Fedís Janet Yellen on Income Inequality: Chutzpah to the

10th Power

By the Curmudgeon with Victor Sperandeo

†

On Friday, October 17th, Federal Reserve Board

Chairwoman Janet Yellen gave a speech

on Income Inequality at a

Fed sponsored conference in Boston, MA.†

Ms. Yellen expressed serious concerns about growing income inequality in

the U.S. without mentioning whether the Fed had aided or abetted the

process.†† Her comments came just days

after Swiss investment bank Credit Suisse warned that inequality in the U.S. is

at levels that have been associated with recessions in the past.† One key measure is at its highest level since

the Great Depression.

"This is a worrying signal given that

abnormally high wealth income ratios have always signaled recession in the past,"

Credit Suisse wrote in a 64-page report

on global wealth released

on Monday.†††

The richest 1% in the world own 48% of all the

world's wealth, according to Credit Suisse, which is a very a worrying signal

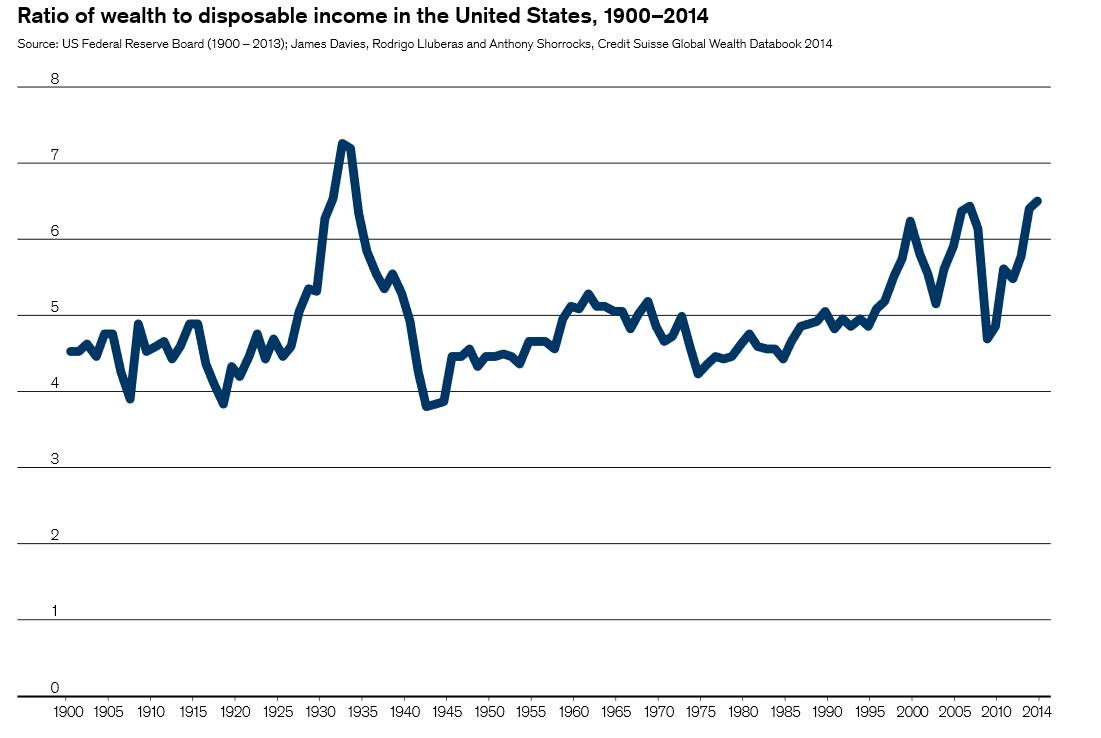

for the global economy.† Here's a chart

from the report, of wealth-to-income ratios going back to 1900:

As can be seen from the above chart, the ratio

today is higher than at the peak of the dot-com and housing bubbles, which

ended very badly.† Is there a bubble

now?† One is in total denial if they

believe financial assets are not in a bubble.†

The stock market that has been inflated partly by reckless Federal

Reserve monetary policy (AKA QE and ZIRP). †Yield on bonds and mortgages have been driven

down by the Fed buying up most of them.†

Corporate profits are at record highs at least partly because companies

are parking cash and buying back stock, rather than spending on new plants,

equipment and hiring more workers.† Wages

have been flat throughout the recovery and for the past few decades, when you

adjust for inflation.††

So one may think that Yellen is justifiably

concerned about income inequality. Here's what she said at the Boston Fed

conference:

