Martin W. Hennecke

Regular readers of websites like this one will already be well informed of the onrushing financial collapse and national bankruptcy of the United States, as this topic is receiving ample coverage nowadays from an abundance of writers and economists, including unmistakable warnings from many former senior government officials and central bankers as well as from the very institutions that are presently in charge, such as the International Monetary Fund, the Bank of International Settlements or the US Federal Reserve. So I will save myself repeating the obvious here, suffice to say that anyone who is new to the real world and would scoff at such notion may want to start educating himself/herself by reading some introductory books such as Bill Bonner’s ‘Empire of Debt’, or browse the Federal Reserve Bank of St. Louis’ report ‘Is the United States Bankrupt?’ published earlier this year.

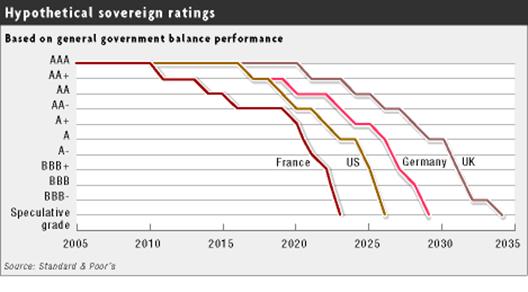

What a large number of even the more educated US Dollar bear-and US financial crisis expectation camp however do NOT seem to be aware of is the global nature of the problem. It is completely wrong to assume, for example, that the Euro or the British Pound are inherently ‘hard’ and healthy currencies that would provide protection from a plunging US Dollar. It is not known by most, that in fact the majority of the Western ‘developed’ world and not just the United States is facing national bankruptcy shortly ahead, and that this has been officially predicted by the world’s leading rating agency, Standard & Poor’s.

US,

Source: Standard & Poor’s

It

has also largely gone unnoticed that Germany’s

capital city Berlin just went officially bankrupt, and that Standard &

Poor’s has revised its rating outlook for Germany since publication of the

above chart, stating that the

country may loose its triple-A credit rating on sovereign bonds already in 2007,

which would speed up the previous sovereign default projection as above by

roughly 10 years. Weimar II is much closer than most people would imagine.

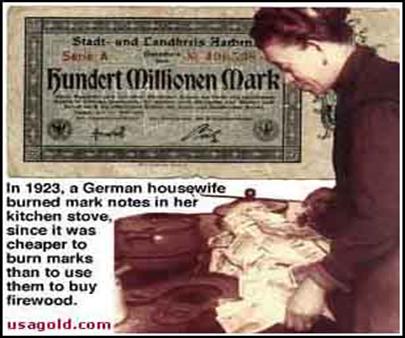

It is the same old story time and time again that repeats itself. Governments go too deep into debt, loose control of their budget deficits, and then have to hyperinflate their currencies to get out of unpayable debt. There is not a single case in history where this has NOT happened. And yet most investors who seek ‘safety’ today mostly still choose to invest in government bonds or bank deposit thinking it is safe and earns a ‘yield’. I am afraid, not only is such yield mostly an illusion, as true inflation nowadays is at least as high as the interest earned on deposit or sovereign bonds, but the entire capital invested is now at acute risk of being destroyed through either default or hyperinflation, whether it is UK guilts, German bunds or US T-bills, it really doesn’t matter, although, unlike projected in the above chart, my guess is that the US will be hit first and hardest, due to the large trade deficit on top of the debt.

Source: www.usagold.com

What lies ahead therefore is yet another replacement of the major present currencies with new ones. Life will go on, but those holding the present (old) money or bonds are at risk of loosing everything while those holding precious metals can simply, after the crisis, use the metal to exchange it for the new currency, with no loss and very possibly actually with substantial gains.

Against this background it is very curious, if not intriguing, to note that those institutions commonly entrusted with taking care of the financial security of individuals, mainly the banks and insurance companies, busily portray gold and silver as an unpromising, high-risk speculative assets, while marketing cash deposits, or Western sovereign bonds or bond funds as meaningful and basically risk-free investment-strategies. Nothing could be further removed from reality.

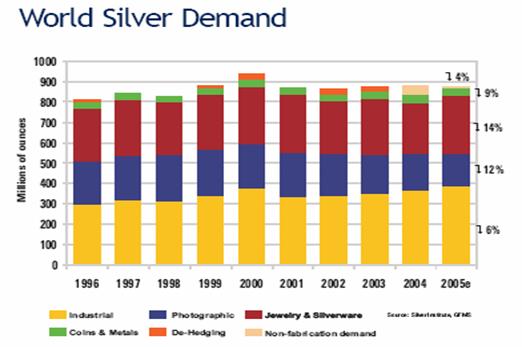

Giving

the rise of

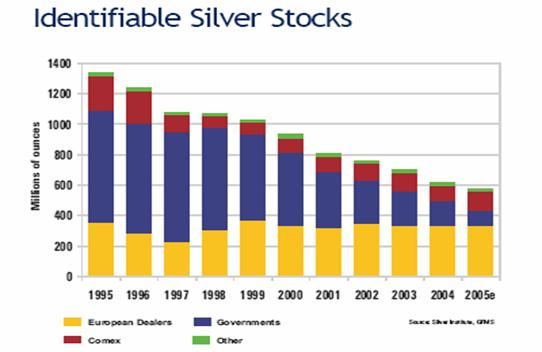

Source: Pan American Silver Corp Annual Report 2005

Furthermore there are currently more patents for new silver applications being filed each year than for all other metals combined, due to silver’s unique light-reflectivity, conductivity and anti-bacterial properties, with many promising future-oriented industries depending on use of the metal, such as space travel, the solar industry, water purification and the fastest growing sector of nanotechnology, silver nanoparticle textiles, among many others. The often cited reduction in silver demand for photography has in fact very little bearing on total silver demand.

Source: Pan American Silver Corp Annual Report 2005

But

clearly, and most importantly, non-withstanding details in demand trends for

various metals, it is most important of all for investors to understand that

gold and silver mean safety as either a sovereign bond default wave or

hyperinflation in the major Western economies approaching. Anyone with an open

mind therefore is advised to educate himself/herself on the true state of the

financial system, and to use his/her common sense rather than relying on the

mainstream

Owning gold and silver today is no guarantee to make a fortune, but it does increase the chances of investors to go through the coming financial crisis unharmed. One word of caution though, when purchasing precious metals, one should purchase the physical bars and coins and/or fully allocated, independently audited and un-leased/lend bullion funds which store the metals on a fully segregated basis from the custodians’ assets and/or precious metals mining assets. The ‘paper-gold’ offered by most banks on the other hand should be avoided, as it is usually not backed by any physical metals and therefore subject to the risk of default.

Martin W. Hennecke

email: question@bridge-water.com

website: www.bridge-water.com

An investment adviser with Bridgewater Ltd. based

in

Copyright ©2006 Bridgewater Limited. All rights

reserved.