Eurozone

Growth, Greece and Ukraine Hopes Send Stock Markets to New Multi-Year Highs

By the Curmudgeon with Victor Sperandeo

Equities Rise on Stronger Economic Growth in Eurozone

Global stock markets this week shrugged off concerns of a

Greek debt default/exit from the Eurozone, continued fighting in Ukraine

(despite a weekend "cease fire"), and persistent European

deflation. Germany's Xetra

DAX, broke through the 11,000 barrier for the first time on Friday in response

to better than expected German growth numbers.

The DAX closed at a record high of 10,970.3, up 0.5% on the day. The

FTSE Eurofirst 300 index rose 0.7% to 1,503, its

highest level since early 2008.

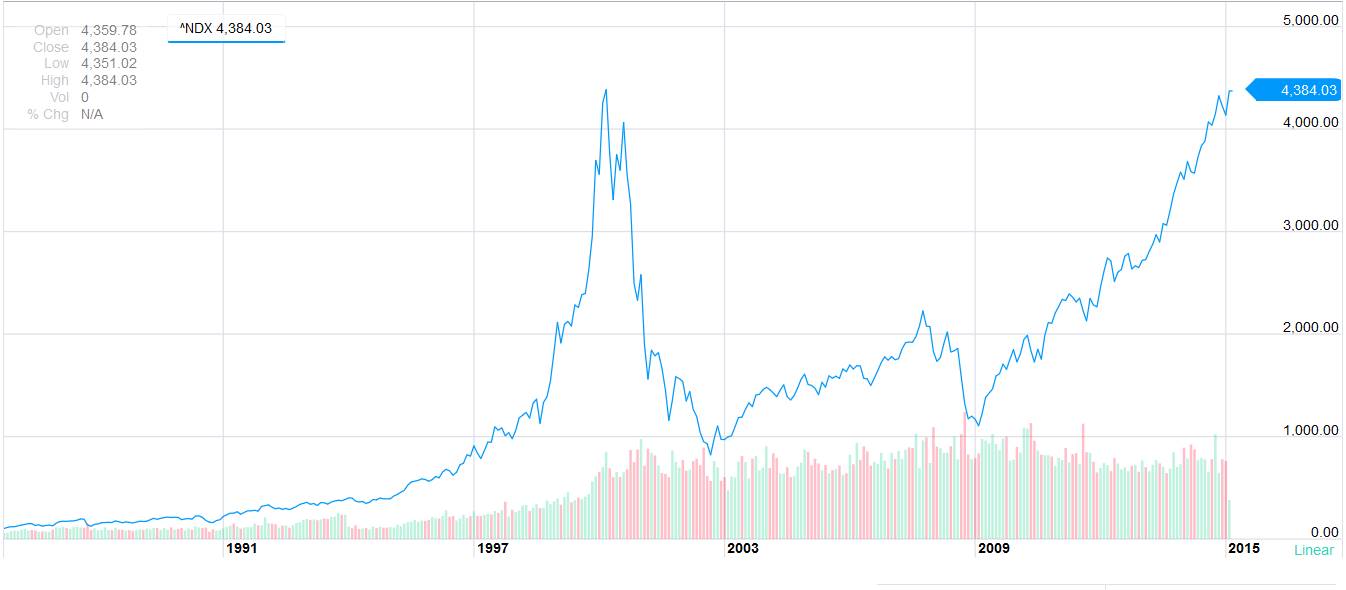

U.S. stocks also advanced, with the S&P 500 and Russell 2000 closing at all-time record highs of 2097 and 1,223.13, respectively. The NASDAQ 100 (^NDX) closed on the day's high print of 4,384, up 0.83% for the day, and tantalizing close to its all-time high of 4397.84 set during the dotcom boom. Many (including the Curmudgeon) thought that a new all-time high in ^NDX wouldn't happen for decades. Looks like we're going to be wrong yet again!

Source: Yahoo

Finance

Greek financial assets ended a volatile week on a positive

note, even after emergency talks on the terms of Athens’ bailout broke down

without agreement (see details below).

