just compounding, as lower growth leads to, yet again, a smaller economy than what was thought....The new updates including the 2012 Economic Census are for an average of just 1.09%; more than a year of GDP growth at about 1%, which is how far from a mild recession?

Friday WSJ staff editorial titled: The Six-Year Slough:

New GDP revisions show the worst recovery in 70 years was even weaker.

“From 2011 through 2014, the economy grew at a paltry annual rate of 2%, down from the previous estimate of 2.3%. This means the overall U.S. economy is smaller—with GDP slashed by $105 billion in 2013 and $71 billion in 2014 to $17.35 trillion.”

ShadowStats' John Williams wrote:

“Again, the GDP does not reflect properly or accurately the changes to the

underlying fundamentals that drive the economy, at present. Fundamental,

real-world economic activity shows that the broad economy began to turn down in

2006 and 2007, plunged into 2009, entered a protracted period of stagnation

thereafter—never recovering—and then began to turn down anew in recent

quarters.”

More from John Williams: “With headline detail for GDP coming out of the 2018 comprehensive revision likely to show an economic collapse into 2008 and 2009, starting to recover in 2009 but turning down again in 2011, 2012 and 2014, from the perspective of history, such a pattern likely would be viewed as something along the lines of a protracted, multiple-dip economic collapse, not an ongoing economic recovery from 2009 to date.”

Victor's Comments:

Why? That is the question everyone seems to be asking as to the cause of the worst GDP growth rates since the great depression. Keynes is dead and so is "Keynesian Theory." In this case it has completely failed.

Debt has doubled, the Fed balance sheet has increased 5.6X's {$800 billion to $4.5 Trillion} while short term interest rates have been at zero for going on 7 years. This is uncanny and surreal based on this amount of "stimulus" the Fed created. As a result of monetary stimulus alone, one would think the U.S. economy should be booming 6+ years into an economic expansion.

The typical answer, as to why the economy is not booming was mentioned recently by economist Robert J Samuelson in an op-ed in the July 30, 2015 Investors Business Daily titled: "An Exploration of the World's Economic Funk." Samuelson wrote:

“Throughout the recovery, forecasters have repeatedly overestimated the economy’s strength. They’ve predicted faster economic growth than has occurred. The main reason for the errors, I have argued, is that the forecasters have underestimated the influence of the financial crisis and Great Recession on people's confidence. Lower confidence reduced Americans' willingness to spend. My argument has applied to the U.S. Some new figures now suggest that the same phenomenon operates globally."

In the Euro zone they call this policy austerity, because it is also based on raising taxes... as we did in the U.S. This coupled with "draconian" regulations has stopped businesses from being created, and lowered investment in capital expenditures while curbing hiring of new workers. All that resulted in lower productivity, thereby causing zero and declining wage gains, low employment (especially considering the all-time low in the labor participation rate.)

As Curmudgeon readers know, I call this a worldwide trend towards “socialism" and economic fascism. It's the real reason for the low confidence in the economy by both companies and the public.

Any economist that noted our loss of economic freedom and independence, would have correctly called the U.S. economy's stagnant growth. Friedrich August von Hayek, a social philosopher and Austrian School economist, explained:

"To act on the belief that we possess the knowledge, and the power which enable us to shape the processes of society entirely to our liking,

knowledge which in fact we do not possess, is likely to make us do much harm."

And that "harm" is yet to be felt!

Good luck and till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and the

companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).