Is

Decline in Economic Freedom Responsible for Dismal U.S. Economic Growth?

by the Curmudgeon

Introduction:

I usually disagree with whatever Barron's ultra permabull

Gene Epstein writes, but not this week. In

his column titled, What Really Killed Economic Growth (print) /The

Slow Economic Recovery Has a Surprising Culprit (online), Epstein sees a

causal connection between the trend in economic growth and in the Fraser

Institute’s Index of Economic Freedom. The

latter consists of five components: measures of regulation, the rule of law,

the size of government, the soundness of money, and openness to trade.

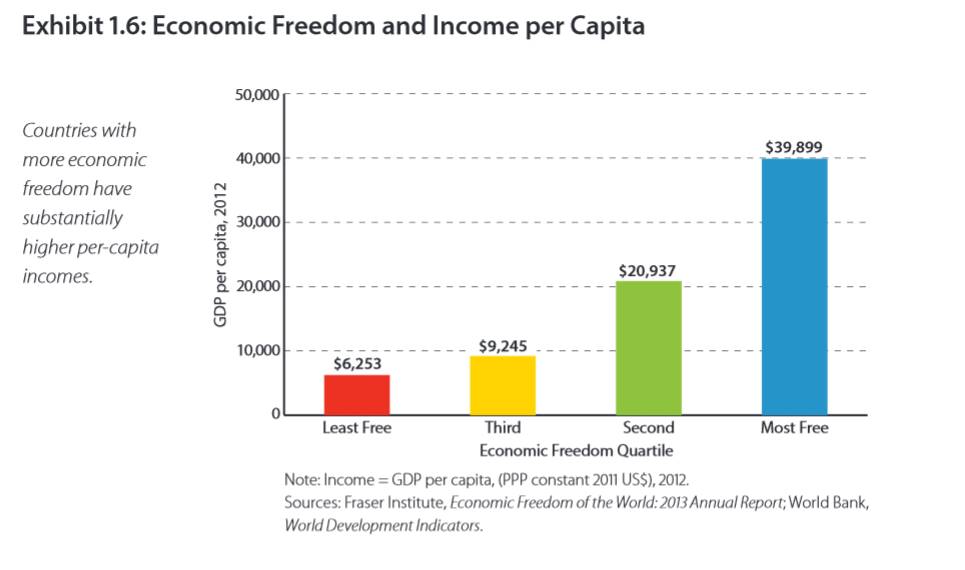

Here's a very interesting chart (not shown in Barron's) that depicts Economic Freedom vs Economic Growth for countries in four distinct quadrants:

Fraser’s Index of Economic Freedom for the U.S has

plunged since 2000 to a level comparable to 1970. That decline has coincided

with very weak U.S. economic growth.

Private-sector GDP growth in the George W. Bush and Barack Obama

expansions were the slowest on record (yet the stock market has soared to new all-time

highs!).

Epstein doesn't explain why there is a correlation between

the decline in economic freedom and growth.

He simply says, “that confirms the view that the decline in economic

freedom since 2000 is the main cause (of dismal economic growth)—a view that

has important policy implications.” He

doesn't even quote from the press

release announcing the 2014 Annual Report. We do so here:

“The United States, once considered a bastion of economic

freedom, now ranks 12th in the world, tied with the United Kingdom.”

“The United States has suffered from a weakened rule of

law, the ramifications of wars on terrorism and drugs, and a confused

regulatory environment. Consequently, it’s dropped from second place in the

world rankings in 2000 to 12th place this year, behind countries such as Jordan

and the U.A.E.,” said

Michael Walker, Fraser Institute senior fellow and co-founder of the Economic

Freedom of the World project.

Declining U.S. Economic Freedom Explained:

From the 2014 Economic Freedom of the World (EFW) Annual Report:

“Throughout most of the period from 1980 to 2000, the United

States ranked as the world’s third freest economy, behind Hong Kong and

Singapore...By 2005, the US rating had slipped to 8.20 and its ranking fallen

to 9th. The slide has continued. The United States placed 15th in 2010 and 16th

in 2011 before rebounding slightly to 14th in 2012. The 7.81 chain linked

rating of the United States in 2012 is more than 8/10 of a point lower than the

2000 rating.”

“What accounts for the US decline? While U.S. ratings and

rankings have fallen in all five areas of the EFW index. The reductions have been largest in the Legal

System and Protection of Property Rights, Freedom to Trade Internationally, and

Regulation. The plunge in the first area listed has been huge. In 2000, the

9.23 rating of the United States was the 9th highest in the world. But by 2012,

the area rating had plummeted to 6.99, placing it 36th worldwide.”

“Expanded use of regulation has also been an important

contributing factor to the declining ratings of the United States. During the

past decade, non-tariff trade barriers, restrictions on foreign investment, and

business regulation have all grown extensively. The expanded use of regulation

in the U.S. has resulted in sharp rating reductions for components such as

independence of the judiciary, impartiality of the courts, and regulatory

favoritism. To a large degree, the U.S. has experienced a significant move away

from rule of law and toward a highly regulated, politicized, and heavily

policed state.”

The decline in the summary economic freedom rating between

2000 and 2012 on the 10-point scale of the index may not sound like much, but

scholarly work on this topic indicates that a one-point decline in the EFW

rating is associated with a reduction in the long-term growth of GDP of

between 1.0 and 1.5 percentage points annually (Gwartney,

Holcombe, and Lawson, 2006).

“This implies that, unless policies undermining economic

freedom are reversed, the future annual growth of the U.S. economy will be only

about half its historic average of 3%.” Hence, Epstein says the decline in U.S.

economic freedom has “important policy implications.”

Continued Subpar Economic Growth in 2015?

According to a Saturday NY

Times article, Fed researchers only expect 1.55% economic growth in

2015!

In a July

17th note to subscribers, ShadowStats John Williams wrote:

"New" Recession Remains in Play—a Virtual

Certainty—But Broad Recognition of Same Still May Be a Couple of Months Out.”

“The U.S. economy never has seen such a weak six-month

period of growth, in industrial production and real retail sales, without being

in recession...I had expected by the now-rapidly-approaching end of

second-quarter economic reporting that two other key elements of the U.S.

economy would be faltering clearly, as well, specifically foreign trade

activity and housing-sector activity.

Such reporting would have moved market expectations towards a

much-weaker initial second-quarter 2015 GDP reporting than now is likely, along

with early recognition of the "new" recession. Broad recognition of the recession probably

is now several months off.”

The reported real 1st quarter 2015 GDP is a

shallow, annualized contraction of -0.17%.

We are anxiously awaiting this Thursday's (July 30th)

benchmark revision, along with the 2nd quarter 2015 GDP estimate.

Acknowledgement:

Many thanks to Brent Berarducci http://www.blacklioncta.com/ for tipping me off to the referenced

Barron's article.

Good luck and till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2015 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).