Nonetheless, Greece's ATG stock index rose 5.6%, ending with a weekly

gain of 11.3%, while the three-year Greek government bond yield — which brushed

22% midweek — was down 264 basis points on Friday at 15.41%, according to data

from Bloomberg.

Has Europe Turned the Corner?

Optimism that Europe’s economy might finally be turning a

corner was fuelled by stronger than expected growth data from Germany,

encouraging signals from the wider Eurozone, and more negative interest

rates/QE from European countries that don't use the Euro.

·

Germany’s economy, the Eurozone’s largest by

far, grew 0.7% in 2014 fourth quarter (4Q-2014) -- well ahead of analysts’

expectations of 0.3% growth.

·

The above data took the annual growth rate for

the Eurozone’s biggest economy to 1.6% for 2014, up from the 1.5% recorded in an

earlier reading from the Federal Statistical Office.

·

Eurostat (the European Commission’s statistics

bureau) reported that the entire Eurozone growth in 4Q-2014 was up 0.3% —

higher than the 0.2% recorded in the previous three months and also ahead of economists’

forecasts.

·

Many European monetary policy authorities have

set negative deposit rates for banks in recent years, including the ECB, Swiss

National Bank and Nordic central banks.

Last week, Sweden's central bank (Riksbank)

cut the repo rate 10 basis points to minus 0.1% and said it would buy SKr10bn

($1.2bn) in government bonds in its own form of quantitative easing.

·

The Bank of England also decided to end the

effective 0.5% floor for its main interest rate, in a signal that if

deflationary forces caught hold in the UK it, too, would be willing to

contemplate negative interest rates.

The Eurozone1 makes up around 17% of the

global economy, according to World Bank data.

Its failure to recover from the 2008 financial crisis has been quite problematic. The region has suffered years of economic

stagnation and remains smaller than before the global financial crisis,

expanding just 0.9% cent in all of 2014.

The jobless rate in the Eurozone has been hovering above 11% for months,

and there is little hope that the labor market will turn around in the near

term, economists say.

1There

are 28 member states in the European Union (EU). The 19 that use the Euro are collectively

called "the Eurozone." They are: Austria, Belgium, Cyprus, Estonia,

Finland, France, Germany, Greece, Ireland, Italy, Latvia, Lithuania,

Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain.

Cheaper oil, a weaker euro and a landmark sovereign

bond-buying program (60 billion euros per month) by the ECB have fueled

expectations that the euro-zone will this year record its strongest annual

growth since 2010. Last month, the

European Commission upgraded its forecast for eurozone

growth for this year to 1.3%, suggesting that the outlook is improving.

Carsten Brzeski, an economist at

ING-DiBa in Frankfurt, said it appeared that

“domestic demand was the main growth driver” in Germany, where growth came in

twice as fast as many economists had expected — at a 0.7% quarterly rate, or

2.8% annualized.

While the breakdown of the data will not be available for

two weeks, the report is “a clear sign that lower oil prices have found their

way into consumers’ pockets,” Mr. Brzeski said.

“German growth surprised massively on the upside,” said

Rainer Sartoris, an economist at HSBC. “The expansion

in the fourth quarter was mainly driven by domestic forces. Consumer and investment

spending expanded, while the effect from net trade seems not to have had a

marked impact. Taking into account recent sentiment indicators, we expect a

significant quarterly growth rate over the next quarters.”

Clemente De Lucia, an economist at BNP Paribas, said that

the data on Friday showed that things were looking up for the Eurozone. He

pointed in particular to a report showing that retail sales in December rose by

a solid 2.8 percent from a year earlier, and were “particularly buoyant in

Germany and Spain.” The available information “suggests that the recovery is

definitely strengthening,” Mr. De Lucia wrote in a note to clients.

“The euro area recovery appears in better shape than

expected,” said Thomas Harjes, an economist at

Barclays.

However, the Eurozone economies are not consistently

positive. France eked out quarterly growth of just 0.1%, while Italy stagnated

and Greece’s economy shrank 0.2% after three successive quarters of expansion.

Economists warned that there remained substantial clouds

over the Eurozone in the form of the Ukraine crisis, as well as Greece’s

high-stakes negotiations over its debt repayment.

Will Ukraine or Greece Spoil the Party?

