Share

Buybacks Fuel Stock Market, Increase Debt and Lower Capital Expenditures and

Growth

by the Curmudgeon

Introduction:

For years, we've argued that the U.S. stock

market's relentless rise has been largely driven by share buybacks, which are the

result of ultra-easy (and reckless) central bank monetary policies that

encourage companies to borrow money at ultra-low interest rates to buyback

shares. That reduces the float of stock

outstanding and artificially boosts earnings per share, which lower the P/E

ratio and appears to make stocks more valuable.

In reality, it's a game of financial engineering, which results in very

subdued global economic growth as companies are not investing in their future.

Artificially pumping up stock prices adds nothing

to the company’s overall productivity or growth prospects. Conversely, it undermines future earnings by

adding more debt to the corporate balance sheet. Furthermore, cutting back (or eliminating)

longer-term research and development doesn't augur well for future growth of a

company. Yet corporate CFOs don't think

about these “negatives,” because their objective is strictly short term

profits. It’s worth noting that

“highly rated U.S. nonfinancial companies” are now more leveraged than they

were in 2007 just before the market peaked (please see Sidebar: Global Debt Skyrockets since 2007).

Do I hear an Echo?

This week, several columnists and fund managers

started to echo the above points in what seemed to almost be a chorus!

Henny Sender's May 9-10 Financial Times column

- Tech chiefs accused of using share buybacks to ‘get rich quick’ (online

subscription required) exposes this financial chicanery. Bolko Hohaus,

manager of a technology fund for Lombard Odier in Geneva is on a crusade

against share buybacks that enrich management while doing little for minority

shareholders.

Mr. Hohaus

is especially upset about the propensity of a group of tech companies to grant

options or stock units to executives and then buy back shares to offset that

issuance. That sin is compounded by opaque accounting and the extensive use of

pro forma rather than generally accepted accounting principles (GAAP), which

often conceal the extent of dilution for institutional shareholders such as

Lombard Odier.

“If a company gives out a stash of options,

diluting shareholders by 10 per cent, and then buys them all back, you could

say nobody got harmed,” Hohaus told the FT.

“But the truth is that the money does not find its way back to

shareholders, but into the pockets of employees as a substitute for wages that

would otherwise need to be expensed,” he added.

Mr. Hohaus told the FT he laments the short-termism

of executives who engage less in investment than in such financial

engineering.

[Haven't we just heard about the pervasiveness of

"short-termism" in our

economy and our society from BlackRock CEO Larry Fink? In case you need a refresh on that item,

please read Reflections on Our Short

Term, Gambling Culture].

“You can only go so far with financial engineering

before you actually have to have a business with real growth,” said Chris Bouffard, chief investment officer who oversees $9

billion at Mutual Fund Store in Overland Park, KS.

In a recent note to investors, Chris Woods of

CLSA (Asia’s leading and longest-running independent brokerage and

investment group) wrote: “Corporations in America are increasingly devouring

themselves in a cannibalistic fashion as they opt to buy back more shares

regardless of the price, rather than invest in the future . . . S&P 500

share buybacks, combined with dividends, accounted for 95% of reported earnings

in 2014, with a record $104bn in February. Share buybacks are by far the most

important driver of market direction.”

According to other fund managers, some of the

newer "dotcoms" are even more egregious in their accounting practices

and the dramatic rise in stock compensation they offer. Moreover, pro forma

earnings per share are often far higher than results under GAAP accounting

rules.

Here's what Zero Hedge had to say

this week about the troublesome topic of buybacks:

"One of the themes we’ve been keen to advance

this year is the idea that the rally in US equities is in large part

attributable to corporate buybacks. In essence, companies tap yield-starved

investors in the debt market and use the proceeds to repurchase shares, thus

ensuring a constant bid for their stock while artificially inflating earnings

and propping up the value of equity-linked compensation at the same time. All

of this comes at the expense of capex (i.e. investing in future productivity

and growth) and as we’ve noted on several occasions, is easy to spot if one

looks at the divergence in the percentage of companies beating earnings

estimates versus the percentage of companies beating revenue estimates."

From JP Morgan (via ZeroHedge): "Why Are Companies Buying Back Shares?

Lack of confidence in organic growth alternatives, very low cost of debt

relative to equity, a struggle to improve ROEs, and relatively flat WACC

(Weighted Average Cost of Capital) curves have driven the pace of share

buybacks. While buybacks are more conservative than capex or LBOs (both of

which are well below last cycle’s peaks), they erode credit quality by draining

cash and/or increasing debt, and we expect them to continue."

Meanwhile, corporations have amassed massive cash

stockpiles (and debt) in the years since the financial crisis, which they don't

invest in their actual business or significantly hire more workers. Instead, the money is used for

"shareholder friendly" activities like buybacks and dividends (which

Blackrock's Fink says is very short sighted). Cash held by S&P 500

companies stood at a record $1.43 trillion as of the end of the fourth quarter

of 2014, according to FactSet. Debt has also increased sharply.

..............................................................................................................

Sidebar:

Global Debt Skyrockets since 2007

According to a February 2015 study by the McKinsey

Global Institute, Debt

and (Not Much) Deleveraging, total global debt is up 40% since 2007

to $199 trillion. Since the start of the

global financial crisis at the end of 2007, the total debt worldwide has risen

by $57 trillion, rising to 286 percent of global economic output from 269

percent.