"The extent of and continuing increase in

inequality in the United States greatly concern me. The past several decades

have seen the most sustained rise in inequality since the 19th century after

more than 40 years of narrowing inequality following the Great Depression. By

some estimates, income and wealth inequality are near their highest levels in

the past hundred years, much higher than the average during that time span and

probably higher than for much of American history before then.† It is no secret that the past few decades of

widening inequality can be summed up as significant income and wealth gains for

those at the very top and stagnant living standards for the majority. †I think it is appropriate to ask whether this

trend is compatible with values rooted in our nation's history, among them the

high value Americans have traditionally placed on equality of opportunity."

The implication of the last sentence is that

somehow and in some way, income inequality is "un-American."† But who's at fault?† We submit unequivalently

it's the Fed!† The NY Times Binyamin Appelbaum seems to agree.†

On October 17th he wrote:

"The Fed might even have made inequality worse,

with stimulus measures that have boosted stock and bond prices, mainly a boon

to the already wealthy. Yellen noted that the wealthiest 5 percent of

Americans own two-thirds of all stocks, bonds, mutual funds and other such

financial assets....Even lower mortgage rates, one of the most direct Fed

stimulus effects, have mainly helped people who already own homes or have

credit good enough to buy homes. Many of those people are closer to the middle

and bottom of the economic ladder, at least. But the small bounce in home

prices since the Great Recession has been dwarfed by soaring stock and bond

prices, and has done nothing for those homeowners' stagnant wages."

Boston Fed President Eric S. Rosengren

said in an interview Thursday. "When you think about maximum employment,

monetary policy can deal with the cyclical.†

If we were able to change the mindset in some of these cities, the

employment picture in these cities would clearly be better."† †That statement implies that Fed monetary

policy could favorably change the "mindsets" in selected cities, resulting

in lower unemployment.† Do you really

believe that?

Chutzpah is a Yiddish word derived from the Hebrew word ḥutsp‚

meaning "insolence," "cheeky" or

"audacity." †In New York City,

the hometown of the CURMUDGEON (Manhattan) and Victor (Queens), Chutzpah was untranslatable to English, but

meant "more than egregious" or "ultra-outrageous."††

Take Chutzpah

to the 10th power and that's what Yellen's inequality comments

represent!† Why?† Because the Fed is the primary cause for

widening income inequality!† Its

monetary policies have increased the wealth of the very rich who own

substantial financial assets, yet have resulted in stagnant wages and

significant under-employment for everyday workers.† Victor, who came up with the Chutzpah title

of this post, identifies two other root causes in his comments below.†

Victor and

I wrote about causes and effects of U.S. income inequality in U.S. Regional Income

Inequality Hits All-Time High

From that Curmudgeon post:† "We've pounded the table for months that

there has been little growth for lower and middle class wage earners, which

constrains demand for houses and big ticket items across much of the

U.S."†

Here's what Tracy Alloway

wrote in this weekend's Financial Times (on line subscription

required):†† "Successive rounds of

QE have helped push stock and bond prices to historic highs. Yet there is

little evidence that QE has had much effect on the real world economy beyond

pumping up financial asset prices Ė in many peopleís eyes, above what the

underlying economics would suggest was reasonable."

Matt King, Citigroup strategist, put it bluntly in a

conference call this month: ďEverything revolves around monetary policy. Itís

not the underlying economics thatís driving things, its central bank

liquidity.Ē

On Thursday, St Louis Fed President James Bullard seemed

to suggest further QE, or at least a pause in the planned tapering, could be on

its way to combat disappointing economic growth.† Or was that due to recent stock market

weakness?† See Victor's comments for his

take. Many pundits credited Bullard's remark for putting a floor under the

stock market.

Simply stated, the Fed's monetary policies don't

encourage companies to hire more employees or expand operations.† Instead, corporations buy back shares and

fire workers in order to improve earnings per share, which tends to boost the

company's stock price.

