Global

Debt: Growing, Growing, Gone?

By Victor Sperandeo with the Curmudgeon

The Big Picture:

U.S. consumer borrowing increased by $14.8 billion in

December 2014, pushing consumer debt to a record $3.31 trillion, the Federal

Reserve reported Friday. That's consistent with the strong global trend of debt

expansion since the global financial crisis and start of the great

recession.

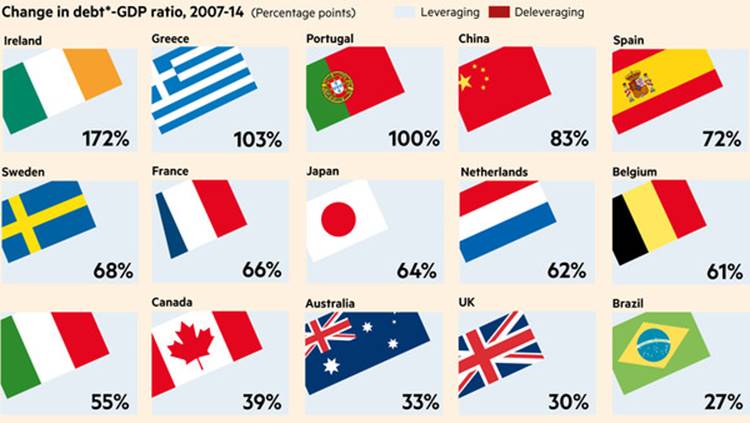

Global debt has increased by $57 trillion to $199 trillion

since 2007 - a 40.1% rise which far exceeded economic growth during the same

time period, according to consults at McKinsey & Co. As a per cent of gross domestic product, debt

has risen from 270% to 286% from 4Q-2007 to 2Q-2014. All major economies are now recording higher

levels of borrowing relative to gross domestic product (GDP) than they did in

2007.

McKinsey’s survey of debt across 47 countries highlights

how hopes that the turmoil of the past eight years would spur widespread

“deleveraging” to safer levels of indebtedness were misplaced. The report calls

for “fresh approaches” to preventing future debt crises. McKinsey said higher

levels of debt “pose questions about financial stability." McKinsey warned of risks in its property,

local government financing and “shadow” banking sectors.

China’s debt, including the bank sector, has nearly quadrupled since 2007 to the equivalent of 282% of GDP. China’s debt relative to its economic size now exceeding U.S. levels, according to the McKinsey report. Financial sector debt relative to GDP has declined in the U.S. and other crisis-hit countries.

Public debt in Greece has almost doubled, from 115.2% of

GDP in 2007 to a projected 200% of GDP in 2014. Similarly, Portugal’s debt has

increased from 75% of GDP in 2007 to an estimated 134.6% in 2014 and Spain’s

from 42% six years ago to 105% next year. In Italy, indebtedness has not risen

as fast but it is on a clear uphill slope, going from 112.4% in 2007 to 131.4%

in 2014.

Japan is a country with a long history of sky-high

indebtedness. Debt as a percent of GDP broke through the 100% mark in 1997 and

has risen steadily since then. It surpassed 200% in 2011 and is headed toward

230% of GDP in 2014. However, in contrast to the U.S. for example, most of

Japan’s debt has been financed by Japanese investors. Some analysts see the

percent of foreign-owned debt as more threatening to an economy’s longer-term

health than total debt.

A Brief History of U.S. Debt:

NONE of the signers of The U.S. Constitutional Republic

were willing to allow "fiat paper money." They wanted our currency to be backed by real

assets, rather than faith or trust.

Article 1 section 10 of the U.S. Constitution does not

allow states to use "Bills of Credit" i.e. Federal Reserve

Notes/Dollars as cash without the backing of silver or gold. [See "The

Constitutional Creation of a Common Currency in the U.S. 1748-1811"]

Our founding fathers did permit debt to be used for

emergencies like war, but as Thomas Jefferson stated: "It is incumbent on

every generation to pay its own debts as it goes. A principle which if acted on

would save one-half the wars of the world."

Jefferson was very much against passing debt on from one

generation to the next. "Then I

say, the earth belongs to each of these generations during its course, fully

and in its own right. The second generation receives it clear of the debts

and encumbrances of the first, the third of the second, and so on. For if

the first could charge it with a debt, then the earth would belong to the dead

and not to the living generation. Then, no generation can contract debts

greater than may be paid during the course of its own existence." --Thomas

Jefferson to James Madison, 1789.

There are so many good quotes on this subject (e.g.

Voltaire: “It is dangerous to be right in matters on which the established

authorities are wrong."). I suggest you read and ponder them at

length. It will then become crystal

clear that the U.S. founders researched and understood what debt can do: overturn

a society from freedom to dictatorship, or communism.

The Real Story of U.S. Debt:

In the U.S., off-budget spending and exponential debt

increases make (now defunct fraudster) Enron Corp look like it was run by a

hero of business ethics. For example, the blatant use of term "Debt held

by the public1" (=$12,779tn at the end of fiscal 2014 vs

Gross/total debt of $17,792tn) is pure propaganda.

1 The Debt Held by the Public is all

federal debt held by individuals, corporations, state or local governments,

Federal Reserve Banks, foreign governments, and other entities outside the

United States Government less Federal Financing Bank securities.

The difference between Public and Gross debt is

the (nonexistent) money in the Social Security trust fund, which is 100% U.S.

debt. Note also that gross federal

debt is the only number that really counts, as it is legally subject to the

"national debt limit."