Despite the economic rebound since 2009, McKinsey

found that the debt of households, corporations and especially governments

continues to rise strongly. "Governments in advanced economies have

borrowed heavily to fund bailouts in the crisis and offset demand in the

recession." McKinsey warns of potential risks created by the latest surge

in debt. Is anyone paying attention

to that risk?

..................................................................................................................

How big is big?

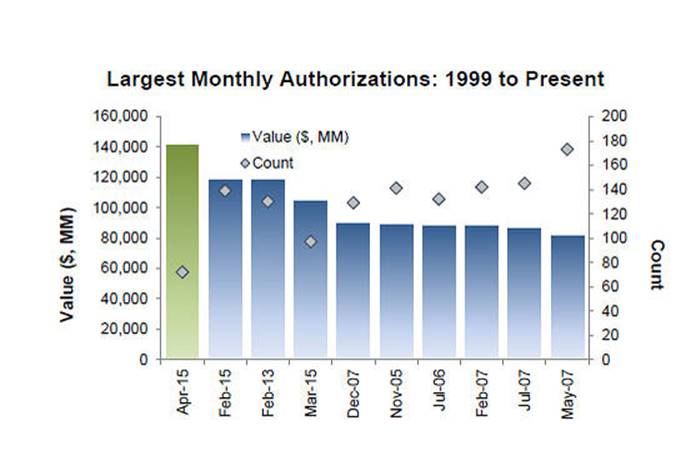

CNBC reports that in April, U.S companies said they would buy back

$141 billion worth of their own stock, the largest repurchase authorization

ever for a single month. Corporate announced buybacks are now on pace to hit

$1.2 trillion in 2015, nearly 40 percent higher than the previous record year.

Again, from ZeroHedge this week (emphasis

added):

“In 2014,

the constituents of the S&P 500 on a net basis bought back ~$430Bn worth of

common stock and spent a further ~$375Bn on dividend payouts. The total capital

returned to shareholders was only slightly less than the annual earnings

reported. On the fixed income front, the investment grade corporate bond market

saw a record $577Bn of net issuance in 2014. While the equity and bond

universes don’t overlap 100%, we think these numbers convey a simple yet

important story. U.S.

corporations have essentially been issuing record levels of debt and using a

significant chunk of their earnings and cash reserves to buy back record

levels of common stock.”

The gargantuan buyback

binge has gotten so huge that it actually exceeded profits in two quarters

in 2014. From Bloomberg:

“Companies in the Standard & Poor’s 500 Index really love their

shareholders….Money returned to stock owners exceeded profits in the first

quarter of 2014 and may again in the third. The proportion of cash flow used

for repurchases has almost doubled over the last decade while it’s slipped

for capital investments (capex), according to Jonathan Glionna, head of U.S. equity strategy research at Barclays

Plc."

..................................................................................................................

Sidebar: Apple's 4th stock buyback in

last year

Here's a glaring example of the stock buyback

mega-mania: In the first week in May,

Apple (the largest cap stock in the U.S. by far) announced plans to raise $8bn

in debt to help fund its fourth buyback-driven deal in just over a year. The

iPhone and iPad maker increased its share repurchase authorization by $50

billion to $140 billion. Apple plans to

spend $200B, mostly on buybacks (though some will go to dividends) until March of

2017.

“The company has now launched $43.5bn of long-term

US dollar-denominated debt offerings since April 2013, backing massive capital

returns to shareholders,” said S&P Capital IQ’s LCD division. Apple had spent $80bn on such buybacks over

the past two years, it added.

..................................................................................................................

Buybacks Propel U.S. Stock Market, but for how

long?

Buybacks have helped fuel one of the strongest

rallies of the past 50 years as stocks with the most repurchases gained more

than 300 percent since March 2009. Data

from Birinyi Associates indicate that the

single biggest factor for keeping the equity bull market going is the purchase

by companies of their own shares. Individual

and institutional investors have sold more stock than they've bought this year

(i.e. net redemptions).

It's important to note that the last stock

repurchase record was just before the market topped in 2007 (prior to the

financial crisis the following year).

Here's a "deja vu" reminder for you

to ponder from July 18, 2007: Boom in Buybacks Helps

Lift Stocks to Record Heights

Institutional investors, like those quoted above, say

executives should start plowing money into their businesses, rather than

buyback shares or hoard cash. Investment

strategists have warned this easy money fueled buyback bubble could end very

badly if the Federal Reserve raises rates too fast (not likely). Victor has

repeatedly stated that the bubble will likely pop when there's some financial

accident or a negative event occurs which the Fed can't control.

Conclusion:

We end with a quote from the earlier referenced ZeroHedge

post, which identically matches our belief:

"Summing

up: record corporate issuance, record buybacks, record stocks, and record

margin debt. So when the cycle finally turns and everyone who gorged themselves

on corporate debt in a desperate attempt to find yield suddenly discovers just

how illiquid the secondary market has become (prompting fire sales) and when

the margin calls start for everyone who has borrowed in a frantic attempt to

serve as the greater fool for the last guy who bought on margin, don't say we

didn't warn you."

Till next time…

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).