Here's what the NY Times Neil Irwin wrote

on October 17th:†

"The Bernanke Fed again and again turned to

quantitative easing and ultra-low interest rate policies to try to shock the

economy into speedier expansion. (Ms. Yellen was the No. 2 official at the Fed

for most of this time, and helped engineer the policies).† But this has contributed to an imbalanced

form of growth in the United States. Many of the first-order effects of the

Fedís bond buying have been, for example, to drive up the stock market and to

help lower mortgage rates. Because stocks are disproportionately owned by the

wealthy and the upper middle class have been in best position to refinance

their mortgages, the benefits of Fed policy for middle and low-income workers

have been more indirect."

"It is unclear what that means for the proper

course of monetary policy...Ms. Yellen did not address in her speech whether

she agrees with the premise that a Fed-driven economic recovery has contributed

to inequality, and if so what it implies for her agency."

Victor's Comments on the Causes of Income

Inequality:

Willie Sutton - the famous bank robber, who stole

more than $2 million dollars in the 1920's and early 30's, was asked why he

robbed banks.† His well-known answer was:

"because that's where the money is."†

This can honestly be applied by Ms. (Queen) Yellen to where

"income inequality" mostly comes from or that's where the money comes

from - it's THE FED!

Some background: the Fed is a private corporation

(i.e. a cartel) owned by the banks, but whose specific ownership is

secret.† They have a "license"

from Congress to control the nation's money supply and interest rates.† For this "license" they get 6% of

the profits of the Fed plus many other benefits like causing recessions and

"economic recoveries."† Also,

the Fed doesn't allow audits on themselves or what they do.

Lastly, the Fed and their owner banks don't like

gold, as it is a competitor to the paper (fiat) money standard.† As a matter of record, the Fed is also a

custodian of the storage of gold (in trust) for the other major central

banks/countries of the world.† Earlier

this year and last, when Germany asked for their gold back (only for about one

tenth of their deposit), the Fed couldn't deliver!† They would not even let the Germans see

it.†† Obviously, the Fed sold or leased

Germany's gold without their permission.††

Yet they have to get it back (somehow) in order to deliver it to Germany

by 2020, which is the estimated delivery date.†

Banks obviously want to maintain their effective monopoly of these

profits on fiat money via the Fed.

The "ChutzpahĒ of Ms. Yellen was to

talk about "income inequality" without mentioning the Fed's

irresponsible monetary policies that have widened the gap between the rich and

poor.†† Her ambivalence to one of the

root causes of income inequality is an insult to the intelligence of anyone who

knows the very basics of the Fed, the history of that institution, and the law

that created it (the 1913 " Federal Reserve Act").

Income Inequality is also caused by our

progressive income tax system, which takes more† of the earnings

as income rises even if most of that's due to inflation.† Let's do a quick, back of the envelope

calculation to prove that point:

∑ The inflation rate from the time Nixon

went off the gold standard in 1971 is 4.2%.

∑ Median U.S. household income in 1971 was

$7805, according to the US Census Bureau.†

∑ As of 2012, the median U.S. income was

$49,486.†

∑ That's only a 30 bps annual compounded

earnings gain over inflation!†††

∑ Thereby, workers are paying taxes on

inflated incomes, rather than on any real earnings gain.†††

∑ Moreover, 1971 taxes were much lower on

$7805 than they are today on $49,486.†

And this analysis doesn't include state income taxes! [The highest

margin tax rate in CA is now 13.3%]

∑ The bottom line is "we the

people" lose while the government wins, i.e. they get more revenue to buy

power.

Now let's look at what would happen if tax rates

were indexed to inflation:

∑ In 1913, the original income tax on $4,000

was zero.† It was 1% up to $20,000.†

∑ Adjusting for inflation, that $4,000 is

worth $95,500 today with no tax due if inflation indexing was in effect.

∑

$20,000

would be worth $477,000 today.† If the

income tax was indexed to inflation, an individual would only pay 1% or

$4,770 on that amount today.† Such a

tax proposal would have gotten my vote!

The point is that as The Fed inflates the

economy it lowers net income after inflation and taxes.† Moreover, when you have the fiscal

policies of 2009-2014 where full time jobs and wage increases are not

forthcoming, the poor/middle class get poorer.†

That increases income inequality!†

Yet previous Fed heads Greenspan, Bernanke and now Yellen (nor any other

Fed officials) never mention this fact.