"Investors" cheered easing geopolitical tensions

over Ukraine following the ceasefire reached in Minsk (capital of Belarus)

earlier in the week. But not all

analysts were bullish.

Jim Reid, a macro strategist at Deutsche Bank, noted that

the latest Ukraine deal appeared to differ little from the initial ceasefire in

September, which failed shortly thereafter.

“Crucially, the agreement still fails to deal with the issue of the

political status of eastern Ukraine and the lack of control that Kiev has over

its Russian border,” he said. “Clearly this is still a fragile situation which

could still generate headlines in the near term,” Reid added.

This Monday, Eurozone finance ministers (FMs) gather in

Brussels for a final showdown with Athens (the Greek government) over whether

to extend, renegotiate, or end, Greece’s €172bn bailout. Athens said it would make every effort to

reach a deal at Monday’s meeting.

Meanwhile, the ECB extended another €5bn in emergency loans to Greek

lenders.

At a Eurozone finance ministers’ meeting on Wednesday,

Greece FM Yanis Varoufakis

was negotiating a statement that suggested a bailout extension request was in

the works. But it didn't happen and there was no communique issued after the

meeting. Therefore, the likelihood of

reaching a deal on extending the current €172bn bailout, which expires at the

end of February, seem even more remote now.

The Financial Times reports that Irish ministers

seem insistent that Athens complete every last yard of its grueling austerity

program just as the Irish did. “They’re saying, ‘We’ve done our homework, it

wasn’t easy, and part of the homework is keeping Germany happy, and the Greeks

are being unrealistic,’” says Tom Healy, director of the Nevin

Economic Research Institute.

German FM Wolfgang Schäuble is

determined Athens should stick to its rescue program as a condition of further

assistance. Dogged resistance to such

demands from Alexis Tsipras, Greece’s Prime Minister,

has seen his poll ratings soar at home, with thousands taking to the streets in

a rally of support.

“You cannot ask a newly elected government that has been

elected with a mandate for a new programme to

implement the previous [bailout] as a precondition for discussion,” a senior

Greek official told the Financial Times.

“EU officials should be able to reach a deal that keeps

Greece in the euro area while also providing debt relief and easing austerity,”

said Dario Perkins at Lombard Street Research. “But the politics look tricky and the threat

of ‘Grexit’ is not trivial. Global finance is less exposed to Greece than in

2010 and the EU has set up firewalls, yet the systemic implications would be

uncertain,” he added

In its weekend edition, the Financial Times (on

line subscription required) asks: "When

must a new bailout deal be reached? Athens insists that it has enough cash to

last months but euro-zone officials believe Greece could run out of money as

soon as March. That would give the negotiators four to six weeks to bash out a

new deal."

"At the end of it, Greece is barely closer to

reaching a deal to keep bailout money flowing from the Eurozone and

International Monetary Fund and financing coming from the European Central

Bank. This was perfectly predictable. Greece’s Syriza government is still less

than three weeks old. Real discussions at a technical level will take place in

the coming days. But the atmosphere in which the talks are conducted will have

to improve from the mutual distrust shown this week."

It will surely be a very difficult conference for the Eurozone

FMs meeting this week in Brussels!

Victor on the Ukraine Ceasefire:

The signing of a ceasefire in Ukraine has boosted the

"risk-on" markets, e.g. global stocks, currencies, commodities

(especially oil), while hurting the "risk-off" markets, e.g. bonds,

U.S. dollar, and gold.

Although Putin has been violating the September 2014 Minsk

Protocol and denies there are Russian troops in Ukraine (despite U.S. satellite

images), the signing a cease fire makes investors feel good. However, most

geopolitical analysts are skeptical this means anything.

Curmudgeon Note: The cease fire is actually between

the pro-Russian rebels in Eastern Ukraine and the Ukraine government. Russia is not directly involved. Ukraine's

president Petro Poroshenko said the truce must be honored, as he ordered the

army to stop fighting at 12:01am Ukraine time Sunday. Officials say more than

5,400 people have been killed since the conflict erupted in eastern Ukraine in

April, but the UN believes the actual death toll to be much higher. Ukraine and the West accuse Russia of sending

troops and weapons to help the separatists in Ukraine's eastern Donetsk and Luhansk regions - a claim the Kremlin vehemently denies

(despite satellite photos

confirming Russian heavy weapons in Ukraine).