In my opinion, the publicly held debt is used extensively

by the CBO as a sham to make the debt to GDP ratio look substantially lower

than it actually is.

In addition, to making the debt "ratio" to GDP

look smaller, the government makes GDP itself bigger! That's mainly due to the government's "imputation"

assumption, which averages 16% of GDP.

They never actually take place and are therefore a "mirage."

Sidebar: Imputations

Explained

Imputations approximate the price and quantity that would

be obtained for a good or service if it was traded in the market place. The largest imputation in the GDP accounts is

that made to approximate the value of the services provided by owner-occupied

housing.

Including owners' imputed rent (an estimate of how much it

would cost to rent owner-occupied units) in GDP has been standard practice in

U.S. national income accounting. Were owners' imputed rent not included, an

increase in the homeownership rate would cause GDP to decline!

Another important imputation measures financial services

provided by banks and other financial institutions either without charge or for

a small fee that does not reflect the entire value of the service. Examples are checking-account maintenance and

services provided to borrowers. For the

depositor, this “imputed interest” is measured as the difference between the

interest paid by the bank and the interest that the depositor could have earned

by investing in “safe” government securities. For the borrower, it is measured

as the difference between the interest charged by the bank and the interest the

bank could have earned by investing in those government securities.

For more on this topic, please see: Why

does GDP include imputations?

Recalculating Real GDP and Debt to GDP Ratio:

U.S. GDP is approximately $15tn. Debt - without the $10tn

off-budget debt - is ~$18tn. Those

numbers result in Debt to GDP ratio of 120%. Without unfunded liabilities, but

adding in off budget items, Debt is ~$28tn and the Debt to GDP ratio is

187%! Yet the federal government tells

us the ratio is only 74.1% (based on "public debt held") as of Sept

30, 2014!

The key point here is that the government misleads the

public with accounting gimmicks and tricks to make GDP larger and Debt to GDP

substantially smaller than it actually is.

Derivatives Guaranteed by Governments May Spectacularly

Increase Debt:

Thinking about these government distortions, deceptions,

corruption, fraud, jobbery, and financial debauchery what's the actual world

debt? That might best be estimated by a

bookie in Las Vegas.

To be realistic, we must add in the multi 100x's a - trillion

world of derivatives, which are guaranteed by the FDIC and that in turn by

the U.S. government. Some pundits

have called them "ticking time bombs" or "an accident waiting to

happen."

The world backing of these potential derivative debts are

all different, but in general the government backs up the system.

Consider QE/money printing schemes in the U.S., ECB,

Japan, UK, etc. The staggering amounts

of worldwide government debts are accommodated by global Central Banks which

buy it by creating money out of thin air.

Without the ability to

print unlimited amounts of "fiat money," the massive amounts of

global government debt couldn't be financed by the private sector.

Those QE's combined with potential derivative losses are all potential future debt, as it is on the central bank balance sheets or will be on all central banks’ balance sheets.

Exponential Debt Growth & Compounding Effects:

The debt is "growing exponentially" and once

this "hockey stick" curve starts it can never stop or the system

implodes. This is so because you constantly need more new debt to sell, and to

roll over old debt plus interest. Any slowdown in debt creation will likely

show up as a recession.

The exponential function of debt growth is not well

understood. I suggest you read Dr. Albert Bartlett for a mathematical discussion

of compounding. Using population as

an example...if you start with 1 million people at 1% growth it will take 694

years to get to 1 billion people, but only 100 years to get to 2 billion, 41

years to get to 3bn, 29 years to get to the 4th and by the 5th billion only 22

years! The analogy gives you a clue as to the explosive result of debt

compounding.

U.S. debt has been growing over 30+ years at a 9% annual

rate - more than triple GDP growth rate over the same period. At the beginning of 1982 recession, debt

to GDP* was stated as 31%. That

ratio was reported as 101% as of Sept 30, 2014.

* See: National

Debt by Year: Compared to GDP, and Major Events

Although the U.S. budget deficit is "only" $483bn,

as long as it increases, it causes compounding of the interest owed on the debt. The roll-over of the principal must also be

considered, as some principal is always withdrawn by investors (rather than

re-invested in new debt).

Conclusions:

Because debt is effectively future consumption spent

today, it is a claim on future labor or assets. So there's an implicit

assumption in the current $199tn global debt that world growth will be much

stronger than it is today. Otherwise

that huge (and growing) debt could never be repaid.

As John Maynard Keynes put it: “If I owe you a pound, I

have a problem; but if I owe you a million, the problem is yours.” Does that

remind you of "too big to fail?"

As we've discussed in many previous Curmudgeon posts,

there are only two practical possibilities if the debt can't be repaid: default

or print even more money. Raising taxes

to pay these huge amounts of debt are impossible, as is stealing the people's

money/assets. Which one would you chose - a deflationary depression or hyperinflation?

End Note:

Thanks to readers who emailed comments/feedback/suggestions. Keep 'em coming along with the retweets!

One reader emailed: "Part of the problem causing the

rise in debt is demographics. Too many old people drawing on the system and not

enough working folks paying in. Japan is

twenty years ahead of the U.S. in the demographic situation and now have a

negative savings rate. What happens to them will likely happen to the rest of

us later. The scary part is that Japan is still close to being the world’s

second-largest economy. What happens there matters to all of us."

Till next time...

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies. Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by the

Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).