Thomas Sowell a well-known economist who has

written 30 books on economics and studied with Milton Freedman has written on

the subject and concludes that "the rich" in GENERAL are an age

group. The bulk of the people that are considered rich are in their mid-50's. This is logical as when you come out of high

school or college you don't earn over $250,000.†

By working for over 30 years and perhaps building a business you arrive

at your peak earnings capacity.† This has

little to do with the Fed or is a cause of income inequality.† Instead, it's a natural outcome of a

successful professional life and work experience versus no experience.† Why should that group be penalized by an

unfair tax code?

Immigration policy is also a huge cause of income

inequality. The Gini

coefficient or Index (also known as the Gini ratio) is a measure of statistical

dispersion intended to represent the income distribution of a nation's

residents. This is the most commonly used measure of inequality.† Obviously with an estimated 12-20 million

illegal aliens in the U.S. and no border controls to speak of, the Gini index

will naturally rise simply because only the poor come to a rich country

illegally.

Hong Kong also has a high Gini index 53.7% in

2011, as does Singapore at 46.3% in 2013.†

Contrast that to Marxist countries like Cuba (Gini index not available),

where people try to escape to the U.S. to have a better life.† The U.S. has a 45.3% Gini index in 2012.† Interestingly, the U.S. Gini "state

average" has Utah the lowest at 41.9% and Washington DC at 53.2% the

highest.

An example which proves my immigration thesis is

Switzerland.† That rich, high income per

capita nation has a low 28.7% Gini index in 2012 (est.), because they have a

gravely stringent immigration policy.††

In conclusion, the incredibly contentious issue of

income inequality in the U.S. is the Fed's being oblivious to its role in

widening it.† Since the financial crisis

(and maybe even before that) the Fed has targeted the equity (and also the

fixed income) markets, rather than the real economy, i.e. Main St.† That notion is 100% proven by the events

of the last two trading days on Wall Street.

The "Bullard Bounce" (dubbed by

Barron's after† St Louis Fed President

James Bullard) came out on cue with the S&P 500 down 9.95% from its peak

[on 9/18/14† to an intra- day low on

10/15/14]† to announce that on Thursday

(via a Bloomberg interview) that QE could be eased if inflation declined.† Who gave the Fed the power to target

the stock market?

With the Russell 2000 up 97.86% from 10/3/11 low

without a correction of 10% till the recent decline of 13% [from 7/1/14 high of

1205.95 to 1049.30 low on 10/13/14] really needs to be explained by the Fed for

its thinking.† In the 1970s, there

were often two or more 10% corrections per year!† Now it seems that one in three years is one

too many for the Fed?

It's apparent that Bullard, Yellen, other Fed

officials want inflation, which hurts the poor and middle class, but helps

corporate America in raising asset prices! Yet not one elected official

states this problem to the Fed.† Why

not?

When "Queen Yellen" says she is

concerned about income inequality, she should be looking into a mirror -as† evil stepmother Queen Elspeth does in Snow

White- for her answer to the question " ....who the fairest† of them all?" It is certainly not The

Fed!

Till next

time......

The Curmudgeon

ajwdct@sbumail.com

Follow the Curmudgeon on Twitter @ajwdct247

Curmudgeon is a retired investment professional. He has been involved in financial markets since 1968 (yes, he cut his teeth on the 1968-1974 bear market), became an SEC Registered Investment Advisor in 1995, and received the Chartered Financial Analyst designation from AIMR (now CFA Institute) in 1996. He managed hedged equity and alternative (non-correlated) investment accounts for clients from 1992-2005.

Victor Sperandeo is a

historian, economist and financial innovator who has re-invented himself and

the companies he's owned (since 1971) to profit in the ever changing and arcane

world of markets, economies and government policies.† Victor started his Wall Street career in 1966

and began trading for a living in 1968. As President and CEO of Alpha Financial

Technologies LLC, Sperandeo oversees the firm's research and development

platform, which is used to create innovative solutions for different futures

markets, risk parameters and other factors.

Copyright © 2014 by The Curmudgeon and Marc Sexton. All rights reserved.

Readers are PROHIBITED from duplicating, copying, or reproducing

article(s) written by The Curmudgeon and Victor Sperandeo without providing the

URL of the original posted article(s).