Mr. Putin is a virtual dictator and a very rich man, with

an estimated net worth estimated to be $75-225 billion in Swiss banks. What does he want? Another USSR! He wants to put "Humpty Dumpty"

back together again, as he has alluded to several times.

In an interview with Reason magazine, former World Chess

Champion Garry

Kasparov said that when dealing with Vladimir Putin: “You

cannot project weakness...Putin's game is [not chess but] poker. And he knows

how to bluff." Later in the interview: "So now Putin's only rationale

is to present himself as a big hero, "Vladimir the Great"; "The

collector of Russian lands"; "Putin, the man who is restoring the

Russian empire."........."Now, combine it with his clear statement

that all the borders of the former Soviet Union are in question—that is why he

believes that Russia was in its rights to challenge Ukrainian borders, and

others as well (e.g. Latvia, Estonia)."

Ukraine Prime Minister Arseny

Yatsenyuk said at a conference last year: "Russia wants to destroy Ukraine

as an independent country and restore the Soviet Union." He told CNN on

Feb 5, 2015:

"It is crystal clear that (the) Russian military is

on the ground. We are not fighting so-called rebels or guerrillas. We are

fighting with the Russian regular army."

But for now Putin's strategy gives him time to restore the

Ruble to stability, raise oil prices, and plan his next takeover. The cease

fire agreement means little, but everything looks good to the markets.

Victor on Greek Debt Bailout Talks:

Greece is now controlled by a Communist party called

Syriza. The nice words used to describe the negotiations with their creditors

are more like a poker game of "Texas Hold-em." Who is bluffing and who holds winning

cards? Any give-away by the EU on debt

will cause other European nations, e.g. Spain to also ask for debt forgiveness.

Not giving sufficient debt concessions (Greece wants 50%

of the estimated €300 billion debt written off) would likely cause Greece to

leave the Eurozone. Greece will never

be like Germany. They don't have the

same work ethic or values. More

importantly, the institution known as the EU is toast from the beginning of its

creation, but on life support after 2008.

Here are some facts based on OECD data:

·

The average German earns $21,187 in disposable income

vs the average Greek's $15,142 annual income as of 2012.

·

Auto production is Germany's main export having

Mercedes, BMW, and Volkswagen Group owning Audi, Bentley, Bugatti,

Ducati, Lamborghini, Porsche, SEAT (auto manufacturer of Spain) and more.

·

Other European nations are similar but not

seriously competing with Germany. For example, France has Peugeot, Citroen, and

Renault made autos.

·

Greece is big on tourism olive oil (agriculture

products) miscellaneous industrial products in small amounts.

I firmly believe last month's election in Greece spoke

loud and clear. Greece must get what it campaigned

for or Mr. Syriza is toast. I don't

believe this can ever be resolved.

Meanwhile, Germany is the richest European country and

therefore does not want to debase the Euro. Although it's stabilized recently,

the Euro has declined 15% in the last five months vs the US dollar. As a result, German cars are a bargain and on

sale, especially with zero interests rates for car loans. Buying a German car

is like shopping at a JC Penny's- deals galore!

Victor's Summary and Conclusions:

So we have positive psychology - Putin backing off on

Ukraine (for now) and debt relief talks with Greece - working to extend the

up-trend for risk assets. Also in the

mix are: a back door tax cut via lower oil prices, money printing/QE for the

rich investors who have access to it, negative interest rates in Europe, and a

15% off sale on Euro exports (thanks to the recent decline in the Euro/$

exchange rate). That's the cause of

short term pop in several stock markets to new highs. It's mostly smoke and mirrors and

temporary news on oil prices.

As the November 2015 crude oil futures are almost 20%

higher than their recent lows, expect more upside in oil prices. If so, the low

oil "tax cut" disappears as does the boost to consumer spending.

The bottom line: Another political paper over of events kicking the can down the never ending road that ends in tears. But "in the long run we're all dead," so enjoy it while you can!

Till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).